China Just Dumped the Largest Amount of U.S. Debt in History

Dropping It Like a Hot Potato, the Lowest level of U.S. Debt Ownership in Decades, Not Just a "China-Leaning" Countries Problem

At this point, the government is completely and totally bankrupt. It's like Wile E. Coyote that's walked off a cliff, but doesn't really realize it yet.

~ Doug Casey

We just learned that China has accelerated its de-dollarization efforts with record sales of U.S. debt.

Turns out, China dumped a staggering $53.3 billion worth of U.S. Treasuries and U.S. agency bonds in the first quarter of this year.

Interestingly, the Chinese government announced the sale right after issuing a joint statement with Russia, where both nations emphasized their resolve to keep moving away from reliance on Western countries.

No doubt, this will seriously dent the appeal of U.S. debt on the international market. But let's take a closer look to see exactly why.

Yes, It Is a Big Deal...

Now, this isn't the first time China has unloaded a portion of the U.S. debt it owns. For example, the country sold $21 billion in U.S. Treasuries and agency bonds in late 2023.

But what makes this latest dump stand out is that it's the first time China has shed such a big chunk of debt so quickly.

The move brings the nation’s holdings of U.S. government debt to around $767 billion. That’s the lowest level of ownership in decades.

It's quite something when you think about it… Just a few years back, China was leading the pack in investing in U.S. debt. Things changed around 2018 though, when the trade war with the U.S. began. By 2019, China ceded the position to Japan as the biggest holder of U.S. debt.

But China really started backing off from U.S. debt in 2022, when the U.S. hit Russia with unprecedented sanctions, including removing many of its major banks from SWIFT. Between then and now, China’s ownership of U.S. government debt dropped off a cliff. You can see this trend in the chart below.

In about two years, China's Treasuries holdings plunged by $266.4 billion. That's a huge 26% decrease. But go back a decade earlier, and you're looking at a much steeper 42% drop.

The big deal about this is that it sends a clear signal to every country to think about doing the same.

No, It's Not Just China...

As I write this, Japan remains the largest foreign holder of U.S. debt. In January 2024, it owned $1.15 trillion. Then there's China, followed by the United Kingdom, holding around $754 billion. Luxembourg and Canada are also major holders, with $377 billion and $340 billion, respectively.

Media talking heads would have you believe that these countries won't be selling U.S. debt anytime soon, if at all. After all, they argue, these nations aren't exactly what you’d call "China-leaning.”

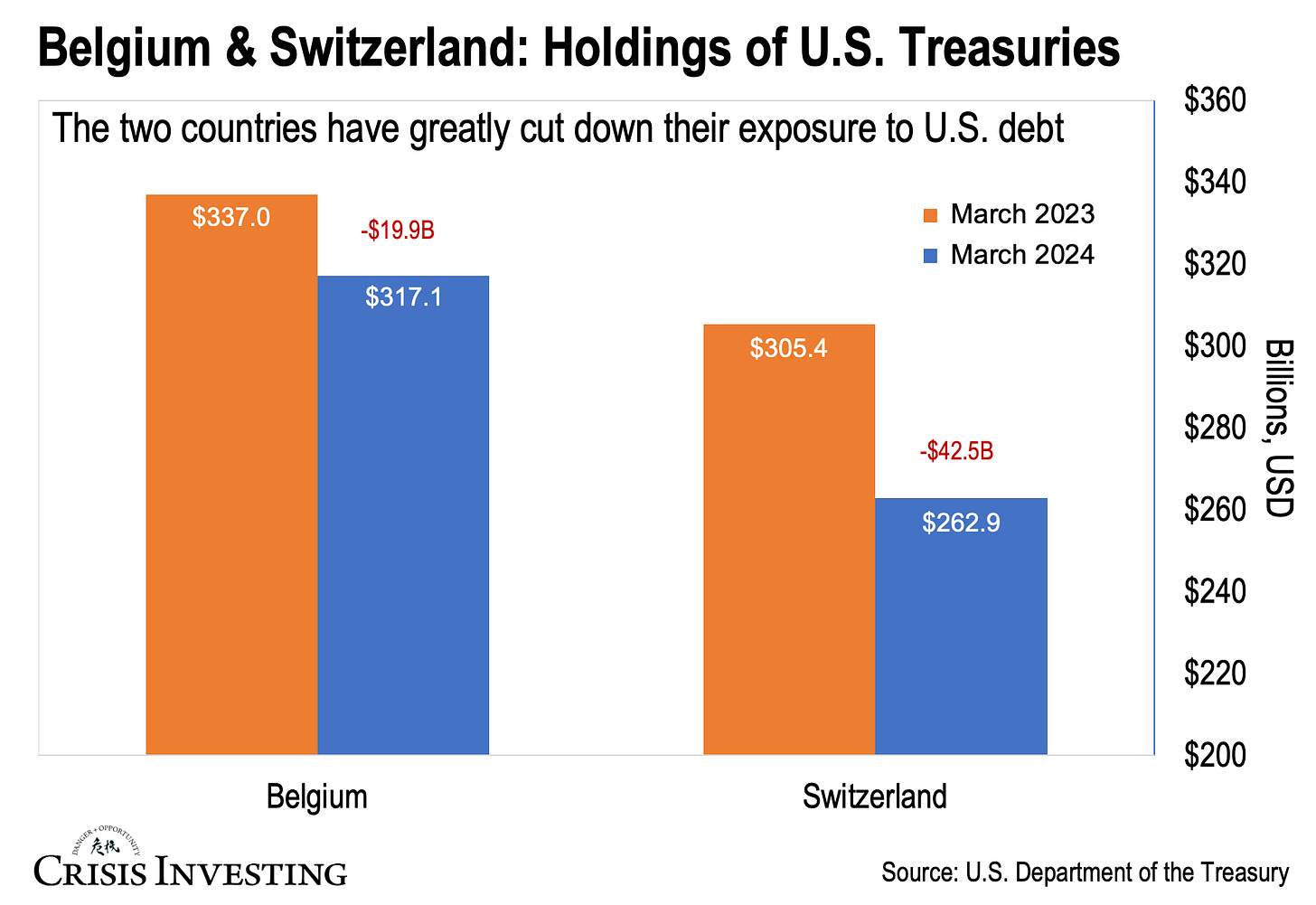

Well, neither is Belgium or Switzerland. And yet, in the past 12 months, these countries have unloaded an impressive $20 billion and $43 billion worth of Treasuries, respectively.

That’s quite an amount for nations with just a fraction of China’s GDP.

This is what I mean when I say that the U.S. government can't just bank on foreigners to keep buying their debt.

Now, countries like Belgium and Switzerland aren’t distancing themselves from the U.S. because they’re scared of sanctions — that's more of a concern for "China-leaning" nations... whatever that means. No, they're just starting to see the massive U.S. debt as too burdensome. As U.S. politicians keep on "working hard" to surpass the national debt-to-GDP ratio of Lebanon and Eritrea, these nations are beginning to realize the risks of putting all their eggs in one basket.

If this keeps up, it's a big problem for the U.S. government because about one-third, or $8 trillion, of its debt is currently held by foreign countries.

Regards,

Lau Vegys

P.S. Currently, global central banks still hold about 58% of their foreign reserves in U.S. dollars. To earn returns on all this cash, they invest it in U.S. debt. There’s just no alternative… or is there? Well, China seems to think so. Stay tuned for Part 2 of my later this week, where I'll dig deeper into that.

An important question

Who now holds the debt discarded by China (and others) and why?

China sells treasuries for two reasons (1) to make themselves less vulnerable to U.S. sanctions and (2) to prop up their own weak, depreciating yuan and the associated flight of capital that accompanies it.

No hand wringing called for.