No Escape from Unchecked Government Spending and Deficits... Here's the Proof

70-Plus Years of Overspending, Our 'Leaders', and the Road to Ruin

"Nothing is so permanent as a temporary government program."

~ Milton Friedman

Yesterday, I wrote to you how the Congressional Budget Office (CBO) now predicts the government will overspend by $1.9 trillion this year. This is a massive 27% increase in the deficit, or about $0.4 trillion more, compared to the agency's projections from February 2024.

That’s essentially new debt being piled on top of the existing $34.8 trillion the government already owes. Thanks for that, government.

But, as bad as things may seem already, I have something to show you today that makes me believe we're really past the point of no return. This realization struck me after reading a comment from a reader under yesterday’s essay. Here's a snippet of what they wrote:

Personally, I'd love to see an analysis of historical deficits. My hunch is they were practically nonexistent from the early days of our country until about halfway through the 20th century, then they really exploded in the latter half. But I'm not sure...

Happy to oblige.

The reader is, of course, absolutely correct. Government deficits were indeed “practically nonexistent from the early days of our country until about halfway through the 20th century.”

But this changed in the second half of the century, when government spending started picking up, partly due to initiatives like Lyndon B. Johnson's War on Poverty and the introduction of new social programs such as Medicare and Medicaid.

The outcome?

In the 20 years between 1950 and 1970, 15 of those years ended in deficits.

And it only got worse from there. Take a look at the next chart; it shows the surpluses and deficits of the U.S. government since 1970.

What you'll notice right away is that since 1970, the government has had a surplus in only 4 years. Put another way, in the past 54 years, the government has run a deficit in 50 of those years.

But if you look at the last 22 years, the federal government has overspent every single year. And each time, it piled on more and more debt. Every single time.

It went something like this… George Bush sets a record with a huge deficit and skyrocketing national debt. Obama takes over and tops that, adding even more. Then Trump comes in and breaks the record again, with even bigger deficits and more debt.

Finally, not wanting to be outdone, President Biden goes on a trillion-dollar spending spree with stimulus projects like the American Rescue Plan, the Infrastructure Investment and Jobs Act, and the Inflation Reduction Act. Naturally, the debt hits another all-time high.

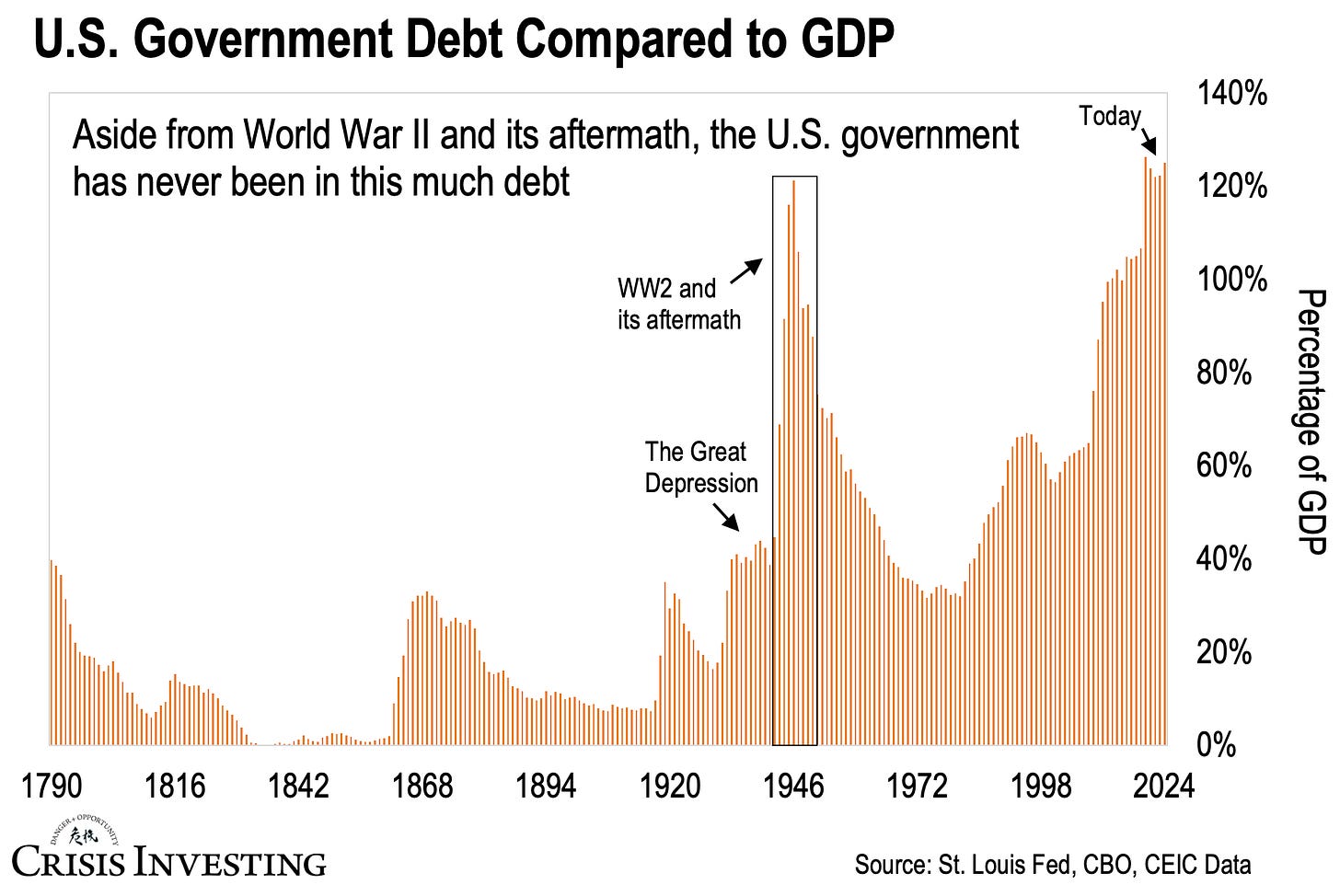

The end result of all this spending is the government debt reaching $34.8 trillion and counting. That’s about 125% of America’s GDP. The only time the nation was this deep in debt relative to the economy was during World War II and right after. Not even the Great Depression came close. Take a look at the graph below.

So, here’s the takeaway… Our so-called leaders have been overspending for the last 70-plus years. That alone should tell you they probably aren’t going to change their ways. Even the $34.8 trillion mountain of debt, worth 125% of GDP, isn’t enough to make them reconsider.

The expected $1.9 trillion deficit this year, driven by aid to other countries, failing bank rescues, and paying off student loans, makes this pretty clear.

If this isn't a damning indication that the U.S. is on fast track to complete fiscal ruin, I don't know what is.

Regards,

Lau Vegys

P.S. Yesterday, also in the comments section, someone asked, "How do we get out of this mess?" Another commenter suggested that it's impossible for "we" and that we need to think in terms of "ourselves, our families, and our loved ones." I completely agree. There's no getting out of this collectively, only as individuals. To do that, you need to take responsibility for your financial future by buying assets that cannot be "printed," investing in companies that produce things our economy won't survive without, and, of course, speculating.

Note: Doug Casey has defined speculating as risking 10% of your capital targeting 100% gains rather than risking 100% of your capital striving for 10% gains.

At the very least, you should try to convert as many government currency units as you can into real money: gold. The metal’s track record speaks for itself, which is why Doug always recommends holding it in your long-term investment portfolio while investing in gold stocks for even more profits. That's also why a big part of our Crisis Investing portfolio is focused on these stocks, which Doug himself owns.

Another fun statistic : In 2000, our total federal debt was $5 trillion. Todays its more than 7X that amount.

Doug, since property rights in US are an illusion, seems to me anything to do with gold and assuming it can be a real store of value worth one's investment is actually amazingly risky. This is a room elephant that most gold podcasts on YT wont even bring up. Thoughts?