A U.S. Debt Crisis Is Looming... And Most Are Blind to the Why

Elitist Complacency, Foreign Debt Holders, and De-Dollarization

“Debt is a cancer. The more debt you have, the sicker the patient becomes. And right now, the U.S. is terminally ill."

~ Doug Casey

Yesterday, I wrote to you about how people like BlackRock’s Larry Fink and other elites are finally waking up to the crazy levels of U.S. debt. This suggests that the U.S. debt situation might be even worse than most realize. Remember, it just hit a record-breaking $34.6 trillion.

But there are also those who argue that fretting over the national debt is overblown. They say it’s just “money we owe to ourselves.”

Nobel Prize-winning economist Paul Krugman made this argument back in 2015.

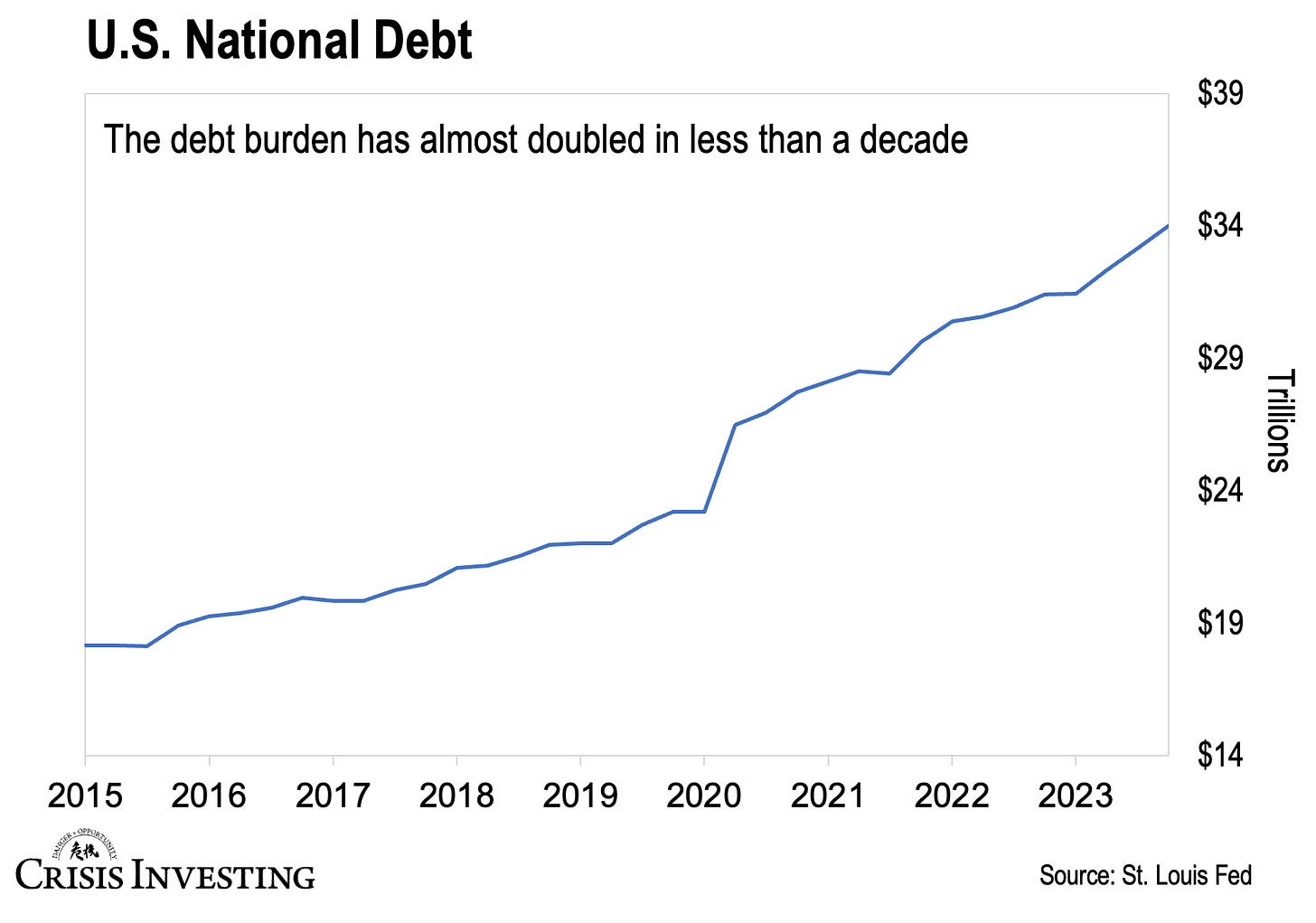

His message seems to have resonated with those at the top, given the staggering increase in our debt from "only" $18 trillion in 2015 to over $34.6 trillion today. That’s a 92% increase in under 10 years.

And here’s the interesting part.

The recent steady rise in U.S. debt is unlike anything we've seen in historical spikes during major wars and financial crises like the Panic of 1837, the Civil War, and World War II, as it lacks a single exceptional event driving it.

Now, going back to Krugman's "we owe it to ourselves" argument, it's just plain nonsense. Let me explain.

Don't Take Those Foreigners for Granted

Today, around 30%, or $8 trillion, of U.S. government debt is held by foreign nations. Many people don’t realize this. And it’s a huge problem. Here's an excerpt from Larry Fink's recent annual letter to shareholders, which I discussed in yesterday's essay.

Why is this debt a problem now? Because historically, America has paid for old debt by issuing new debt in the form of Treasury securities. It’s a workable strategy so long as people want to buy those securities — but going forward, the U.S. cannot take for granted that investors will want to buy them in such volume or at the premium they currently do. Today, around 30% of U.S. Treasury securities are held by foreign governments or investors. That percentage will likely go down as more countries build their own capital markets and invest domestically.

The main reason the U.S. has a large portion of its debt owned by foreigners is because the U.S. dollar, serves as the world's primary reserve currency.

Today, central banks hold about 58% of their foreign reserves in U.S. dollars. The rest is in euros (19.6%), British pounds (4.8%), Japanese yen (6%), and Chinese yuan (2.9%).

And so, to earn returns on all this cash, they park it in U.S. Treasuries, the supposedly safest asset in the world.

Currently, Japan is the largest foreign holder of U.S. debt. In October 2023, it owned $1.1 trillion. China owns $869 billion. And the United Kingdom owns about $693 billion.

But as these countries start distancing themselves from the dollar and begin to see the massive U.S. debt as too burdensome, more of them may think twice before buying U.S. Treasuries.

Remember that 58% figure I mentioned earlier? Well, it’s actually the lowest in 25 years for how much central banks are keeping in dollars. So, de-dollarization is already well underway.

I'll have more to say about that soon, but it's definitely tricky for the U.S. that China, a major holder of its debt, is the main driver behind de-dollarization. From making deals that bypass the dollar to starting oil trades in yuan and promoting its digital yuan (e-CNY) globally, China has been chipping away at the dollar’s global dominance.

Is it any wonder that it's also been simultaneously diversifying away from U.S. dollar-denominated debt? And, might I add, at breakneck speed.

According to U.S. Treasury Department data, China's ownership of U.S. government debt fell from about $970 billion in June 2022 to $872 billion by December 2022. That's a steep drop of $98 billion in less than six months.

Along with that, China has been taking steps to open its $20-trillion bond market to foreigners. This includes improving overseas access, streamlining the process of opening accounts, and reducing foreign investors’ costs, among other things.

The upshot is that China perfectly illustrates Fink's point: the U.S. can't just bank on foreigners to keep buying its debt. And as their backing gradually (and inevitably) fades, a dire fate awaits the nation.

What’s a Government to Do?

Now, when it comes to owing money, you typically have two choices: pay it back or default on what you owe. That's how it goes for anyone in debt.

But the U.S. government can't just default on its debt. That'd probably tank the whole global economy by now — and, more importantly, for those at the top, it'd be political suicide. At the same time, there's also no real way for them to pay it all back.

But, being the government, they also have a third option: they can simply print more money. That way, they can devalue the debt they owe, allocate more capital to themselves, and keep kicking the can down the road.

Sure, a U.S. government default could occur if China moves to a gold-backed currency, leading other countries to abandon the U.S. dollar for a gold-backed Yuan, and the U.S. government has to raise interest rates on Treasury bills to 12–15% to manage its towering debt.

But that's not happening overnight. Until then, this is only one way for those in power to bail out the system. The devaluation of the dollar (and the government’s debt).

Devalue or die.

I know most people don't believe currency devaluations can happen in highly developed countries like ours. But the writing is on the wall.

And the fact that the elites are even entertaining the thought that the U.S. government could run out of money suggests it might happen sooner than most think.

Until next time,

Lau Vegys

P.S. Doug Casey believes that the Fed's eventual decision to fire up the money printer this year will create a bubble in commodities. This is good news for one of the metals recently added to our Crisis Investing portfolio, and we're planning to include two more equity picks to capitalize on it.

Thanks, Lau. My published research via The Claremont Colleges on solutions known and documented back to Benjamin Franklin, typically referenced as "monetary reform" and "public banking":

‘Financial’/‘monetary’/‘derivative’ house-of-cards collapse? Remember: Superior mechanics already proven by Ben Franklin with monetary reform and public banking, backed by Thomas Edison, 86% of Economics professors

https://carlbherman.blogspot.com/2023/03/financialmonetaryderivative-house-of.html