Here’s Proof That Woke Capitalism Is in Retreat

How It All Started, DEI and Earnings Calls, the Fed, and the Great Un-Wokening

Earlier this week, I wrote about how the DEI (Diversity, Equity, Inclusion) movement has hit a rough patch, with American companies starting to pull away from it. Here’s what I concluded:

While some major companies are backing away from the concept, the process won't be instantaneous. BlackRock and other deep-pocketed vanguards of woke capitalism still control the voting power in our 401ks, giving them the ability to foist DEI on all Fortune 500 companies. Alongside that, you've also got a ton of diversity-focused initiatives and consulting companies still pushing for these things because they make a lot of money from advising on them.

None of these actors are going away overnight… certainly not on their own volition, as they are too invested in pushing woke capitalism, both financially and otherwise. But the tide IS turning.

A great way to see that the tide is truly turning comes from data I’ve come across at FactSet, a financial-data company.

But first, some important context to set the stage…

If there's one point in time that really catalyzed the DEI movement, it was George Floyd's death and the immediate aftermath, like the BLM riots.

Suddenly, you had major companies (too many to count) falling over each other to put out endless statements, decrying the “horror of what had happened” and vowing to “ramp up their DEI efforts.” The likes of Larry Fink of BlackRock talked ad nauseam about the importance of companies “acting as responsible social stewards.” Corporate America was all over the media, announcing their ESG and DEI goals, setting lofty targets and quotas. The Chief Diversity Officer role became the hottest gig in town (saddling companies with activists who caused harm for many quarters to come).

This was the time when meritocracy had to step aside for a wave sanctimony pushing the narrative that everyone is either a victim or a victimizer—and the fallacy that racial disparities in the office (and elsewhere) could only be explained by “systemic racism,” as taught in racial sensitivity seminars on “how to be less white.”

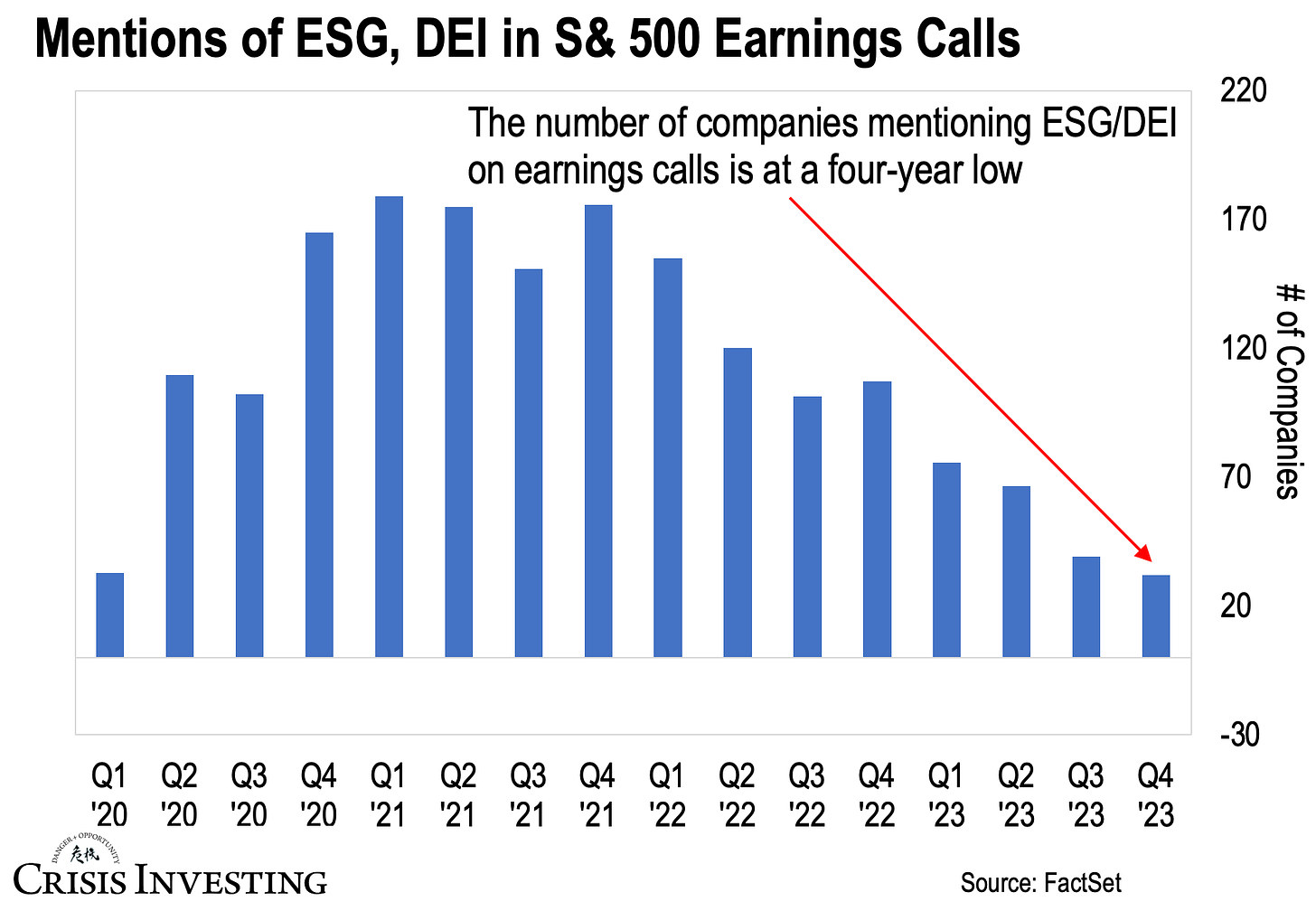

According to FactSet data, the number of S&P 500 companies mentioning DEI and ESG in their quarterly earnings calls surged by an impressive 450% from Q1 2020 to Q1 2021.

The DEI movement stayed strong and kept going for at least another year.

But then something happened. If you look at the chart below, you'll see that these numbers have taken a nosedive over the past few years. In the fourth quarter of 2020, 165 companies mentioned DEI and ESG in their quarterly earnings calls. By the fourth quarter of 2023, those numbers had fallen to 32. That’s an 81% drop.

Clearly, corporations are taking their foot off the gas pedal on DEI efforts that once appeared to be an unstoppable trend.

Decoding the Great Un-Wokening

So, what happened?

Well, a lot did, from the Bud Light and trans influencer Dylan Mulvaney debacle to the public backlash against Target's Pride collection, and many other things in between. But most importantly, after years of cheap money, the Federal Reserve, unnerved by the inflation it had created, shifted gears to raising interest rates.

Between March 2022 and June 2023, the U.S. central bank raised interest rates ten times, from near-zero to a range of 5.00% to 5.25%.

The era of cheap money came to an end, and it was bad news for DEI/ESG...

It's no coincidence that the steepest drops in ESG and DEI mentions coincide with the Fed's shift to raising rates. You can observe this in the chart above.

Amid high rates and poor returns, investors began to realize the mistake of corporate America’s obsession with social activism and politics at the expense of actual business performance. This led them to withdraw more than $14 billion from U.S. ESG funds in 2023.

It was an "aha" moment for corporate executives, who reluctantly came to see that DEI might not be the silver bullet to profitability they had hoped for.

Please don’t laugh…

As hard as it might be to believe, profitability was one of the major selling points for DEI, courtesy of McKinsey & Co. Their 2015 research paper, "Diversity Matters," claimed that more diverse companies are more profitable, based on a study of 366 public companies across the U.S., Canada, the UK, Brazil, Mexico, and Chile.

Many academic publications have since tried and failed to replicate McKinsey's findings, which turned out to be a load of baloney, confusing correlation with causation. But as the saying goes, "We only learn from our mistakes," and so it took poor returns and public backlash for corporate America to finally start course-correcting.

Note: I’ll probably write a separate article about McKinsey and how they were largely responsible for the rise of corporate DEI, but suffice it to say their findings have been widely discredited.

This is happening, and it’s a good thing. That’s why the chief diversity officer is no longer the hottest job in America, and why there’s a lot less DEI chatter on S&P 500 companies' quarterly earnings calls.

But wait, does that also mean DEI was a result of the Fed’s money printing and cheap money policies? Yes, in large part, it absolutely was. I’ve said it before and I’ll say it again: when you undermine the fundamental measure of value, everything starts to unravel. The DEI movement is another case in point.

Unfortunately, this suggests we can probably expect to hear a lot more DEI/ESG talk on company earnings calls once the Fed inevitably resumes its cheap money policies. Brace yourselves.

Regards,

Lau Vegys

P.S. Doug Casey believes that the Fed's move to cut rates and fire up the money printer will create a bubble in commodities. That's why a big part of our Crisis Investing portfolio is focused on these stocks, which Doug himself owns.

Thank goodness.

I'm familiar with the research. It's worth mentioning that the drop in companies talking about DEI and ESG wasn't just about the acronyms but also the words: diversity, equity, inclusion, etc. So, the interest is waning, yes.