For the past two weeks we've been banging the table that President Trump's tariffs and economic policies aren't isolated decisions—they're the first steps in a comprehensive plan to transform America's economy and monetary system. And at the heart of it all? Gold.

Now, I've noticed something fascinating—every time I mention America's gold, my comments section explodes with readers wondering if the U.S. gold reserves actually exist anymore: “Is the U.S. gold still in Fort Knox? Or was it all quietly shipped overseas?”

These are fair questions. And frankly, now seems like the perfect moment to be asking them. President Donald Trump recently confirmed as much, declaring he'd personally inspect Fort Knox with Elon Musk.

Donald Trump: “We're also going to Fort Knox. I'm going to go with Elon. And would anybody like to join us? Because we want to see if the gold is still there.”

Imagine the headlines if Trump and Musk crack open Fort Knox and find... nothing but dust and cobwebs!

But until we know for sure, I want to shine a light on what I consider one of the most fascinating—and downright mysterious—stories in American finance.

How Did the U.S. Gov't Get All This Gold?

To understand where we are, we need to rewind to the 1930s, when the U.S. government first began amassing its massive gold hoard.

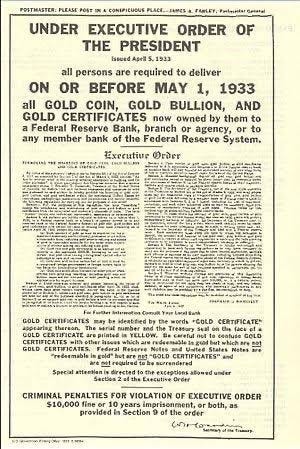

In 1933, President Franklin Roosevelt effectively ended the gold standard for U.S. citizens and ordered one of the most sweeping confiscations of private property in American history through Executive Order 6102. Americans were required to surrender all their gold coins and bullion to the government in exchange for paper dollars—at a fixed rate of $20.67 per ounce.

Note: Soon after, the government revalued gold to $35 per ounce, effectively devaluing the dollar and profiting off the confiscation.

This was a shocking, blatant case of government overreach—a legalized theft, pure and simple—but it funneled a massive influx of gold into the government's hands.

To store all that gold, the Fort Knox Depository was built in 1936, designed as an impregnable vault to house the newly “acquired” wealth. By 1937, trainloads of seized and stolen gold were rolling into these new vaults.

Over the next several years, gold-laden trains kept coming, fueled by America’s trade surpluses.

By 1941, U.S. gold reserves peaked at over 20,000 tons. At that point, America controlled about 23% of the world's official gold—a concentration of wealth unlike any time in human history.

America’s huge gold stash gave other countries confidence in the dollar. And with that, a new monetary system was born.

In 1944, the Bretton Woods Agreement officially pegged the U.S. dollar to gold at $35 per ounce, while other countries tied their currencies to the dollar.

But the golden age didn’t last.

By the 1950s and 1960s, post-war prosperity turned into trade deficits and heavy overseas spending, draining gold from U.S. vaults as countries traded their dollars for bullion. By 1971, reserves had shrunk to about 8,100 tons—about the same level as today.

Faced with this exodus, President Richard Nixon pulled the rug out from under the world economy on August 15, 1971, closing the gold window and ending the dollar’s convertibility to gold for foreigners (recall that FDR had already done this for Americans in 1933).

The Bretton Woods system collapsed, and the world fully moved to a fiat currency—paper money with no gold backing.

The Vaults of Secrets

Trillions in debt, runaway inflation, and relentless money printing later, we’re left asking: Does the U.S. government still have its 8,133 tons of gold (roughly 261.5 million ounces) locked away?

God knows, over the years, there's been enough secrecy around Fort Knox to fuel skepticism in even the most trusting minds. And when there's this much smoke, it's only natural to wonder about fire.

The theories are numerous and compelling. One major claim suggests the gold was shipped out in the 1960s, with persistent rumors pointing to President Lyndon B. Johnson allegedly sending tons to London.

Another theory suggests the U.S. has lent or leased out the gold to foreign entities or banks, leaving Fort Knox as nothing but a guarded empty shell—a PR facade to maintain confidence in the dollar.

Then there's perhaps the most unsettling possibility: maybe the gold is physically there, but it doesn't all belong to us. Some speculate that much of it is foreign-owned, deposited during WWII and never reclaimed, with the U.S. serving as a de facto custodian.

Take your pick of these theories—any one of them could explain why there hasn’t been a proper, public audit in over 70 years.

You read that right. The last full inspection was in 1953 under Eisenhower, and even that was just a spot check of 5–7% of the bars. Not exactly rigorous by modern standards.

Now, what about the often-cited 1970s audit?

It’s true that in 1974, amid mounting rumors of missing gold, the Treasury opened Fort Knox to 100 congressmen and journalists for a quick tour. It was the first time outsiders had seen inside in decades. They saw stacks of gold bars, even held a few for photo ops, but no bars were weighed, tested, or checked against serial numbers. One radio reporter summed it up best: “All I can say is that I saw gold in there."

It was a PR stunt, not an audit.

That same year, in an effort to quiet public skepticism, the U.S. Treasury and General Accounting Office launched what they called a more systematic audit program. From 1975 to 1981, they conducted a series of yearly reviews of portions of the gold reserves.

By 1981, they reported no discrepancies between the recorded and actual gold in storage.

But here’s the problem—these reviews never amounted to a full audit.

The last report vaguely noted that only about 209 million troy ounces—roughly 80% of the U.S.-owned gold—had been checked. No clear word on how many bars were actually verified by serial number, how many were physically tested, or any other details that might suggest they did a thorough job.

And then, after 1981, these already shaky partial audits just… stopped.

The U.S. Mint and Treasury insist the gold is inventoried and audited regularly—but with no public details, no independent verification, and a whole lot of secrecy, it’s basically a “trust me, bro” situation.

A Visit Isn’t an Audit

If you’ve read Matt Smith’s recent report about Trump’s coming reset and gold’s central role in it, you’ll probably agree—there are plenty of reasons to audit U.S. gold holdings right now.

After all, we can’t "monetize the asset side of the balance sheet"—as Trump’s Treasury Secretary, Scott Bessent, recently declared—without first getting a full accounting of the gold that would form its foundation.

Now, my only concern is that a Trump-Musk visit to Fort Knox could end up being just another PR stunt, much like Treasury Secretary Steven Mnuchin’s highly publicized 2017 trip. That was the first time a sitting Treasury Secretary had visited Fort Knox since 1948—a big deal, right?

After the visit, Mnuchin simply tweeted, "Glad gold is safe!"

Oh, great. What a relief—sorry for ever questioning it.

I bring this up so it’s clear—a visit by government insiders isn’t the same as an actual audit.

What we need is a real, full audit—not just of the gold sitting in Fort Knox, which holds about 4,580 tons (more than half of the country’s official reserves), but also the rest, scattered across the U.S. Mint, the New York Fed vault, and any other shadowy Treasury hideouts, if they exist. Every bar needs to be weighed, every serial number verified, and every ounce accounted for—no exceptions.

And here’s where it gets really interesting...

Since December 2024, COMEX has imported around 674 metric tons of physical gold. But when you factor in non-COMEX gold, the total jumps to 2,000 tons—64 million ounces—brought into the U.S. between December and February. That’s nearly a quarter of all the gold the U.S. government claims in its official reserves.

That’s not normal market behavior. Someone with deep pockets—likely the Treasury or the Fed—is stockpiling physical gold with zero regard for price.

My guess is they’re probably trying to get ahead of an audit—quietly filling any gaps before the numbers go public.

Right or wrong, one thing is certain—the gold is pouring into the U.S. And we’re convinced this is part of Trump’s plan to overhaul the American economy and monetary system. Matt’s meticulously documented how this could trigger a financial transformation unlike anything we've ever witnessed. If you haven’t checked it out yet, click here for details.

Regards,

Lau Vegys

Trump should bring Geraldo Rivera with him to cover it.

If the gold is not there, they will not tell us......it will cause a panic. The fact that it has not been audited for a long time is troublesome. Everything the government does corrupts eventually.