Dollar's Reign May Not Last Much Longer (If History Is Any Guide)

Chart of the Week #6

Today's chart ties into the de-dollarization trend we've been talking about a lot lately in these pages.

When most people around the world think about money, they’re probably thinking of the U.S. Dollar. That’s because the greenback is the world’s primary reserve currency. This, of course, is in no small part thanks to its dominant role in global oil trade.

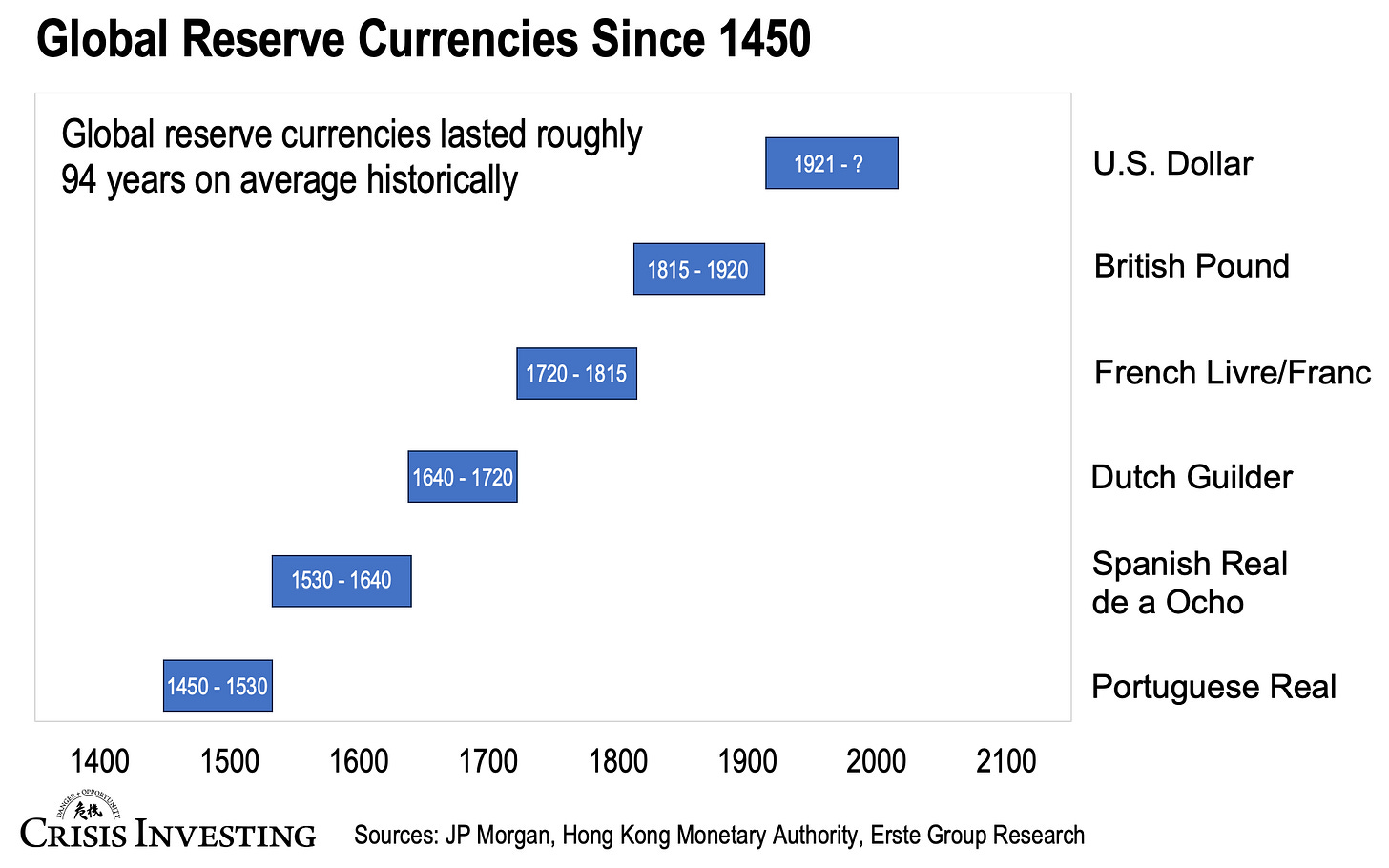

But the U.S. Dollar hasn’t always held the throne. If you look at the graph below, you’ll see that the history of the world’s reserve currencies began with the Portuguese Real in 1450 (and has continuously shifted from one currency to another since then).

This coincided with the Age of Discovery in the 15th century when Portuguese navigators like Vasco da Gama opened new sea routes to Africa, India, and Asia. Portugal's expanding maritime empire and colonial territories gave it control over key trade routes and access to plenty of gold and silver.

For centuries that followed, those who dominated commerce and had the most gold made the rules. Unlike today’s U.S. Dollar, these currencies weren’t fiat abstractions; they were literally made of precious metals or backed by them. They were money.

And so, around 1530, the Spanish took over, followed by the Dutch about a century later, and then the British, all the way to the Bretton Woods Conference in 1944. That’s when a new system was established (solidifying the dollar's global dominance that began after WWI), tying almost every nation's currency to the U.S. Dollar at a fixed rate… and the dollar to gold at $35 an ounce.

Alas, the dollar’s tether to gold wasn’t meant to last.

Interestingly, if you take another look at the chart above, you’ll see that these currencies managed to hold their status as global reserves for about 94 years on average. With the U.S. Dollar already counting over 100 years of reign, it may be a little long in the tooth. The general state of the U.S. and the pressure from BRICS do not give me much confidence that this isn't the case.

Have a great weekend!

Lau Vegys

<<...these currencies managed to hold their status as global reserves for about 94 years on average.>>

So looking at the graph, the Spanish reigned supreme the longest at 110 years. The Dollar's 103+ years put it just seven years short of that and only two years away from the British Pound's 105-year run. Fascinating!