Mark Twain once said, “History never repeats itself, but it does often rhyme.”

That quote came to mind earlier this month when China announced a ban on exports of gallium, germanium, and antimony—high-tech materials critical to military applications—to the United States. I actually wrote about this last week (catch up here if you missed it).

But while Beijing’s actions caught many off guard, they're just the tip of the iceberg. China has plenty more pressure points they can squeeze, and one of the most devastating would be rare earth elements (REEs).

Here’s the thing about REEs… Most people know they’re key to consumer electronics like iPhones, flat-screen TVs, and computers, but what often gets overlooked is their critical role in military tech. We’re talking cruise missiles, bombers, rockets, drones—you name it. Take the U.S. Javelin missiles and F-35 fighter jets—they’re practically bursting at the seams with these things.

And here's the catch: there's virtually no substitute for REEs in these advanced applications. The U.S. military depends entirely on them. And who holds all the cards in the REE market? You guessed it—China.

China's Rare Earths Monopoly

Former Chinese leader Deng Xiaoping once said, “The Middle East has oil. China has rare earths.” He wasn’t wrong.

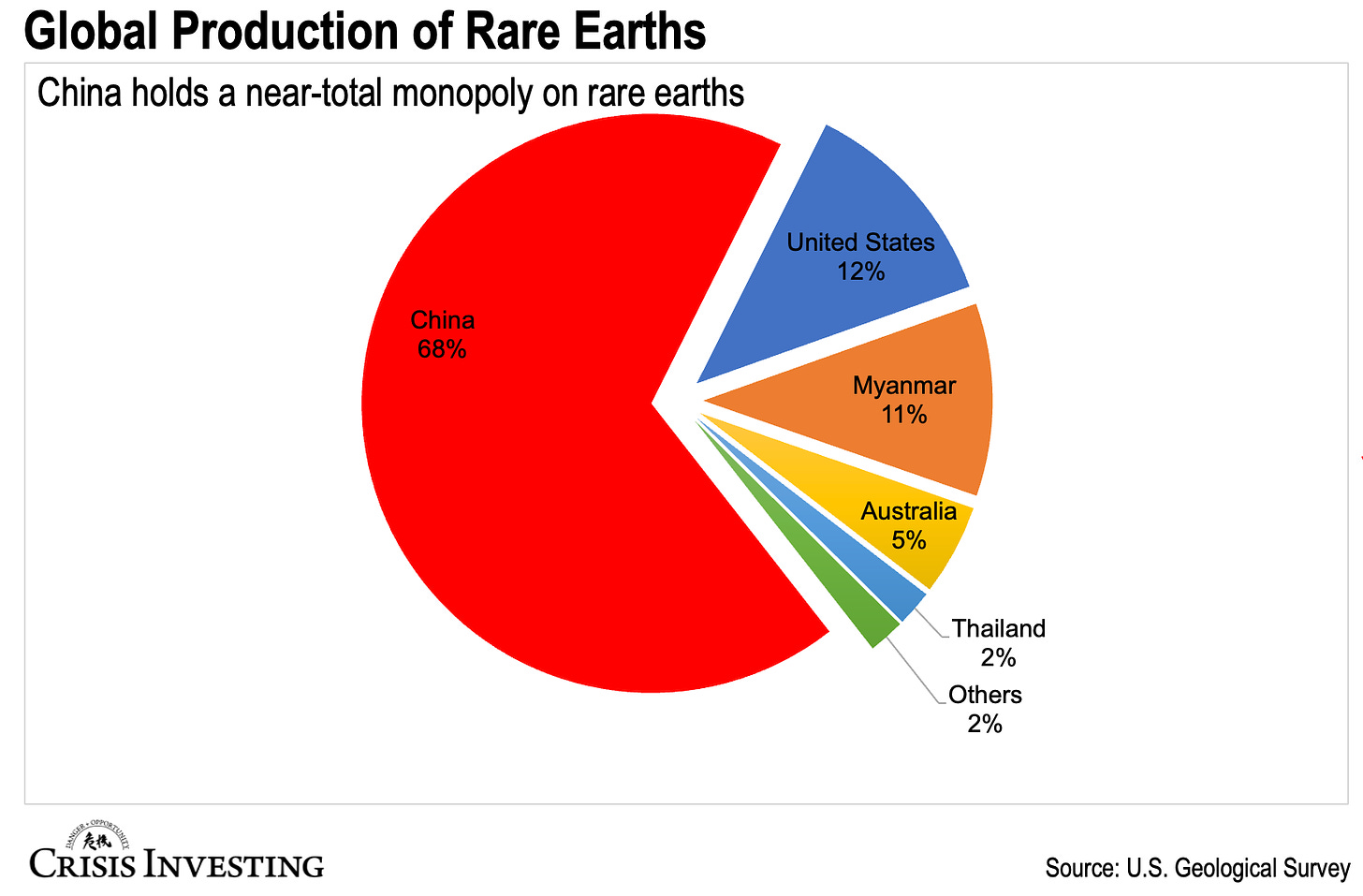

Today, China produces and processes nearly 70% of the world’s rare earth supply, as shown in the chart below.

If you’re wondering how China took over the rare earths game, it’s simple: no environmental rules and generous subsidies from the communist government.

But here’s the critical point hiding in the chart above: China could restrict rare earth supplies at the drop of a hat.

This isn’t some wild speculation. They have done it before.

The story is actually pretty interesting...

It all started with a Chinese fishing boat in 2010, sailing through disputed waters when it collided with a Japanese coast guard patrol boat.

The Japanese arrest the boat's captain. China demands his release. Japan refuses.

What starts as a minor maritime incident quickly erupts into a full-blown diplomatic crisis. In response, China completely cuts off REE exports to Japan and slashes global exports by 40%.

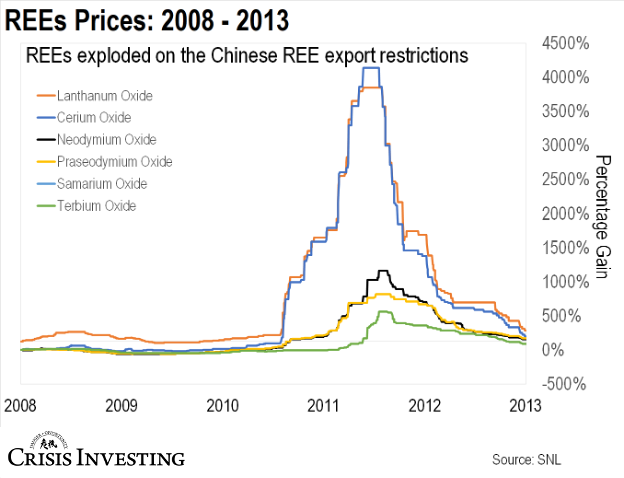

The result? One of the most spectacular REE price booms in recent memory. We're talking gains of over 2,100% on average across the group. Some rare earths shot up even higher—Lanthanum and Cerium skyrocketed by 4,141% and 2,978% between 2010 and 2011. Take a look at the chart below.

The ban also sparked a veritable mania in REE stocks that lasted for nearly a year. Companies involved in rare earth mining and processing saw their shares soar to record highs. Mining companies that hadn't produced an ounce of rare earths—some that barely even had plans on paper—saw their stock prices multiply virtually overnight.

The Writing on the Wall

To say that U.S.-China relations are currently strained would be a gross understatement. They were rocky during President Trump’s first term, and they haven’t exactly “reset” under President Biden. U.S. tariffs on $350 billion worth of Chinese products remain in place, and just this month, Biden’s administration rolled out another round of export restrictions targeting 140 Chinese companies.

Trump’s second term doesn’t look any better for U.S.-China relations either, with his promise to impose a sweeping 60% tariff on all Chinese imports.

But we’d be naive to think China will sit back and do nothing.

Its recent retaliatory ban on gallium, germanium, and antimony exports to the U.S. is a case in point. And it’s no coincidence that it directly targets the military-industrial complex.

But what’s an even bigger card for China to play? You guessed it: REEs.

If history is any guide, a Chinese ban on rare earths is a real possibility. In fact, if you pay attention, you’ll realize it may already be in the works.

Consider this…

In February 2021, the Financial Times reported that Beijing had reached out to its rare earth industry and basically asked: “How much damage could we inflict on the U.S. military by cutting off rare earth exports? Could we cripple their fighter jet production?”

Then, in December 2023, China banned the export of technology used to produce rare earth magnets, which are vital for electric vehicles, wind turbines, and advanced military systems.

And, most recently, in October 2024, China started requiring exporters to detail step-by-step how rare earth shipments are used in Western supply chains.

As an outside observer, it seems China is positioning itself to act before the U.S. can loosen its hold. If it does, it could spark a rare earths bull market for the record books—potentially eclipsing the 2010-2011 boom.

Regards,

Lau Vegys

Bhs (Bayhorse silver) appears to have antimony and is currently drilling into several magnetic anomalies

Ok. But where does China get its rare earths? Domestically or through mining rights around the world?