In yesterday’s essay, I talked about gold’s big moment as it finally broke through its inflation-adjusted all-time high, passing the $2,700 mark. It’s a huge milestone, and I get why some folks might hesitate to jump in at these record prices. While I think holding off could mean missing a great opportunity, I understand the reluctance.

So, if you're still on the fence about gold, I've got another precious metal play for you: silver.

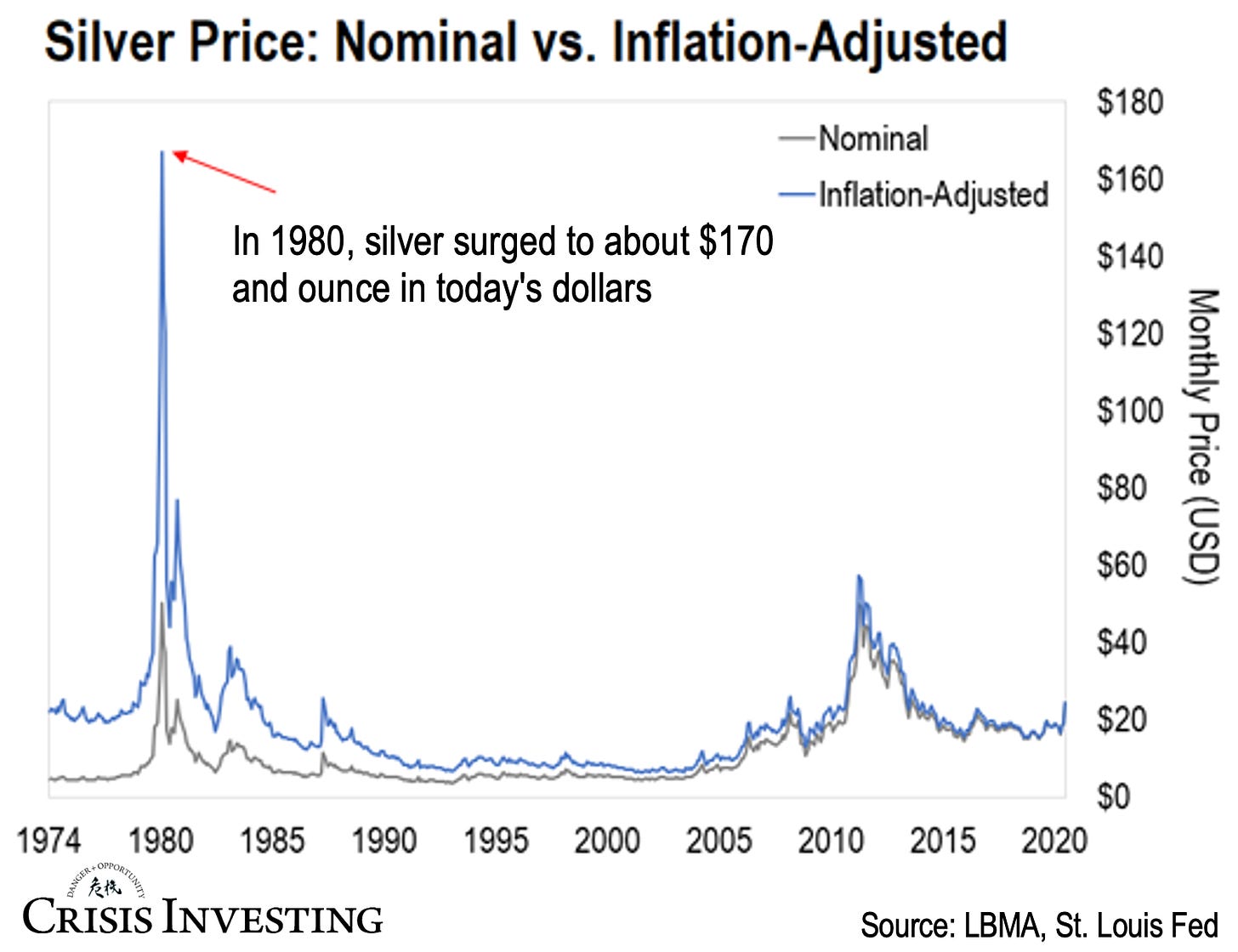

Now, I know silver might not be the most attention-grabbing idea, but there's a solid rationale behind it. And today's chart shows exactly why the metal is a fantastic opportunity right now.

Take a look—despite trading around $33 an ounce, silver is still way below its inflation-adjusted all-time high. And I do mean way below.

As you can see, silver peaked at about $50 back in 1980. In today's dollars, that translates to about $170.

This means silver would need to rise more than five times its current price to hit its inflation-adjusted peak. And it would have to nearly double just to reach its 2011 high (in real terms). Yes, the “poor man’s gold” hasn’t even surpassed that mark yet.

Once again, keep in mind that gold has already smashed through its 1980s all-time high (and it’s been more than four years since it effortlessly vaulted over its 2011 high).

Now, silver’s rally over the past month has pushed it above a key resistance level. It actually looks like the metal may make another run at its previous (nominal) high of $49. And with gold breaking into new highs, there’s good reason to believe silver could finally follow suit and do the same.

What many people don’t realize is that silver often lags behind gold in terms of performance. But when it does catch up, historically, it tends to outperform the yellow metal by a wide margin.

Enjoy the rest of your weekend!

Lau Vegys

P.S. Doug Casey always recommends holding precious metals in your long-term investment portfolio. But he also recommends investing in precious metal stocks for even more profits. That's why a significant portion of our Crisis Investing portfolio focuses on these stocks, which Doug himself owns.