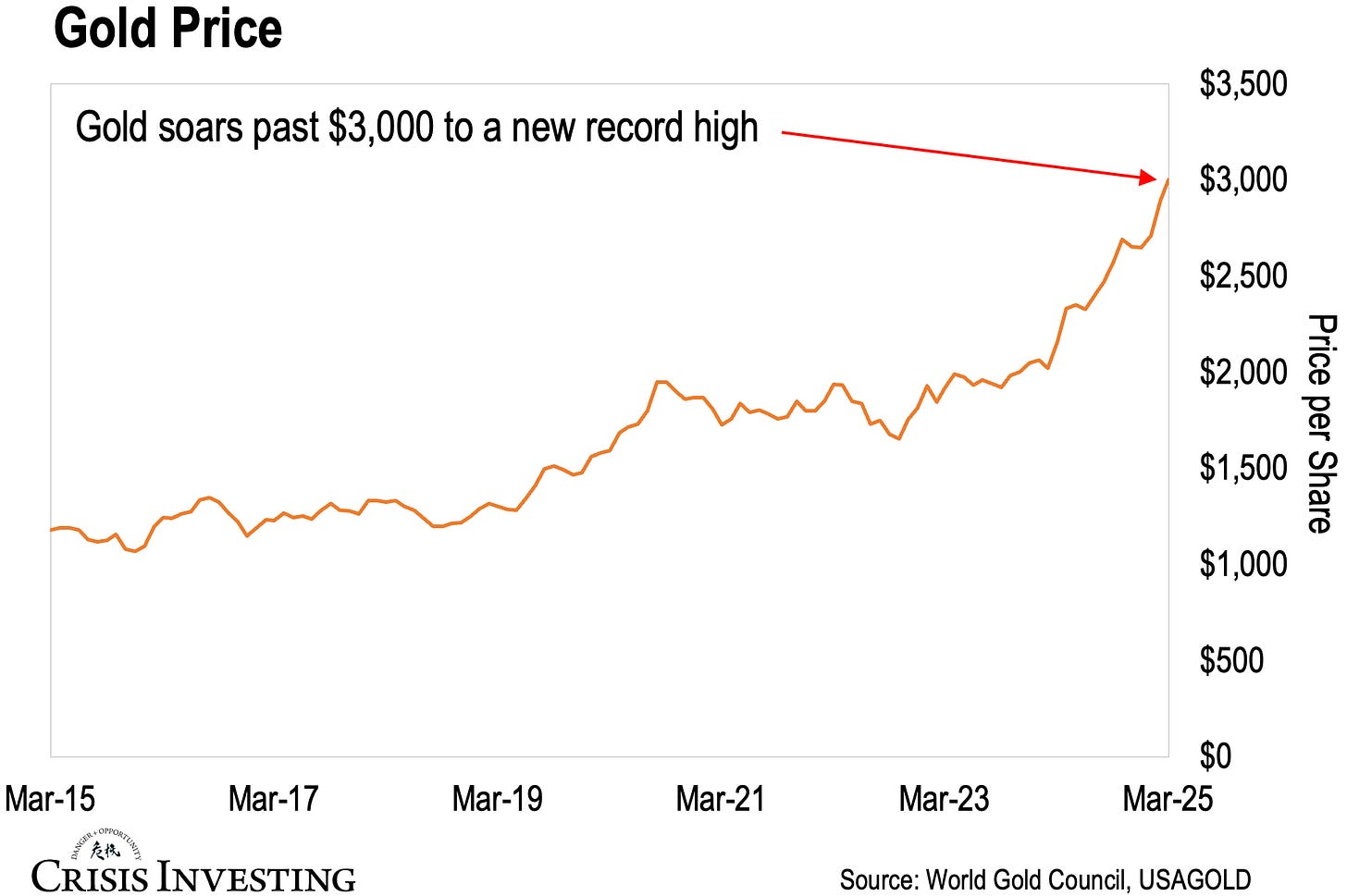

Gold has done it again. It just shattered its previous record, soaring past $3,000 per ounce. You can see gold’s relentless climb over the past decade in the chart below.

As I write this, the metal is up an impressive 15% year-to-date, currently sitting at $3,038 per ounce—making it one of the best-performing assets of 2025.

I knew this was coming.

Back in December 2024, just weeks after Trump's election as the 47th president, I published an essay urging people to hold on to their gold—or better yet, buy more. At the time, many thought that with Trump in office, their worries were over and they could dial back their gold investments. But I saw a dangerous naivety in this thinking.

Thankfully, I was able to persuade those close to me—and hopefully some of my readers—to stick to their gold (and gold stocks). Those who heeded that advice are likely sitting on substantial gains right now.

But I wanted to put out this update—not to brag about having a crystal ball (spoiler: I don’t)—but because I know a lot of people are getting jittery about gold’s new all-time highs… let alone buying more.

I get it. We’re in uncharted waters, and 2025 is shaping up to be one of the most unpredictable years in modern history.

But that’s exactly why you should be holding—or adding to—your gold stash. The yellow metal stood the test of time through every political and economic storm. It’s the ultimate insurance policy. That’s why Doug Casey always recommends keeping gold in your long-term portfolio—no matter who’s in office.

Today, that advice seems more relevant than ever.

A New Era for Gold

Matt Smith and I have been banging the table that Trump’s tariffs and economic policies aren’t isolated decisions—they’re the opening moves in a much bigger plan to transform America’s economy and monetary system. We call it Trump’s Reset, aka the Mar-a-Lago Accord.

At the heart of it?

Dollar devaluation (and subsequent gold revaluation).

Matt lays out the full case in his latest report—I won’t do it justice here—but the bottom line is that Trump’s strategy has historical precedent. The script has been followed before.

The best example?

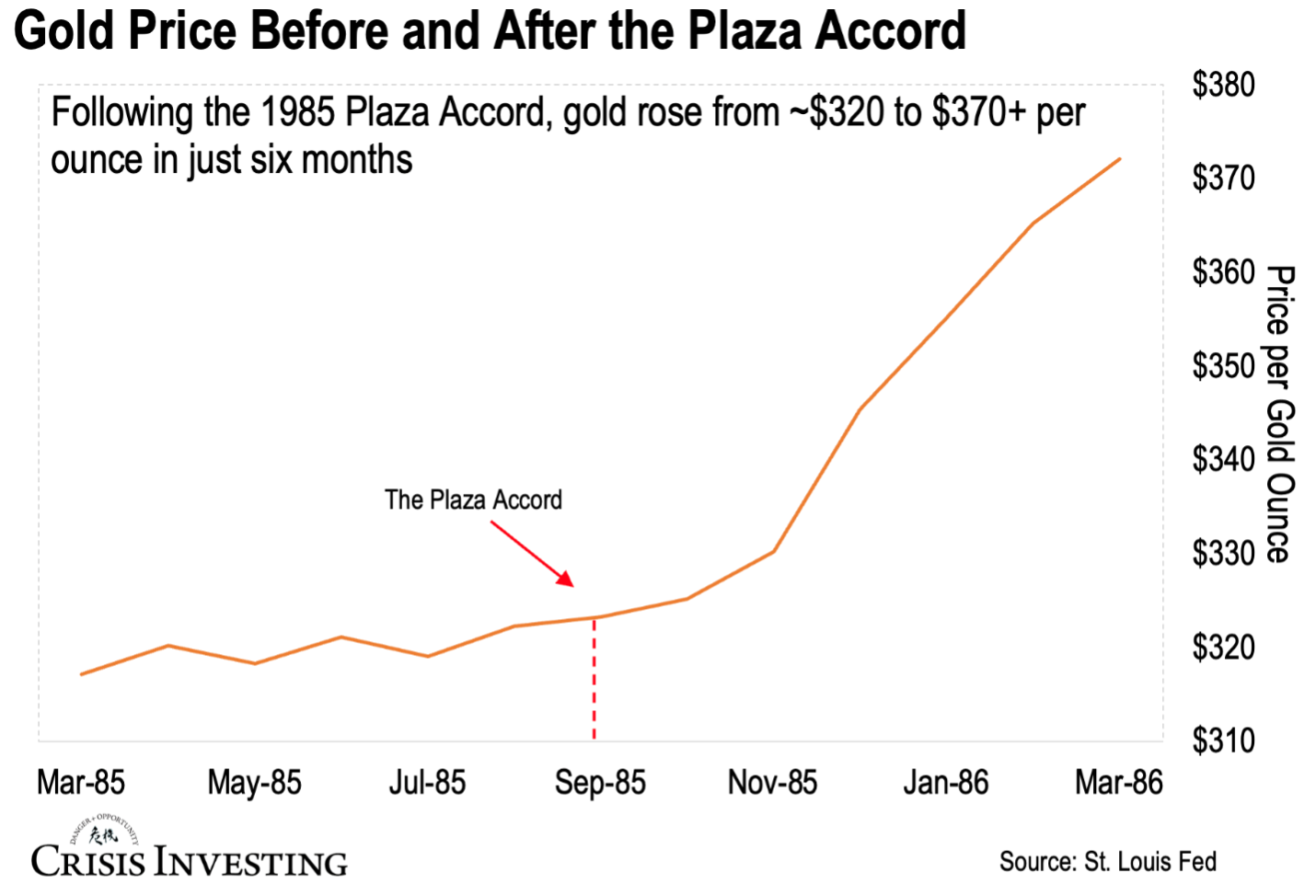

That would be the Plaza Accord on September 22, 1985, when finance ministers from the world’s largest economies gathered at New York’s Plaza Hotel to coordinate a devaluation of the unnaturally strong U.S. dollar.

Nobody wanted a weaker dollar—it would hurt their exports, making their goods more expensive for American buyers. But just like today, the U.S. government applied pressure through tariffs, import surcharges, quotas, and tough talk about “unfair trade.”

And guess what? It worked. West Germany and Japan—the economic powerhouses of the day—caved.

And gold?

It took off. Take a look at the chart below.

After the Plaza Accord in 1985, gold jumped from about $320 per ounce to over $370 between September 1985 and March 1986. That’s in just six months.

Adjusted for today’s prices, that would be the equivalent of gold rising to over $3,500 per ounce.

But here’s the thing… If Trump’s Reset unfolds the way Matt and I believe it will, it won’t just be a repeat of the Plaza Accord—it’ll be that on steroids.

In today’s globalized and overleveraged world, the ripple effects could be immense. I, for one, wouldn’t be surprised to see gold spike to $5,000–$8,000 per ounce as markets scramble to adjust.

This might sound speculative—but if you read Matt’s report, you’ll see the reasoning stands on solid ground. Especially now that roughly 2,000 metric tons of gold—64 million ounces—have poured into the U.S since December. That’s nearly a quarter of all the gold America claims in its official reserves.

Doesn’t seem like a coincidence. More like preparation.

Regards,

Lau Vegys

Hi Lau. What's your thoughts about buying gold if you are a non US citizens especially when the US dollar is going to be actively devalued?