Today, I want to talk about uranium. It's a space I’m incredibly bullish on, and for good reason...

A little over a year ago, in December 2023, 22 nations, including the U.S., U.K., France, Japan, the United Arab Emirates, and South Korea, committed to tripling their nuclear energy capacity by 2050.

This was as close as governments will ever come to admitting that reaching their ridiculous net-zero targets is impossible without nuclear energy. Keep in mind, we weren’t just any nations; we’re talking about the global powerhouses that make this planet go round.

And it's not hard to see why. With the rapid advancements in AI, robotics, and electrification, global energy demand is set to skyrocket. Renewables alone simply can't shoulder this burden.

In fact, countries are already practically falling over each other to build more nuclear reactors—China, Russia, India, South Korea, and the United Arab Emirates, to name just a few.

As I write this, there are 64 nuclear power plants currently being built around the world. Plus, there are another 87 in the pipeline and over 344 more proposed.

And that's what makes uranium, the main fuel for nuclear power plants, a no-brainer in my book.

A Market Like No Other

Now, one thing you should know about uranium is that it undergoes massive—and I mean truly massive—swings between bull and bear markets. This unique quirk enables savvy investors to make fortunes in the uranium market.

Here’s Doug Casey:

I wrote a very long and thorough article on uranium and nuclear power in October 1998 for my newsletter, where I recommended several uranium stocks. About two years later, they all exploded upwards in value and kept running.

At that time, uranium was selling for $10 or $12 a pound. But it cost $20 to $25 a pound to mine a pound of U308. It was obvious that the price had to go up, or over 400 nuclear power plants around the world would have to shut down, and with them, about 10% of the world’s electrical power.

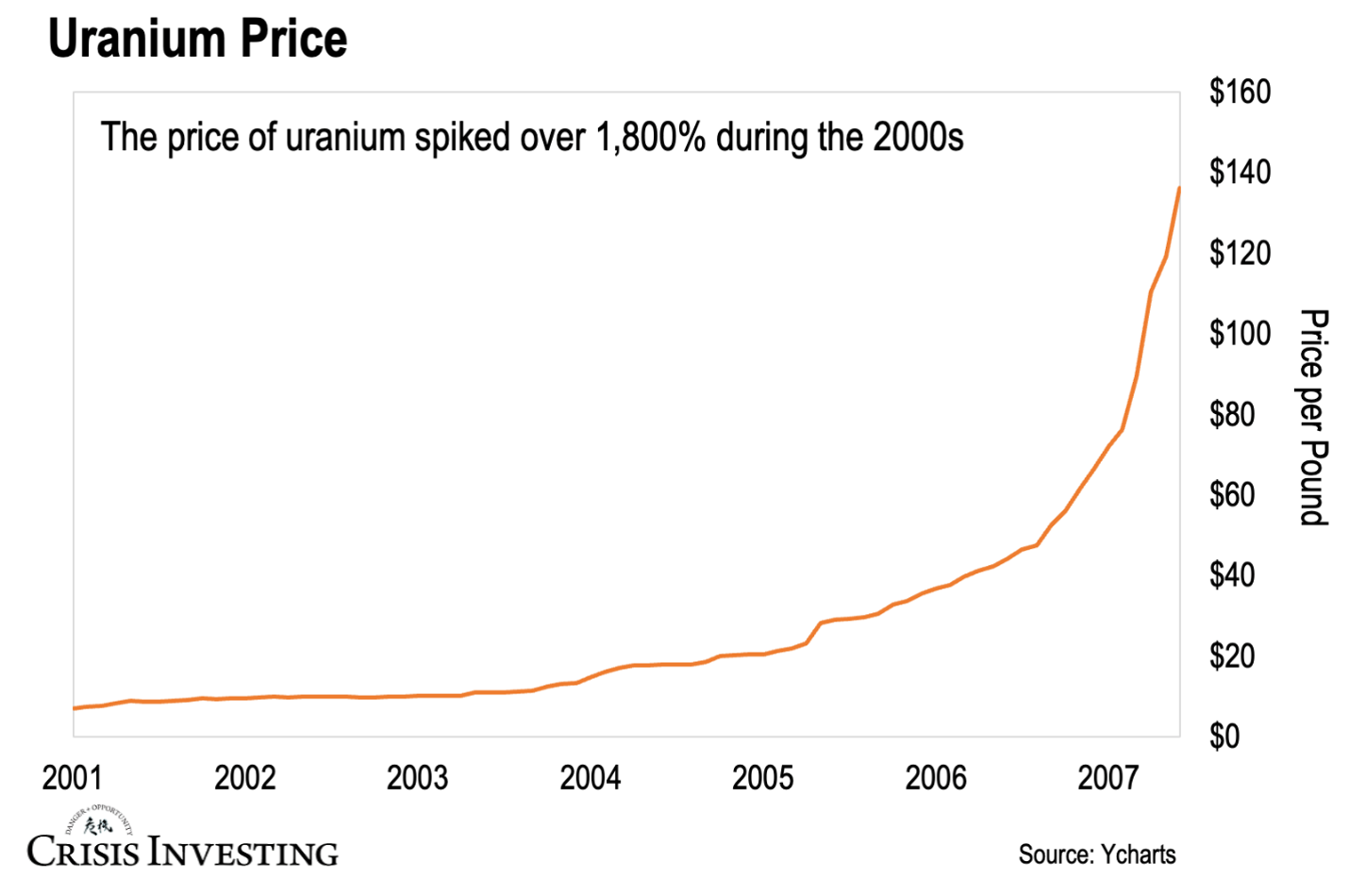

The market went up from there and peaked in 2007 at $140 a pound. One of the best on my list was Paladin Resources, which went from 10 cents to $10. But many, many companies went up between 10 and 50 times.

To truly appreciate Doug's insight, here's a quick visual to give you an idea of what that ride must have felt like for those invested.

Talk about life-changing gains, right?

Now, while we aren’t starting from such a low base in 2025, we’re not in the middle of a massive bull market either. In fact, the price of uranium is currently around $77 per pound, down from about $100 back in January 2024.

That said, I’m expecting the uranium market to bounce back strongly this year.

While most of the factors I covered in our uranium special report last year still hold true, there’s something important to note about the supply side.

If you missed it, Kazatomprom, the world’s largest producer of uranium, announced a 17% reduction in planned production for 2025. This is huge because Kazakhstan supplies about 45% of the world’s uranium.

A cut like this is pretty rare. For example, if the U.S. cut its oil production by the same amount, we'd probably see oil prices spike, even though the U.S. only makes up about 20% of global oil supply.

What makes this even more crucial is that production from 2025 to 2028 is already locked in with their clients. This means Kazatomprom will need to get the uranium from somewhere else. But where can they go? There are no big stockpiles left, no new mines coming online, and almost every producer is facing the same issues. So, they’ll likely turn to the spot market.

And Kazatomprom isn’t alone. Other big players like Cameco, Orano, and CGN are also selling more uranium than they produce.

The bottom line is, someone will be buying a whole lot of uranium from the spot market. And soon. That’s reason enough to think about getting some exposure to uranium prices this year.

Where the Real Money Is

But while having some direct exposure to uranium is smart, the real jackpot is in uranium stocks. That’s because they provide leverage to the underlying commodity, potentially amplifying your returns.

Remember the 2000s uranium bull run from the chart I showed earlier? While the metal itself performed impressively, uranium miners' stocks did even better. Many of Doug's subscribers made a killing with companies like Paladin Resources, as he mentioned earlier. Even the laggards in the sector delivered 20-fold returns.

The best part is, it's still a great time to buy uranium plays right now. I'm especially bullish on American ones, as their stocks haven't moved much over the past year.

Mind you, that's despite Joe Biden signing a bipartisan bill earlier this year banning the import of uranium from Russia until the end of 2040, and Russia's retaliatory move in November, imposing restrictions on the export of enriched uranium to the U.S.

Now, there are some nuances. The U.S. ban only targets low-enriched uranium (LEU) from Russia, and Russia’s retaliatory move still allows authorized companies to export uranium to the U.S. But these are still big developments with serious implications for the uranium market.

Remember, Russia currently controls about 40% of the world’s enrichment capacity and provides roughly 35% of U.S. uranium imports.

The reason we haven’t seen a huge impact on U.S. uranium stocks yet is that most of last year’s uranium deliveries were already made to U.S. utilities. But that could change this year, possibly leaving some reactor operators scrambling to find a reliable supplier.

This is one of the reasons the White House recently announced a big plan to triple U.S. nuclear energy capacity by 2050.

Keep in mind, the U.S. barely produces any uranium anymore. Over 90% of the uranium used by American nuclear plants comes from overseas. The only commercial enrichment facility in the U.S. is in New Mexico, and it’s owned by a consortium from Britain, the Netherlands, and Germany—Urenco Ltd.

Clearly, having abundant domestic uranium production is crucial for a country like the U.S. (which always seems to be making new enemies). Naturally, this is great news for U.S. uranium companies and their investors.

Regards,

Lau Vegys

Hi Lau, thanks for the insight…its always difficult to get on board when everyone is believing it’s a “slam dunk” (think lithium over the past year, and gold miners relative underperformance to the gold price), but uranium definitely appears plausible enough at this time. PDN:AX recently also announce lower production and their share price was smashed (which doesn’t mean they won’t recover, but it won’t be an easy ride)… Keep up the great work!

Thanks for writing this up. Will you be making any specific buy recommendations? I don't really understand the ups and downs of the uranium market, but started a small position in Cameco (CCJ) last year simply because of the massive change in attitudes toward our need for more nuclear power plants. Since it's been taking about 10 years to build a new power plant, there could be a long wait before those plants need to buy uranium for fuel, but it seems inevitable in the long run.

CCJ is very high priced and I suppose it will take a big hit if we go into recession. Do you have some better ideas?