Beyond Pesos, Dollars... and Gold Bars

Meandering Thoughts Post-Milei's X Nod to Doug's Wisdom

I woke up today to an email from my buddy and old colleague, Nick Giambruno. Turns out Argentina’s president, Javier Milei, retweeted a clip from one of Doug’s interviews.

For those who may not click through to watch the video, here’s the translation of Doug’s quote that Milei posted in Spanish:

Milei will succeed because he has economic reality on his side. He has thrown out people who lived off the state without working, he no longer prints money, you can use any currency. Argentina, in this next decade, could be one of the freest places in the world.

Doug is, of course, absolutely right. I was recently in Argentina myself, and it’s definitely moving in the right direction.

Interestingly, one of the main ideas in Milei’s plan to get Argentina back on track has always been dollarization. He talked about it a lot during the campaign. And while he’s seemingly hit pause for now—mainly because the banking system needs serious cleanup first—those close to him say it’s still front and center in his mind.

Don’t think Milei views the dollar as a magic fix. It’s more about choosing the lesser evil—a patched-up canoe over a raft that’s barely holding together.

Ironically, while Argentina may soon be reaching for the dollar like a life preserver, many other countries are paddling away from it.

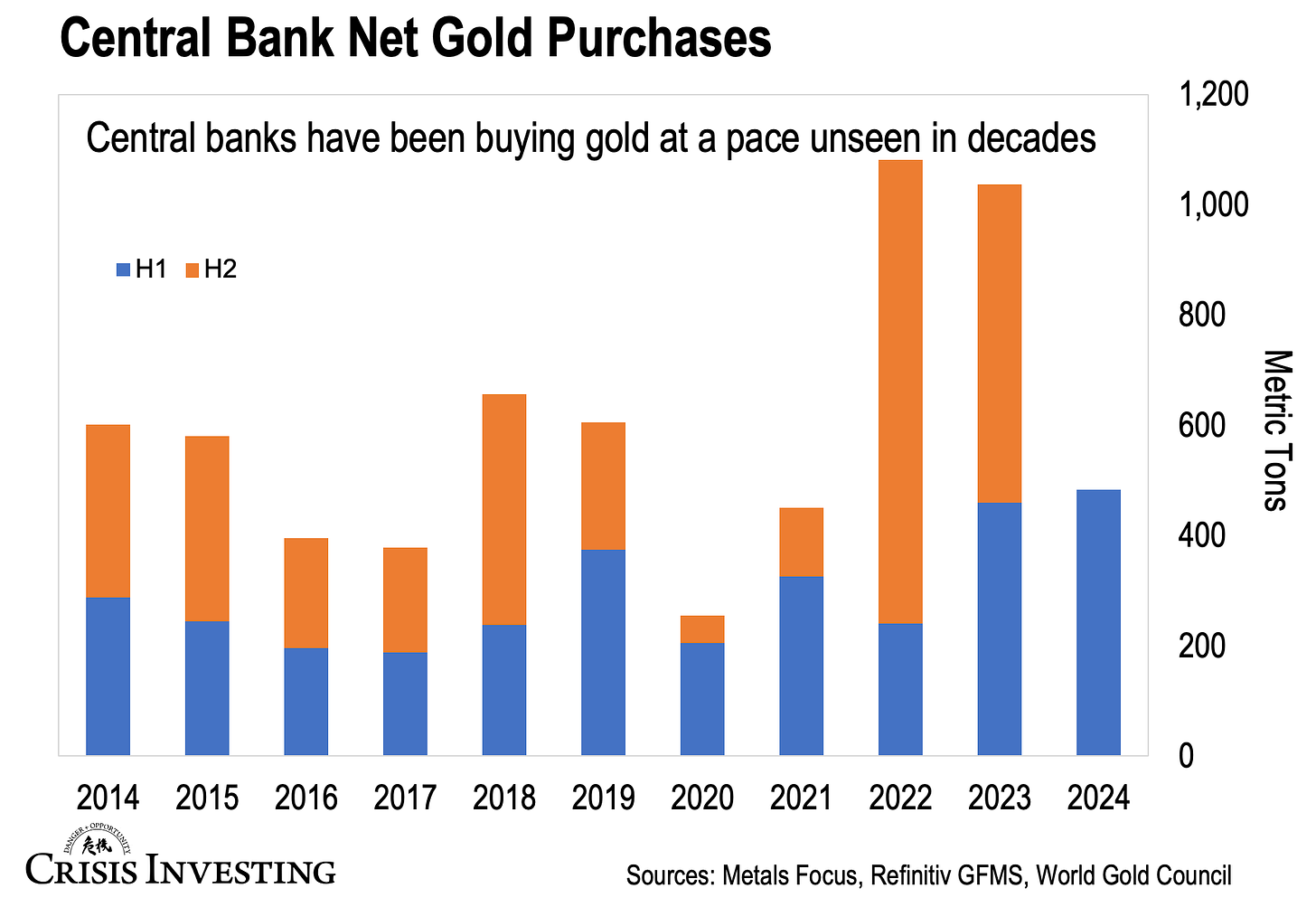

I’ve written about this extensively in these pages (catch up here, here, and here), so I won’t bore you with the details today. But suffice it to say, that’s exactly why central banks are stockpiling gold at rates we haven’t seen in 50 years. Take a look at the chart below.

In 2023, central banks made net gold purchases of 1,037 tons, just shy of the multi-decade record set in 2022.

That’s $75–$80 billion, or roughly 1% of their U.S. dollar reserves going into gold. And with just that small 1% shift, the price surged to over $2,600 an ounce, an all-time record high.

Now, if you’re like me, you’re probably wondering what would happen to the gold price if central banks converted 5%, 10%, or even 20% of their U.S. dollar reserves into gold.

The answer is simple: if recent past performance is any guide, it would go through the roof.

At any rate, as de-dollarization picks up pace, we may soon find out—especially now that the Fed is reverting to its old playbook of easy money.

With that in mind, even buying physical gold at all-time highs could still be a smart move today.

What might be smarter, though, is investing into a company whose revenue comes from mining gold.

Why Gold Stocks Shine Brighter Right Now

If you’ve been with us for a while, you probably know that gold miners tend to outperform bullion when prices go up.

This is because as gold prices increase, mining companies' profit margins tend to expand more rapidly than the price of gold itself. And it’s why Doug always recommends investing (or speculating) in gold stocks for bigger gains.

And right now is the perfect time to do just that.

As I mentioned recently, the HUI index, which tracks major gold miners, is sitting at about half of its all-time high from September 2011. And just last week, I pointed out that fund flows into major gold miner ETFs are so low, it’s like no new money has entered the sector in nearly a decade.

All of this, while gold is hitting new highs, mind you.

But if solid, profitable, dividend-paying gold miners represented by these funds and indices are cheap, then junior miners are downright dirt cheap. Just take a look at the graph below of the index that tracks the Canadian TSX Venture Exchange, home to many small and mid-cap mining stocks.

The index is down more than 80% from its 2007 highs, while gold has surged an impressive 270% over the same period. The TSX-V is also down significantly from its 2011 peak, even though gold is up roughly 70%.

So, what’s going on?

Well, central banks only buy physical gold, not gold stocks. This creates a lag - their gold purchases drive up the price of gold, but it takes time for that increase to show up in gold stock valuations.

The result today? A huge disconnect between these stocks and the actual gold price. I call it the "golden value gap," and it's as glaring whether you're in Toronto or Buenos Aires.

Ignore this at your wallet's peril.

Regards,

Lau Vegys

P.S. The key takeaway is that gold stocks are a screaming buy right now. As the gold bull market heats up, many of these quality companies could become 5-baggers, 10-baggers, or even more. But you need to know where to look. That’s why a portion of our Crisis Investing portfolio is focused on these stocks—many of which Doug himself owns. And just recently, we published a new issue with a fresh gold stock recommendation.

PLEASE FORGIVE CAPS--ALMOST BLIND

EXCELLENT LAU. AS ALWAYS. AND YES, NOW IS THE TIME TO BE LOADING UP ON MINERS.

BUT TODAY, I WANT TO GIVE NICK GIAMBRUNO THANKS FOR PROVIDING THE ANSWER TO

THE QUESTION I HAVE BEEN ASKING IN THE COMMENTS SECTION FOR MANY WRITERS FOR MONTHS---"WHO IS THIS DEEP STATE?" NICK GAVE AN EXCELLENT ANSWER AT TODAY'S INTERNATIONAL MAN COMMUNIQUE. I AM POSTING MY THANKS TO NICK HERE, BECAUSE I TRIED FOR OVER AN HOUR TO MAKE A COMMENT AT THAT SITE, BUT NEVER SUCCEEDED. DUE TO VERY IMPAIRED VISION, I NEVER SUCCEEDED IN PASSING THEIR ROBOT TEST IN THE ALLOTTED TIME. PLEASE FORWARD THIS TO DOUG FOR A HEADS UP TO THEIR INFO TECH MAN. PERHAPS I AM THE COALMINE CANARY.

THANKS. YOU ARE ALWAYS HELPFUL TO YOUR FELLOW MAN---WALTER HAANEL'S MASTERKEY TO SUCCESS.

SINCERELY,

LIAM OF LIAM'S LADDER

- BEST METALS INFO IN - FOREVER …. !!!!!! 10/16/24