Bitcoin’s 2024 Halving Is Here... Now What?

3.125 Bitcoins per Block, Features, not Bugs, and the Hardest Asset the World Has Ever Known

"Bitcoin's monetary policy is its killer feature. No amount of money printing or economic stimulus can ever debase its currency."

~ Michael Saylor

It finally happened.

Bitcoin miners' rewards, which were 6.25 Bitcoins per transaction block just yesterday, got cut in half to 3.125 Bitcoins literally minutes ago.

As you may recall, Bitcoin has built-in mechanism that reduces the rate at which new Bitcoins are created.

This is known as “halving.”

This means that new Bitcoin supply drops by 50%... and it happens every four years or so. And this every-four-years event has just happened today.

Other than the recent approval of spot Bitcoin ETFs, the halving is probably the most anticipated development in the Bitcoin world.

And there’s a good reason for that.

Bitcoin Price Skyrockets with Halvings

You see, with “halvings,” every time Bitcoin has one, its price goes through the roof.

After the first halving in 2012, when the reward dropped from 50 Bitcoins to 25, Bitcoin went into overdrive, going up by 8,850% in just 12 months. Then, after the 2016 halving cut the reward from 25 to 12.5 Bitcoins, it still surged by 2,870% within 17 months. Even after the 2020 halving sliced the reward to 6.25 Bitcoins, Bitcoin jumped by 890% in the next 19 months.

Here's a visual to show you what this looked like...

If you're anything like me, you're probably wondering: Will Bitcoin surge again after today's halving?

While I have no crystal ball for timing, I'm 100% confident that it will. And I'm not just going off the chart above or the (silly) idea that past performance can predict the future.

Let me explain.

It’s a Feature, Not a Bug

To truly grasp the significance of the infamous tech cliché in the context of Bitcoin, you need to understand its origin story.

You see, Bitcoin didn't just materialize out of thin air.

The first cryptocurrency emerged in response to the 2007-2009 Global Financial Crisis, aiming to create a currency free from banks and government control.

Satoshi Nakamoto, the pseudonymous creator(s) of Bitcoin, witnessed the turmoil caused by governments and central banks on the global economy and aimed to provide a decentralized alternative.

Thus, Bitcoin was born — a currency with anti-inflationary properties or "hardness" baked into its very DNA.

A friend and former colleague, Nick Giambruno, introduced the concept to me back in 2019. That was the moment I realized there’s no stopping Bitcoin; its price will continue to rise, despite any short-term jitters. Here’s Nick:

“Hardness” does not mean something that is necessarily tangible or physically hard, like metal. It means “hard to produce.” By contrast, “easy money” is easy to produce. The best way to think of hardness is “resistance to inflation,” which helps make it a good store of value – an essential function of money.

Unlike "easy money" like dollars, which increases in supply annually, leading to inflation and rising prices, Bitcoin was designed to have the opposite effect by issuing less and less of itself, becoming “hard money.”

The World’s Hardest Asset

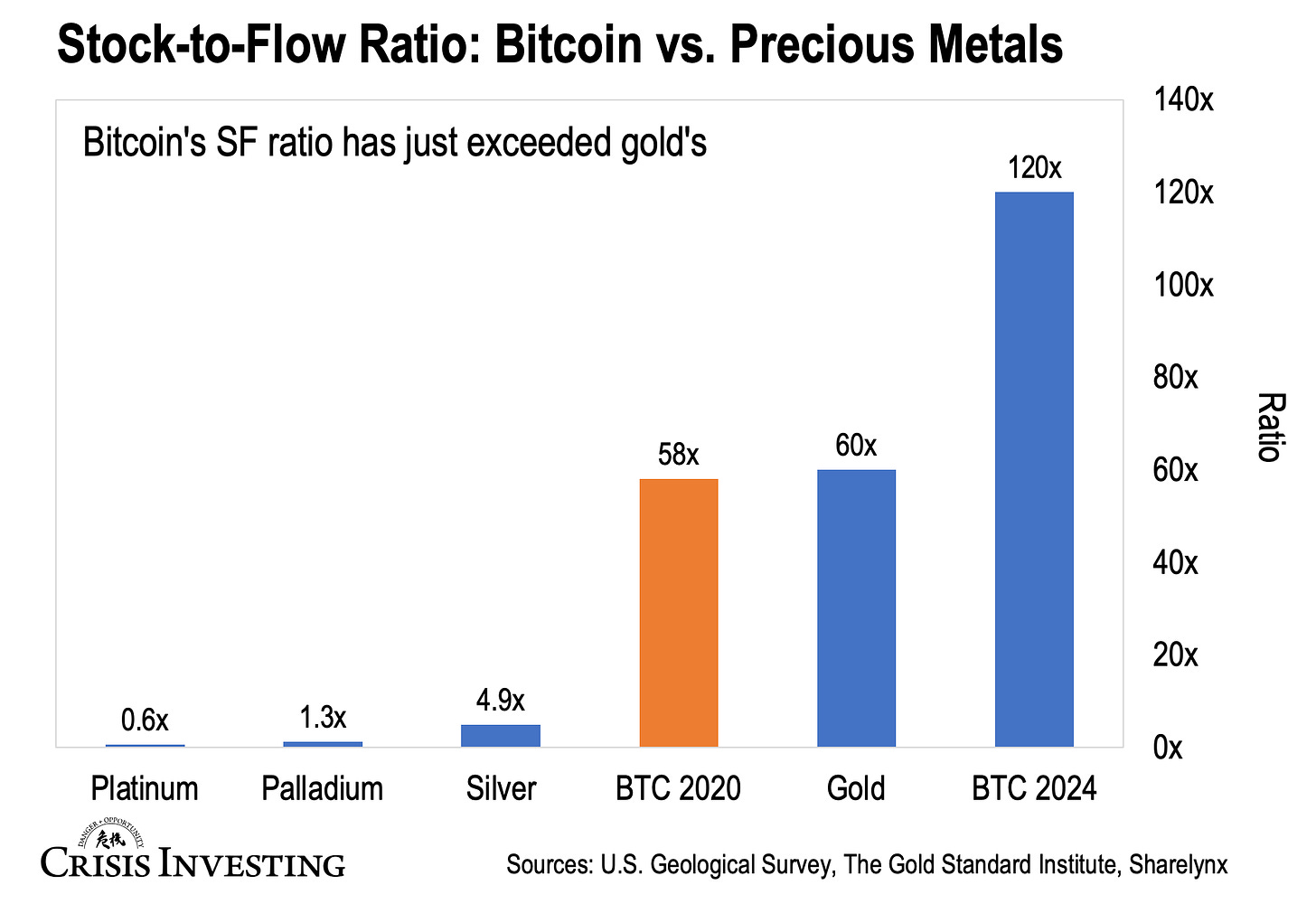

The best way to measure an asset’s hardness is to look at its Stock-to-Flow (S2F) ratio.

The “stock” part refers to the amount of something available, like current stockpiles. It’s the supply already mined. It’s available right away.

The “flow” part refers to the new supply added each year from production and other sources.

Stock / Flow = SF ratio = number of years of new supply needed to equal current supply

A high S2F ratio means that the new supply is small relative to the existing supply. It indicates a hard asset.

A low S2F ratio indicates the opposite: a large new supply relative to the existing supply. This means that market balance can be swayed by the new supply easily.

After today's halving, Bitcoin's annual production will drop to about 164,063 bitcoins from the previous 328,125. This change catapults the S2F ratio for the current total supply of 19.7 million Bitcoins to around 120. In other words, it would take 120 years of Bitcoin’s new supply to equal the existing supply.

Now, have a look at this chart comparing the SF ratios of Bitcoin to those of gold and other precious metals.

As you can see, with an SF ratio of 120, Bitcoin is way ahead of gold and other competition in terms of “hardness.”

Note: If you look at the orange bar, it shows where Bitcoin’s S2F ratio stood from the 2020 halving until today: at about 58x, slightly below gold’s.

Now, before some die-hard gold fans pounce on me in the comments section, let me clarify that I'm not knocking gold. I love gold. Humans have used it as money for over 5,000 years. It is an excellent store of value. Gold is hard to produce, so this quality won’t change any time soon… For all these reasons, I own more gold than Bitcoin.

However, as of today's halving, Bitcoin is now the hardest asset the world has ever known.

And the best part? Thanks to its anti-inflationary properties hardcoded into its core, Bitcoin is set to become significantly harder over time.

Let me break this last part down.

As I mentioned earlier, there are currently about 19.7 million Bitcoins in existence.

There can never be more than 21 million Bitcoins. This is written into Bitcoin’s code. So the current supply is about 94% of the total potential supply.

Crucially, because of the halvings, like the one today, the remaining 6% of new Bitcoins will be added at an ever-decreasing rate.

This means that, by 2028, Bitcoin will reach an SF ratio of 248.

Put another way, Bitcoin’s hardness is set to more than double by the time the next halving event rolls around. This will make it roughly four times harder than gold, assuming its supply dynamics remain largely unchanged.

And that's not even considering the millions of Bitcoins irretrievably lost in discarded hardware in landfills.

Bottom line: each Bitcoin will become significantly more valuable with time.

This will ensure a steady influx of new investors, including both big players and regular folks like you and me (trying to protect the value of their hard-earned money), attracted by Bitcoin's anti-inflationary features. The Bitcoin ETF narrative, as it continues to unfold, is a testament to that.

Regards,

Lau Vegys

P.S. Everything we’ve seen in the past year suggests there’s an ocean of capital waiting to get into Bitcoin. Whether this will result in $100,000 or $500,000 per Bitcoin, and the exact timing, is anyone’s guess. And, of course, Bitcoin's price can be a rollercoaster ride so you ought to be ready for significant volatility along the way (as we’ve already seen in recent weeks). That’s why, you should never dive headfirst. Instead, consider putting in a fixed sum regularly. Just make sure it's not an amount that would keep you awake at night.