Dear Reader,

Today, we've got another exciting gold opportunity to share—one that comes at a moment in the junior mining sector that’s both fascinating and odd.

While gold has been hitting new highs, junior miners are trading at historically depressed levels. Now, I know that all of us at Crisis Investing have been going on about just how ridiculously cheap this space has gotten vis-à-vis the yellow metal, but it's really worth emphasizing.

And nowhere is this disconnect more glaring than in the VanEck Junior Gold Miners ETF (GDXJ), the go-to ETF for investing in junior gold miners. These stocks are still down nearly 50% from their 2012 highs. Take a look.

Just think about what's happened since 2012: we’ve seen the Fed print money like crazy, with the M2 money supply exploding from about US$10 trillion to over US$21 trillion, government debt shooting past US$35 trillion, multiple banking crises, a global pandemic, lockdowns affecting billions, rising geopolitical tensions at a boiling point, and even threats of nuclear conflict.

Through all this, gold has done exactly what it's supposed to do—preserve wealth and hit new highs. Yet gold stocks, particularly the more speculative juniors, have done the opposite.

Even more telling is what's happened to trading volumes. The average daily volume in the GDXJ has collapsed from 14 million shares in 2019 to just 6 million in 2024. You can see it in the chart below.

Keep in mind, the drop would appear even more dramatic if we measured it from 2020, which experienced pandemic-driven spikes amid the March chaos (with volumes even soaring to over 80 million shares).

But the situation is far worse for the broader sector. In fact, only about 60-70 out of 2,600 Canadian mining companies are achieving daily trading volumes over 100,000 shares today.

These aren’t just statistics; they’re a symptom of a broken market. With no volume, companies can't raise capital. Without capital, they can't create value. It's a vicious cycle that's trapped even quality projects in a state of perpetual limbo.

The single-asset company model, once a staple of junior mining, has become increasingly difficult to finance and sustain. Valuable deposits sit trapped in companies without financing prospects, while the amount of actual exploration work being done across the sector has dwindled to historically low levels.

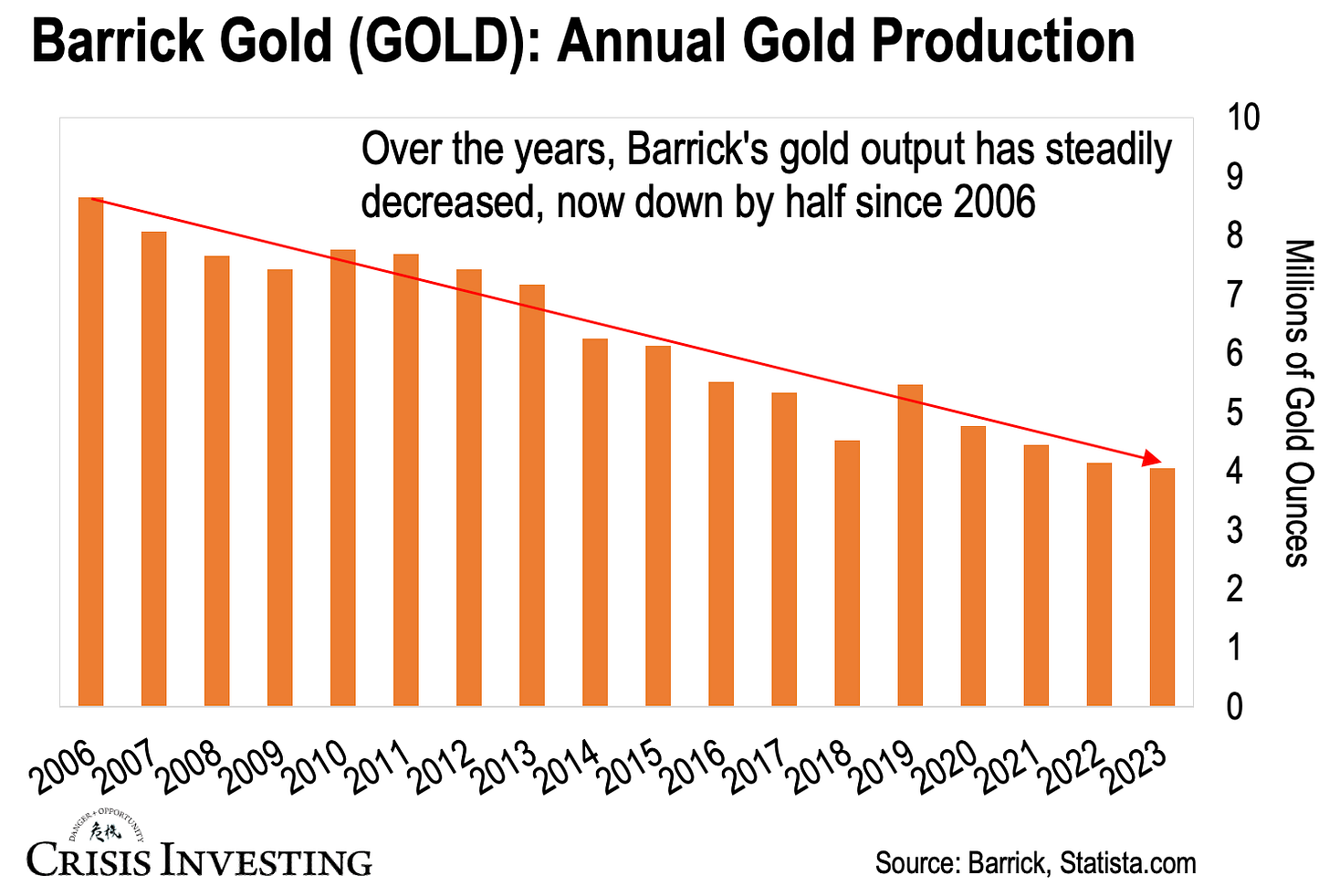

That’s just the reality, but it’s having real consequences, even for the industry's biggest players. Just look at Barrick Gold (GOLD), one of the world’s largest gold producers. Their annual production has plummeted from around 8.5 million ounces in the 2000s to roughly 4 million ounces today. That’s more than a 50% drop and the lowest it’s been in 20 years.

The bottom line is that the junior mining space is fundamentally broken. Traditional financing models just aren’t cutting it, leaving most companies scrambling to keep the lights on instead of focusing on creating value through exploration and development.

All that being said, this dysfunction has created a unique window for those who understand how to navigate it. While most juniors are stuck with the old playbook, some companies are coming up with innovative ways to thrive in this messy market.

This brings us to this month's pick, a company that isn't just recognizing all the above realities—it's building its entire strategy around them. Doug himself has found this opportunity compelling enough to take a position.

Details below…

Regards,

Lau Vegys