Warren Buffett has been called many things over his legendary investing career — the Oracle of Omaha, the Sage of Omaha, the world's greatest investor.

(I could think of a couple less flattering labels too — not being the biggest fan of the guy’s elitist tendencies.)

But these days, he might be earning a new title: America’s biggest cash hoarder.

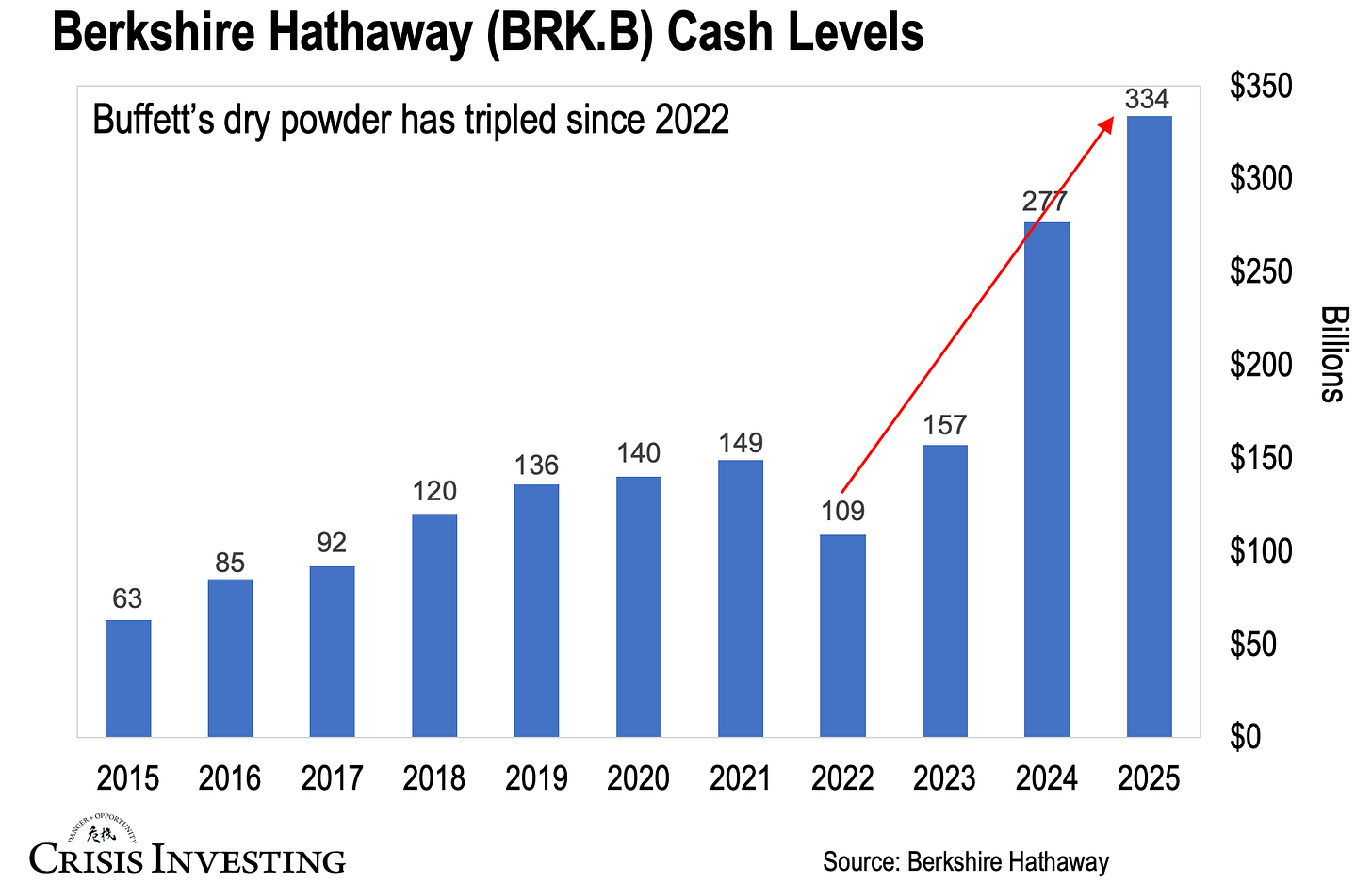

If you look at this week’s chart below, you’ll see that Buffett’s Berkshire Hathaway (BRK.B) is now sitting on a mind-boggling $334 billion in cash. That’s more than triple the $109 billion it held back in 2022.

Berkshire’s been quietly building its war chest for years. But Buffett’s pace of cash hoarding has shifted into a whole new gear since 2022. Much of that $334 billion pile has come together just in the past year (we’ll get to how in a moment) — a staggering buildup, even by Buffett’s standards.

All in all, Berkshire now holds more cash than the GDP of countries like Finland, Portugal, or Greece. If Buffett's cash hoard were a company itself, it would rank among the top 20 in the S&P 500 by market cap.

So, why is Buffett hoarding all this cash?

To answer this question, it’s worth remembering Buffett’s two most famous investing rules:

Rule #1: Never lose money.

Rule #2: Never forget rule #1.

Now, Buffett may be famously tight-lipped about where he thinks the market’s headed — but he doesn’t need to say much. When the world’s most famous value investor is sitting on a $334 billion cash pile, the message is pretty clear: he’s not buying because there’s not much worth buying.

In fact, quite the opposite. He’s been cashing out like never before.

Last year alone, Warren Buffett unloaded a staggering $143 billion worth of stocks — trimming his giant Apple (AAPL) stake, almost completely exiting Bank of America (BAC), and selling down Chevron (CVX), among others. His total purchases for the year? Just $9.2 billion.

But there’s another side to this story.

Buffett’s not just hoarding cash for the sake of it. What he’s doing is building optionality — preparing to pounce when everyone else is forced to sell.

In other words, he’s probably waiting for something big. And no — I don’t mean the little wobble we saw last week. I mean real, blood-in-the-streets kind of opportunities. Or maybe even something more serious.

Have a great rest of the weekend,

Lau Vegys

P.S. Speaking of serious things — Matt Smith has been making a compelling case that Trump’s team could be preparing for a major monetary reset… something that could fundamentally reshape the financial system in ways we haven’t seen in generations (definitely worth a read if you haven’t seen it yet).

Would Buffett really want to be sitting on $334 billion in cash if that was about to happen?

Maybe not forever. But if there’s a window — even a brief one — where panic selling takes over and world-class assets go on sale… that’s exactly when Buffett strikes. It’s how he’s always played it.

After all, in any monetary reset — whether it’s Nixon closing the gold window in the 70s or the Plaza Accord in the 80s — there’s usually a moment of chaos before inflation kicks in… a moment when cash gives you the power to buy the world on sale.

Remember: cash is trash… eventually.

But at the start?

Cash is king. Especially when you’ve got $334 billion of it.

Have a great rest of the weekend,

Lau Vegys

Great article!

Buffett has increased his cash balance significantly since December 2023. Legendary investor Jim Rogers went even further, and except for some equity investments in China and Uzbekistan, sold all his equity investments worldwide, including in the US.

Interestingly, Jim Rogers parks his liquidity either in US dollars (the cleanest shirt in a dirty pile) or buys gold and silver.

https://ffus.substack.com/p/jim-rogers-exits-us-stocks

Buffet doesn't like holding cash. He knows he's/it's losing value.