“That's why they call it the American Dream, because you have

to be asleep to believe it.”

These words spoken by the legendary comedian George Carlin have never rung truer than they do today.

According to a recent study by Investopedia, living the "American Dream" could set you back around $3.4 million over your lifetime.

But the average lifetime earnings for the typical U.S. worker stand at $1.7 million as earlier research from the Georgetown University has found.

You may see the problem.

Here’s some more data…

Another analysis, from USA Today, found that funding the American Dream costs about $130,000 a year for a family of four. However, the average household income, according to the Census Bureau, sits at about $74,450.

These figures just don't add up. Evidently, all is not well beneath the once gleaming facade of the American Dream.

The Fading Dream

But what is the American Dream anyway?

If you're picturing the classic scene of a man and woman with two kids, a white picket fence, a suburban house, and a car straight out of the 1960s, then you’re pretty much on the money.

At its core, the American Dream is about being middle class.

Now, I’m a fan of the middle class. It’s made of people who want to work hard, create and run businesses, take care of their families, and move up in life.

Interestingly, it’s been demonstrated that most people consider themselves to be middle class, regardless of their income.

But for most people, I think we can all agree that middle class just means having kids, being able to afford their education, owning a car, and having a place to call your own.

Owning a home has always been a cornerstone of the American Dream, so let's explore that aspect more closely.

Now, we're all aware that home prices have been skyrocketing since the mid-20th century. That's not the real issue. The problem is that they have risen much faster than income levels.

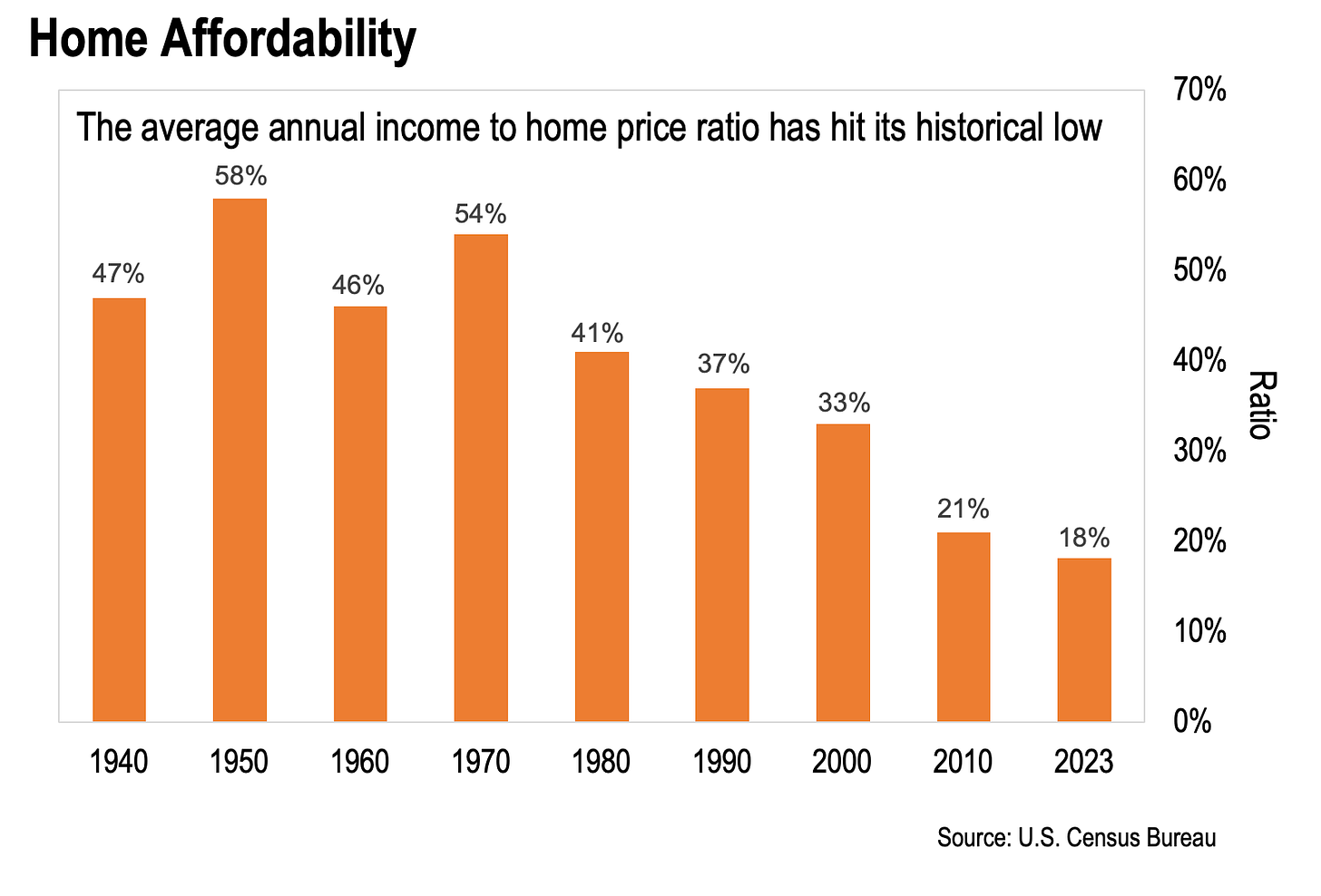

As you can see in the next chart, home affordability is currently at its lowest point in history.

The current income-to-home price ratio stands at 18%. That’s a far cry from the 58% peak it reached in the late 1950s.

Let me break down what this means in real terms...

In 1959, the average annual salary of U.S. families was $5,400, according to the U.S Census Bureau. Meanwhile, the average U.S. home value was $9,627.

That means a family made enough money each year to cover over half of the price of a middle-class home.

Now, the average sales price of a home at the end of 2023 was about $413,200. So, to maintain the 1959 income-to-home price ratio, your average family would need to make $231,392 annually.

Of course, the average family doesn’t make nearly that much. Not even close. U.S. households with two earners had an average annual income of $75,143 as of 2023 – again, just enough to cover 18% of the average home price.

In other words, today's families would need the combined income of three households just to match the home affordability levels of a single family back in 1959.

And that’s just the sad reality of today: purchasing a house is no longer within reach for the middle class; it's reserved for the crème de la crème of upper-middle-class families earning well over $100,000 a year.

But don’t just take my word for it.

Think of someone with good credit applying for a loan from their bank today. They'd likely face a 7% interest rate, which is the current standard.

Now, the traditional rule of home buying also says we should try to put down 20% of the overall price of the house as a down payment. Of course, the reality is no one really puts down 20%.

Most first-timers are lucky to scrape together 6-7%, which is about $30,000 for the down payment. This leaves them needing to borrow an impressive $400,000, resulting in monthly payments of just over three grand.

Now, before you think that it's probably doable for most people, keep in mind that banks typically limit housing costs to 28% of your pre-tax monthly income. Quick math tells us you'd need to be pulling in almost $130,000 a year to make it work. So, acquiring that average home puts a real strain on the middle-class dream, making it feel more like a mirage for many.

The dramatic fall in home affordability is a great illustration of how the average American’s standard of living has taken a huge hit over the past generation or so.

Here’s Doug Casey:

It used to be that the wife was a backup system. A failsafe in case the man lost his job, or something catastrophic happened. Now, both spouses have to work. If either one of them loses a job, they can’t keep their heads above water. That’s a prime indication of what we’re talking about.

Doug is spot-on.

Gone are the golden years of the American middle class, when one bread winner could provide a good life for a family.

And that's before factoring in other expenses like raising a child, which now averages about $307,000, compared to just $25,000 back in 1960 (or roughly $190,000 in today's currency), excluding college tuition.

The Minority No One Cares About

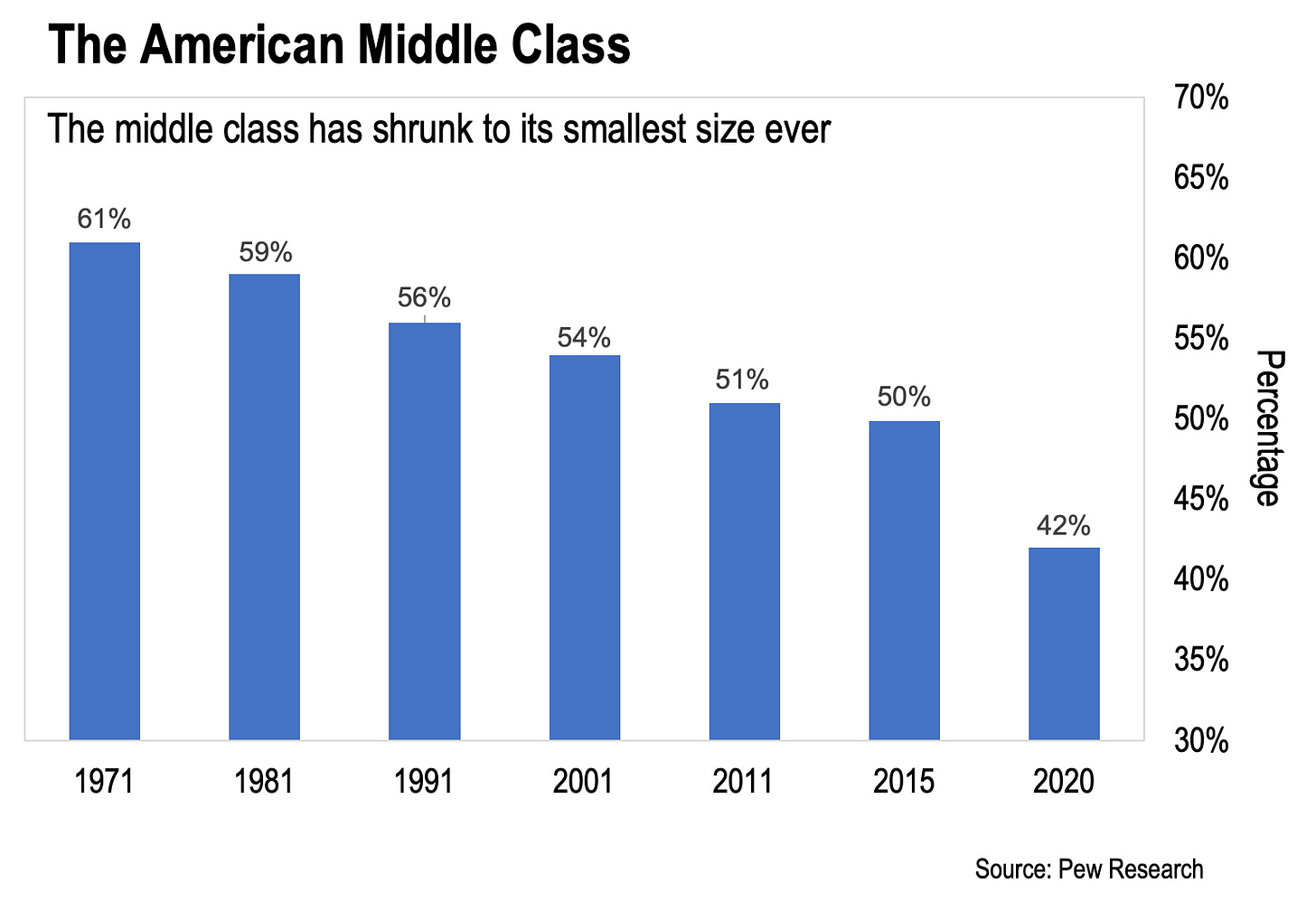

The American middle class is an official minority and shrinking at a rapid pace.

In 2015, the American middle class reached a demographic tipping point. It dipped below 50% of the population for the first time since data collection started.

Today, it remains a minority, making up less than 42% of the population.

Clearly, the trend shows no sign of reversing. In fact, if history is any guide, I expect it to accelerate.

This means that in the years ahead, tens of millions of middle-class Americans will be pushed down into the lower economic tiers.

Eventually, I think this trend will lead to a real crisis, carrying significant socioeconomic consequences for the country. It won’t be pretty.

Here’s Doug again:

Most middle-class people will end up joining either the upper or lower class—mostly the lower – and that’ll be a moral disaster for the country. When a country doesn’t have a middle class, it’s in trouble.

America used to be a place where class wasn’t really important. Most everyone had middle class values, even if they didn’t have much money—not at all like Europe or the Orient. But as the middle class gets squeezed, we’re likely to get class warfare between those on top and those on the bottom.

Doug is, again, correct. But the implications on an individual level are equally daunting...

In a way, it's like facing a rising drawbridge. Either you'll make it to the other side of the moat and live comfortably inside the castle, or you and your family will be left outside with the peasants, members of the permanent underclass.

Thinking about this further, it brings to mind the time an interviewer once asked Ayn Rand, the renowned philosopher and author, “What can society do about poor people?”

Her response: “Don’t be one of them.”

This perfectly encapsulates Doug's and my way of thinking. You might not rescue the American middle-class solo, but you sure can take charge of your own path.

Here at Doug Casey's Take, we strive to accomplish many things - talk markets and life, educate, entertain, and hopefully bring a smile to your face. And, who knows, maybe some of what we share will prove helpful in making sure you don't get left behind that drawbridge.

For Our Freedom and Yours,

Lau Vegys

P.S. Keep an eye out for Part 2 of my essay next week, where I'll explore what led to the decline of the golden years of the American middle class and why sheer hard work isn’t enough to move up in life anymore.

It appears we lost the middle class when the boomers took over from their middle class fathers.

Something was lost in the batton pass.