Government Debt Just Hit New Historic High

$35 Trillion Debt Wall, $140 Billion in June Interest Payments, and the Way Out

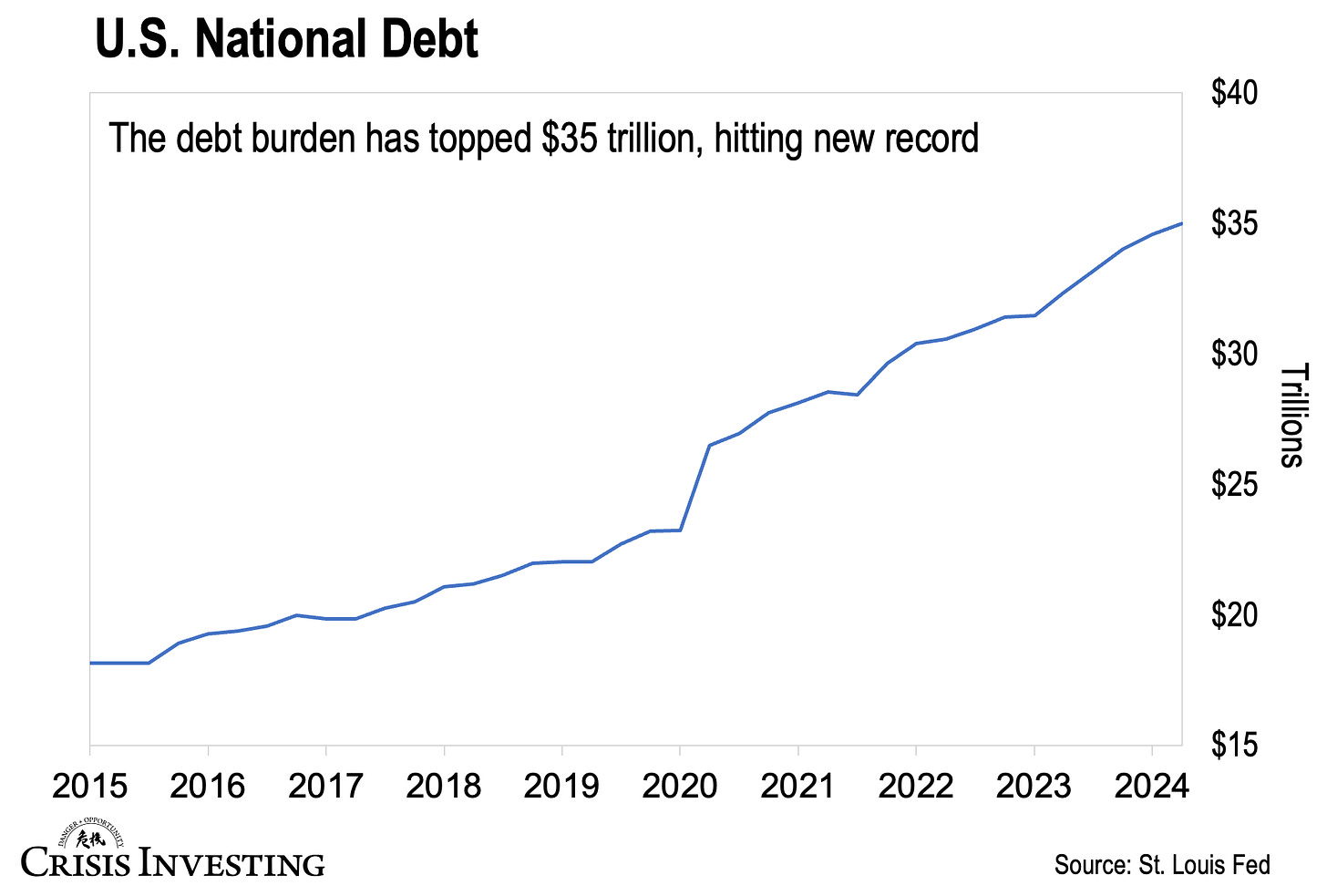

As you read this, the U.S. has smashed through a historic fiscal milestone of $35 trillion in national debt. That is roughly $105,000 for every individual and $270,000 for every U.S. household.

This means that the national debt has surged by nearly $2.3 trillion over the past 12 months. That’s about $6.4 billion every single day, roughly $266.7 million an hour, and around $4.44 million a minute.

Here’s a link if you want to watch it tick up live by the second, but be warned, it’s quite disturbing.

In short, America’s finances are sinking into a quagmire.

If you've been following us for a while, this might not come as a surprise. Doug Casey has been sounding the alarm about the dangerous levels of U.S. debt for decades. Yet, Wall Street and mainstream media have largely brushed it off, leaving Americans in the dark about the true extent of the crisis.

Why Should You Care?

This is a very valid question to ask because many people see national debt as a distant thunderstorm — something far off and abstract, rather than the storm that’s brewing right over their heads.

The fact is, people should be worried because, ultimately, they're the ones stuck footing the bill.

For instance, do you know how much of your income taxes were spent on interest on the national debt last month?

According to the latest Monthly Statement of the U.S. Treasury (page 8) net interest expense was $81 billion. That’s 43% of the $185 billion the government collected in income tax receipts.

Think that’s bad? It’s actually a lot worse…

If you check the bottom of the table on page 9 of the link above, you'll find that gross interest paid in June amounted to $140 billion. That’s 76% of all income tax receipts.

Put simply, 76 cents of every dollar you paid in income tax in June went to cover interest on the debt. If that doesn’t give you pause, I don’t know what will.

Note: “Net interest” is the interest paid on U.S. Treasury debt held by the public, including both domestic and foreign sources. “Gross interest” also includes interest paid to U.S. government trust funds (like Social Security) and other government accounts holding U.S. debt.

Every dollar used to pay interest on the rising debt is a dollar taken from your pocket and sent to U.S. debt holders, including those in Japan, China, and other foreign countries.

Can’t Kick This Down the Road Forever

But here’s the problem. The U.S. can't just bank on foreigners to keep buying its debt as more of them start distancing themselves from the dollar.

Other nations hold about $8.1 trillion of U.S. federal debt — and that doesn’t include the many trillions of additional agency debt they also hold. So, it’s a big deal.

If the trend continues, it could cause serious problems for the U.S.

But it’s not just about de-dollarization; it’s also about prudent fiscal management.

Just think about this from a foreigner's point of view: Would you keep trusting a country that’s so irresponsible with its finances to hold the bulk of your reserves?

Keep in mind that just last year, two of the Big Three credit agencies, Moody’s and Fitch, downgraded their outlook on U.S. debt. One of the main reasons they cited for the downgrade was, you guessed it, surging interest payments.

And you can see where they’re coming from.

Servicing the debt is now the second-largest budgetary outlay. In fact, the U.S. already spends more on interest payments than on national defense. Soon, it will be spending more on interest than on welfare and education combined. How sustainable is that?

It’s not.

But we know the U.S. won’t default on its debt, as that would be political suicide for those at the top. The only alternative for them to bail out the system is through devaluing the dollar.

Devalue or die.

I know most people don't believe currency devaluations can happen in highly developed countries like ours. But the writing is on the wall.

Regards,

Lau Vegys

P.S. Protecting yourself from this crisis is simple: convert as much government currency units as you can into real money: gold. The metal’s track record speaks for itself, which is why Doug always recommends holding it in your long-term investment portfolio while investing in gold stocks for even more profits. That's also why a big part of our Crisis Investing portfolio is focused on these stocks, which Doug himself owns.

"quite disturbing"

You deserve an award for understatement of the year.

I don’t think most ppl care ….. for now