Today, I had a conversation with an investment banker I know. He—let’s call him Steve—actually read my piece yesterday on hyperinflation in Germany’s Weimar Republic. (If you missed it: gold went from around 170 marks to 87 trillion marks in just four years.)

Steve brought up a point I’ve heard many times before: sure, gold is great in times of crisis—but in “normal” times, you’re better off in the stock market.

I disagreed. In fact, I disagreed so much I decided to write this quick follow-up, since I figured others might have gotten the wrong impression too.

Let’s start with a simple fact.

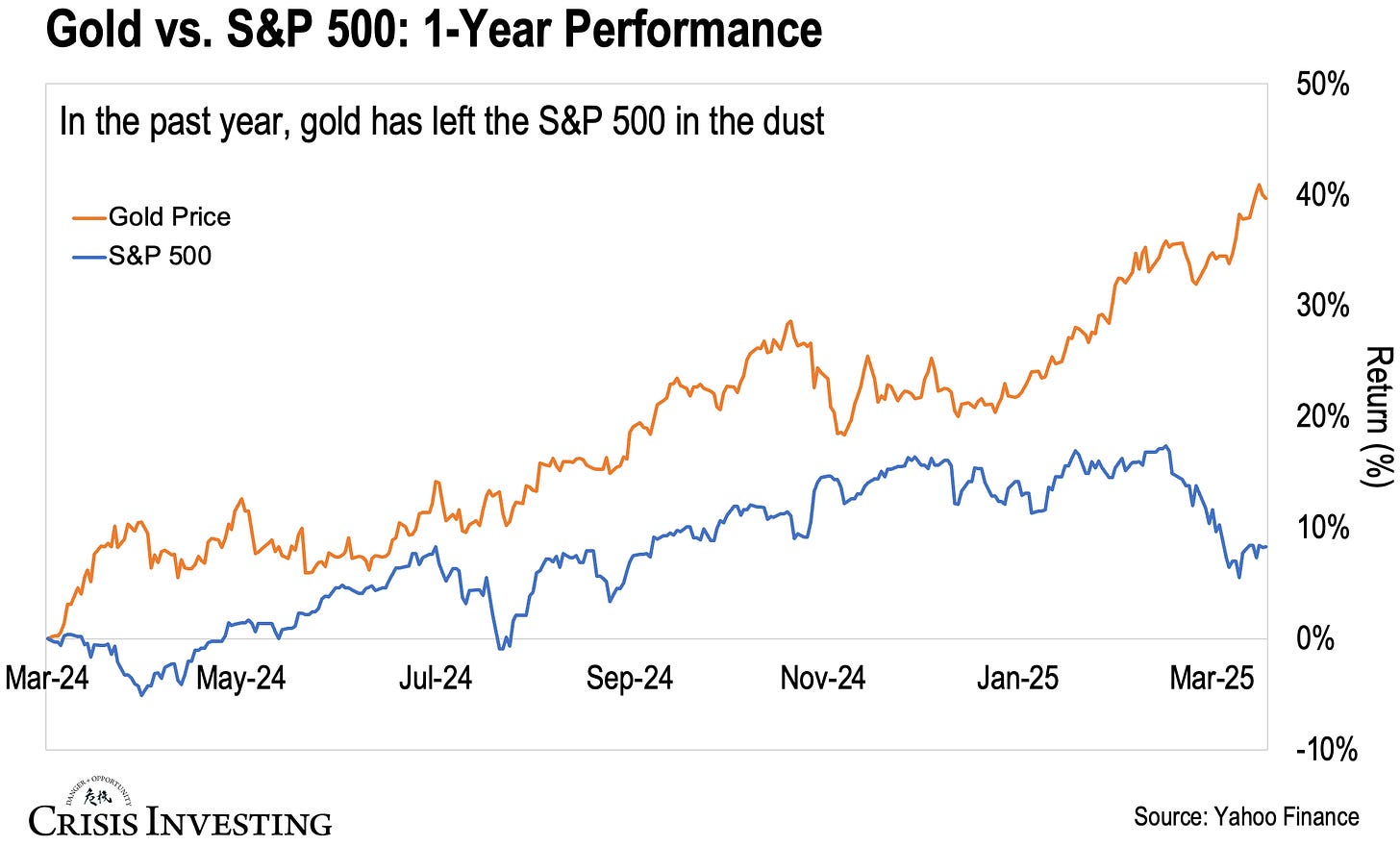

If you held gold over the past year, you’d have done a lot better than if you held the S&P 500. Gold returned 40%. The S&P 500? Just 8%. That’s a 5-to-1 outperformance. Take a look at the chart below.

Now, maybe you're thinking: come on, that’s cherry-picking. Stocks have had a rough few months lately— thanks in large part to Trump’s tariffs and general boat-rocking. Fair enough. That’s exactly what Steve said too, by the way.

So I said, alright Steve, let’s zoom out.

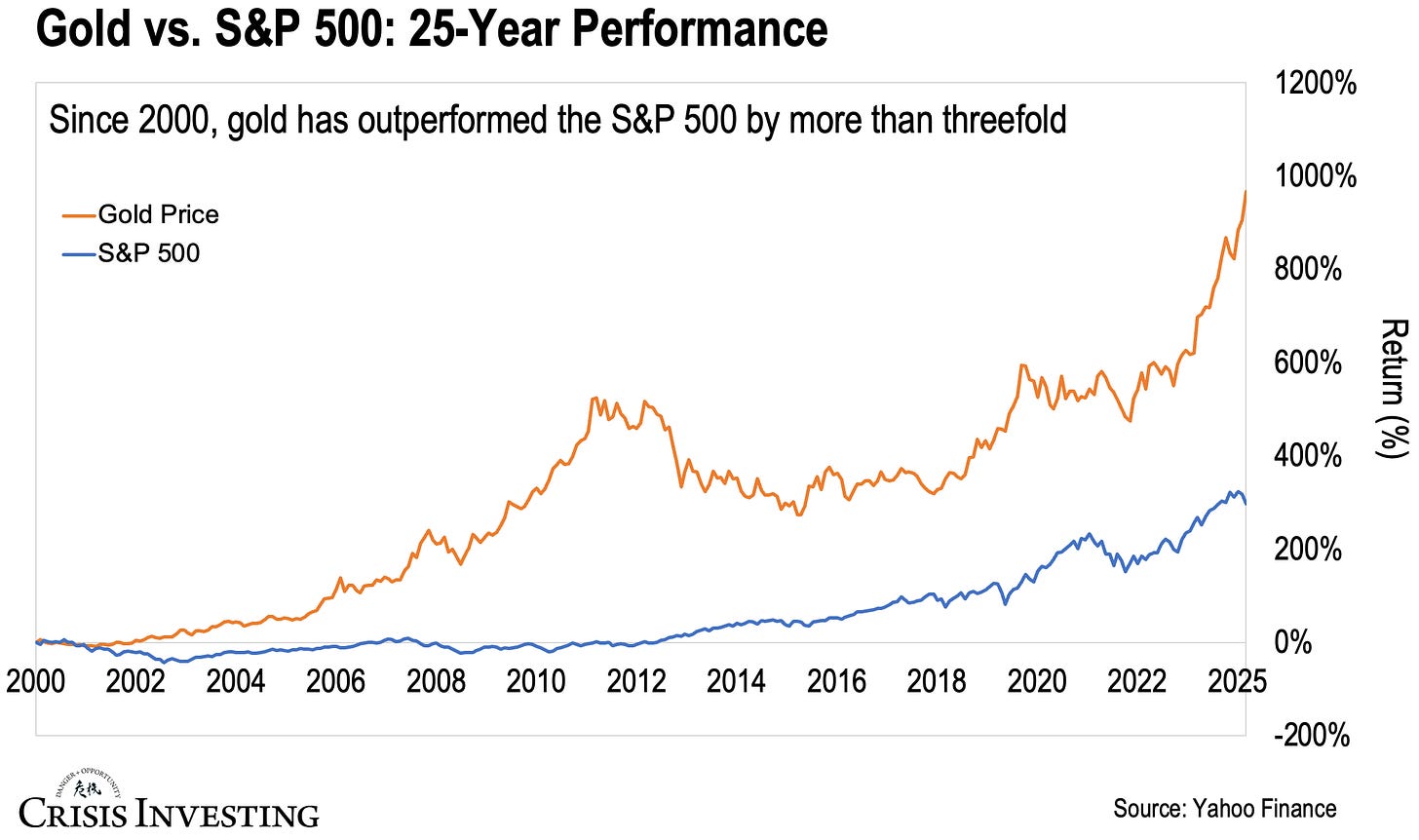

Let’s roll back the clock 25 years. That should be enough time to smooth out the noise. The chart below tells the story.

As you can see, gold is up 966% since 2000, while the S&P 500 has returned a “mere” 296%. That’s gold outperforming stocks by more than 3x.

To put that in dollar terms: if you’d put $5,000 into gold back in 2000, you’d have around $53,300 today. That same $5,000 in the S&P 500? About $19,800.

Big difference.

Again, we’re talking plain old gold here—physical metal, not mining stocks (many of which, by the way, delivered much higher returns over the same period). But nearly 1,000% without any of the added risk that comes with stock picking? That’s pretty impressive.

At this point, even Steve was starting to nod—reluctantly. But if I were him, I might have tried one more angle: “Okay, but what if I didn’t hold gold for the whole 25 years? What if I bought and sold year to year?”

Fair question.

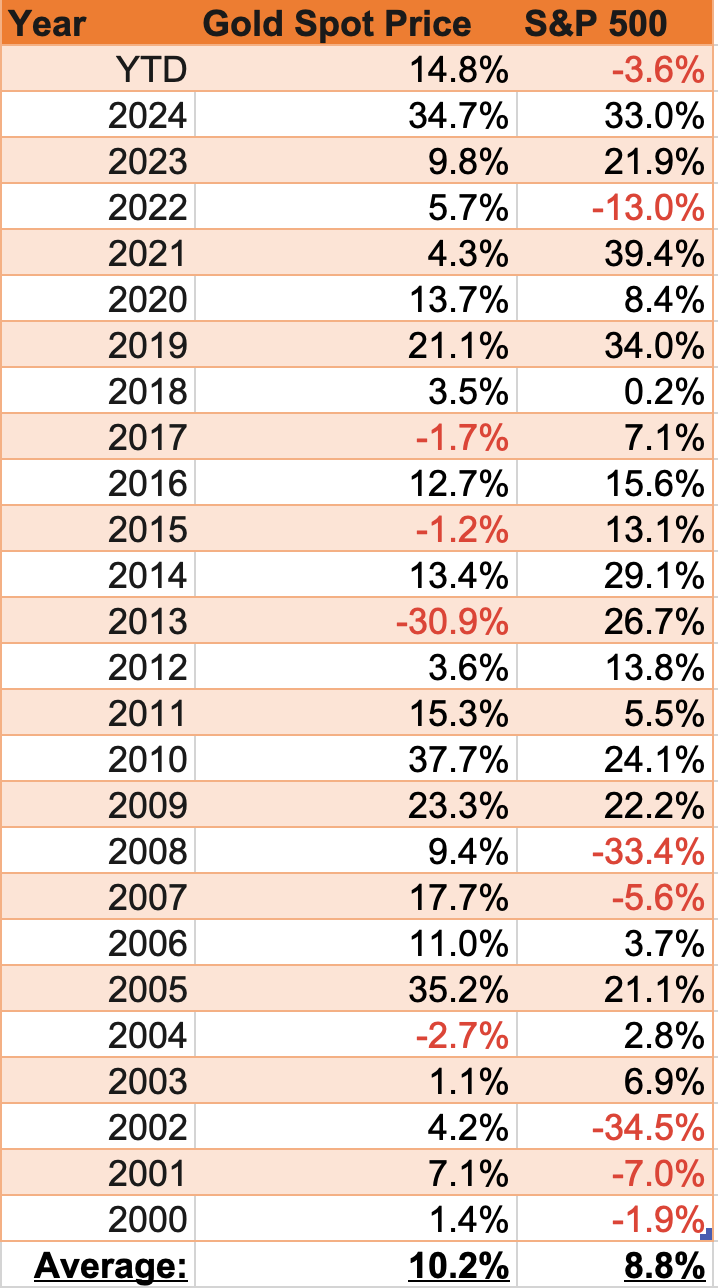

Here’s a table I compiled that breaks down year-by-year returns for gold and the S&P 500 over the past 25 years.

Two things jump out.

First: gold had only 4 down years during that time. The S&P 500 had 7.

Of those 4 red years for gold, only one—2013—was significant (down 31%).

The others were minor (under 3%).

Meanwhile, most of the S&P’s down years were deeper, with three double-digit losses.

In short, gold gave you fewer chances to get burned, especially if you were jumping in and out.

Second: gold delivered better average annual returns.

Gold averaged 10.2% per year.

The S&P 500 averaged 8.8%.

That difference may seem small, but as you saw earlier, compounding adds up—and over 25 years, it turns into a massive gap.

Now, am I saying gold will always beat the stock market? Of course not. There’ve been plenty of periods where stocks came out ahead. But this idea that gold only shines in “crazy” times and is a poor investment in “normal” times just doesn’t hold up.

Have a great weekend,

Lau Vegys

P.S. Since we’re talking about gold—did you know 2,000 metric tons of physical gold have quietly flowed into the U.S. since December? That’s 64 million ounces… nearly a quarter of America’s official reserves. Matt Smith believes this is no accident. He thinks it ties directly into Trump’s plan to overhaul the financial system in a way we’ve never seen before. Click here for details.

A top analysis .. if that doesn’t put reality into perspective I don’t know what ever will… the real issue is we have been assailed, nay assaulted with a trope and incessant narrative that Gold is of no value as an investment, it’s a mantra we have been told time and time again, almost pathologically in order to “steer” and “skew” our thinking away from the Worlds oldest known real money, steering us into the funny money, the fanciful, the unreal, pretend, contrived,made up stuff, anything but real… sure using puts, options, derivatives and every other conceived of financial instrument an individual can become an outlier and make many, many times more money than would ordinarily seem possible with just real and timeless money.. gold, but every second you are in that zone, the funny money exposure you are at risk of loss, big loss.

The market is rigged, it’s not a true representation of reality, big players led the central banks and in the case of the U.S Fed Reserve dominate the market, placing buy/sells all in order to steady the great ship, the Stock Market..

Personally having invested in gold since the late 1990’s and the stock market over the same period, cashing out all of my Stocks save now only a bunch of ETF trades, doing so back in January I have no desire to go back in, good lord, even the treasuries market is manipulated, just as the Metals markets are … however, through it all, metals real tangibles and commodities I say will prove their true resilience, real, no counter party risks, just solid investments, seems the wheels are about to fall off the biggest market manipulation in history, when it comes, watch the worlds oldest, purest money take on a life form of its own, inheriting again its rightful place, both in terms of value and in terms of use and recognition as real money, the only other Tier 1 fiscal asset alongside the manipulated Treasuries to have that privilege bestowed, the genie is all but out of the bottle metaphorically speaking, once completely out, it won’t be going back into the bottle from whence it has come all that easily… nor readily, to many now understanding and realising just what it is Gold, Silver, Copper other precious metals alongside commodities actually represent in this world of make believe we live in… thus the clamour and demand for real is only going to intensify… as it should, best of all, it’s all predicate solid, rock solid fundamentals and your analysis has assisted in reinforcing the age old benefit of owning and possessing real money.. just saying

Kia Kaha ( Stay Strong ) from New Zealand

It looks like you've excluded the S&P dividends from this analysis, which of included would likely show that the S&P beat gold by because of compounding.