As we’ve discussed in these pages and elsewhere, we believe the U.S. is headed for a controlled dollar devaluation—one of the key pieces in Trump’s broader economic reset, aka the Mar-a-Lago Accord.

“Controlled” is the key word here—think Plaza Accord of 1985, only on steroids.

Matt Smith has meticulously documented how this could lead to a financial transformation unlike anything we’ve seen. If you haven’t read his latest report yet, make sure you do.

Now, as unpleasant as this process will be for anyone who doesn’t own “real stuff”—like gold and other “unprintable” assets—the alternative would be much worse: hyperinflation.

And when we talk about hyperinflation, there’s no better historical lesson than Germany’s Weimar Republic in the early 1920s.

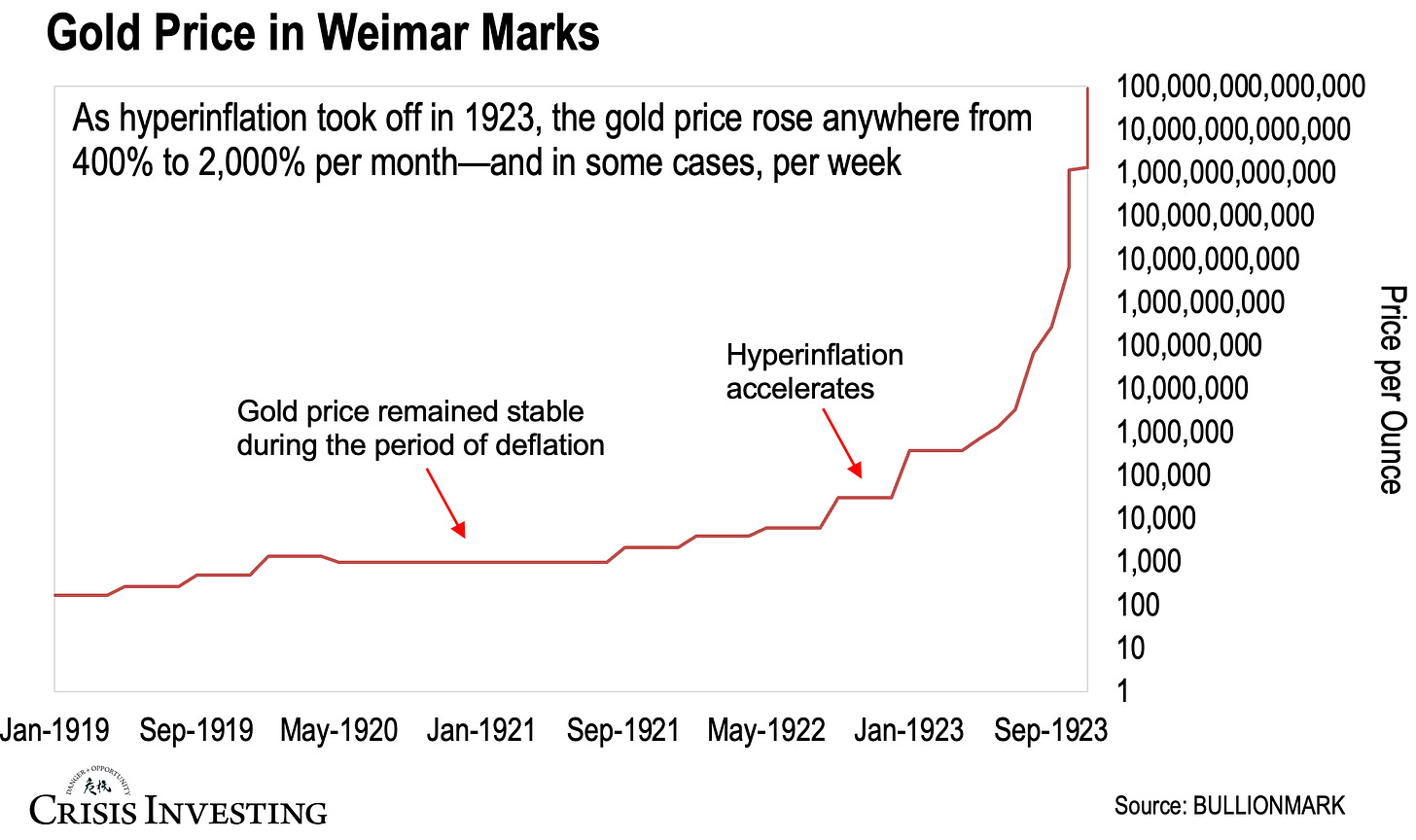

That’s why I wanted to share this chart today. It’s a sobering reminder of what happens when a currency completely collapses. Take a look at what happened to the price of gold—in German marks—during the infamous Weimar hyperinflation.

I used a logarithmic scale, because without it, the numbers would be almost impossible to read.

So, what happened?

After World War I, Germany was saddled with crushing war reparations it couldn’t afford to pay. The government’s solution? Print money. Lots of it.

At first, it looked manageable. But by 1923, things spun out of control. Inflation went from bad to insane. Prices doubled every few days. Workers collected wages in wheelbarrows and spent them immediately before they lost value. A loaf of bread that cost 160 marks in January 1923 cost 200 billion marks by November.

It wasn’t just an economic collapse—it wiped out the middle class and tore apart the fabric of society.

And remember, this didn’t happen in some forgotten backwater. It happened in one of the most advanced economies in Europe—a country of scientists, engineers, and industrialists.

And gold?

Gold didn’t change. It did exactly what it’s supposed to do. It preserved purchasing power throughout this chaos. What changed was the value of paper money, which basically evaporated.

By November 1923, one ounce of gold cost 87 trillion marks—up from about 170 marks just four years earlier. Think about that. The same ounce of gold that once cost a few weeks’ salary was suddenly worth more than anyone could earn in several lifetimes.

The chart above is a perfect illustration of why they say gold has no top… because fiat has no bottom.

Enjoy your weekend!

Lau Vegys

Fabulous graph & fascinating time scales.