I know I'm often the bearer of bad news, but today, I’m thrilled to report something actually worth raising a glass to.

Now, if you own a business or have an interest in a company, the BOI filing deadline might have been weighing on your mind right about now.

Not anymore.

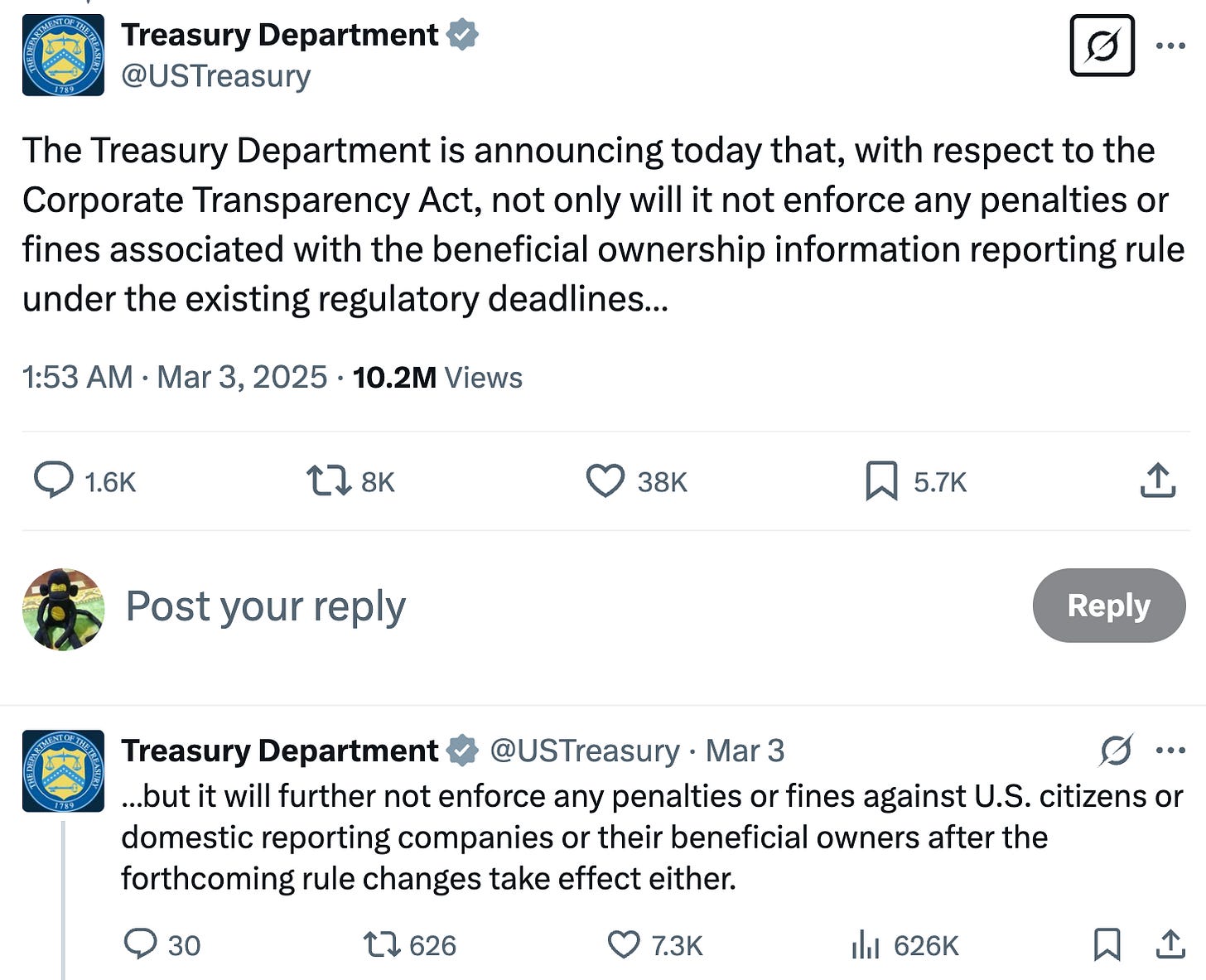

If you haven’t filed your Beneficial Ownership Information (BOI) report yet, you can breathe easy—you don’t have to. The U.S. Treasury just announced it won’t enforce the Corporate Transparency Act’s (CTA) BOI filing requirements, effectively rendering the entire thing dead in the water. Here it is, straight from the horse’s mouth, so there’s no confusion—it’s really over:

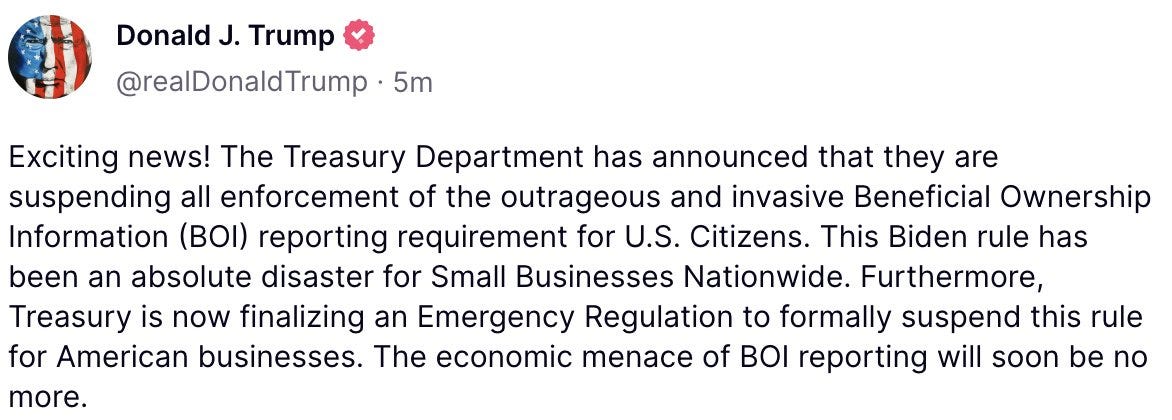

We rarely get to witness a moment when a blatantly overreaching regulation is scrapped before it reaches its full potential for harm. But that's exactly what happened here. President Trump didn't mince words about it either:

Trump is right on the money. The BOI requirement was a bureaucratic Frankenstein's monster—stitched together from the worst ideas imaginable—that specifically targeted small business owners. It forced you to surrender personal information under bogus pretenses (more on that in a minute) while dangling the threat of crippling fines and even prison time over your head.

This regulatory nightmare will likely be studied in classrooms for generations as a textbook example of government overreach. So, let me break down exactly why it was so horrific and why its demise is worth celebrating.

Creating Criminals Out of Hardworking Americans

The BOI monstrosity crawled out of the swamp during the Biden era—though technically passed just before he took office (after Congress overrode Trump’s veto), it was his administration that finalized and enforced it. Sold as a way to “crack down on money laundering,” the rule forced businesses to hand over details on their “beneficial owners” to the Financial Crimes Enforcement Network (FinCEN), a division of Treasury.

These BOI reports didn't just ask for basic information—they demanded everything short of a DNA sample. You had to provide a copy of your driver's license or passport, and God help you if anything changed. Moved to a new address? Updated your ID? Made a tiny adjustment to your business structure? You had 30 days to report to your FinCEN overlords or face their wrath.

And what wrath it was! We're talking fines up to $10,000, up to two years behind bars, and daily penalties of $500 for each day you failed to comply. This wasn't some gentle reminder system—it was a predatory trap designed to catch small business owners in its teeth.

The law was engineered so brilliantly that noncompliance was practically inevitable. Forget to update your address after moving? Ka-ching! Driver's license expired before you updated your filing? Ka-ching! Restructured your LLC but missed a filing deadline by a day? Congratulations—you're now a "financial criminal.”

'Transparency' for Thee, But Not for... The whole charade was justified under the banner of "transparency," but who exactly needed this transparency? The government already has its hands on business owners' information through EIN registrations, tax filings, and a dozen other reporting requirements.

But what made this whole BOI business even more outrageous was that big corporations and financial institutions—many with actual histories of money laundering (and who lobbied for these burdensome regulations to squeeze out small business competition)—got a free pass.

I'm not kidding. The BOI rule specifically exempted banks, investment firms, broker-dealers, venture capital funds, pooled investment vehicles, and any business with over $5 million in revenue or more than 20 employees. The message was crystal clear: If you want to launder money, just do it on a grand scale, and you’re in the clear!

Meanwhile, if you're a barbershop owner, restaurateur, or family retailer just trying to make an honest living? Congratulations—you're treated like a potential criminal. Fork over all your personal information to the government or face bankruptcy-inducing penalties and potential jail time, peasant!

It Took Trump to Finally End It

With a law this absurd, it's no shock it faced an avalanche of legal challenges. In March 2024, a federal judge in Alabama issued an injunction, declaring the CTA exceeded Congressional authority and violated the Constitution. That should have killed it right there.

But the regulatory zombies wouldn't stay buried. Another judge soon overturned the injunction, briefly resurrecting the rule. Then a third judge reinstated the injunction, sending BOI requirements back to the grave.

This legal ping-pong match continued for months. All the while, FinCEN stubbornly insisted businesses must still comply. The original deadline of January 1, 2024 was pushed to March after the first injunction. Then, following the February 28, 2025 ruling that lifted the injunction yet again, the deadline was reset to March 21, 2025.

But now, none of it matters. BOI is dead—staked through its black bureaucratic heart—and small business owners across America can finally breathe a collective sigh of relief.

As Trump’s Treasury Secretary, Scott Bessent, put it:

This is a victory for common sense. Today's action is part of President Trump's bold agenda to unleash American prosperity by reining in burdensome regulations, particularly for small businesses that are the backbone of the American economy.

This victory gives me genuine hope that we're entering an era where regulatory sanity might actually prevail. Who knows? I might have to rebrand myself as an optimist if this trend continues!

Regards,

Lau Vegys

The question now is, will the database with all our information be deleted.

God bless the Association of American Physicians & Surgeons (AAPS). Their fast and aggressive legal actions helped bring the authoritarian legislation to a halt for everyone, not just their membership. Now we need to make sure the intrusive information gathered is destroyed.