Earlier this week, I wrote to you about gold breaking past $3,000 per ounce—a new all-time high.

But what if I told you the U.S. government still values its gold at just $42.22 per ounce?

That’s not a typo. The official book value of America’s gold reserves hasn’t changed since 1973.

That price was set under the Par Value Modification Act, a relic of the Bretton Woods system, and has remained frozen for accounting purposes—even as gold’s market price has skyrocketed.

The result? The 261.5 million ounces of gold the U.S. (supposedly) holds are officially valued at just $11 billion. At market prices, they’d be worth nearly $785 billion.

That’s a textbook example of America undervaluing its assets if I ever saw one. Not a problem in regular times, but a serious oversight in an era of nearly $37 trillion in debt, out-of-control deficits, and accelerating de-dollarization.

Now, if you’ve read Matt Smith’s recent Trump’s Reset report, you’ll understand why we believe revaluing U.S. gold holdings could be the first major move in Team Trump’s grand strategy.

Simply marking these reserves to market prices would strengthen the nation’s balance sheet and give the government more leverage in devaluing the dollar—a key piece in Trump’s broader economic reset.

Pegging the dollar to gold at a much higher price post-devaluation would also drastically reduce the real burden of U.S. debt.

Doug Casey: The dollar started out as a receipt for a specific amount of physical gold, 1/20th of an ounce. Is it possible Trump will raise the price of gold to a level where the dollar is again redeemable? I’d say yes. It would be part of the solution to the $37 trillion national debt.

Why?

Think about it—if gold were revalued from $3,000 to $10,000 per ounce, the U.S. government’s gold reserves would suddenly be worth more than three times their current value. That increase in balance sheet value could be leveraged to retire debt—yes, either directly or through gold-backed bonds—but also to stabilize the dollar post-devaluation (or help fund Trump’s broader re-industrialization agenda).

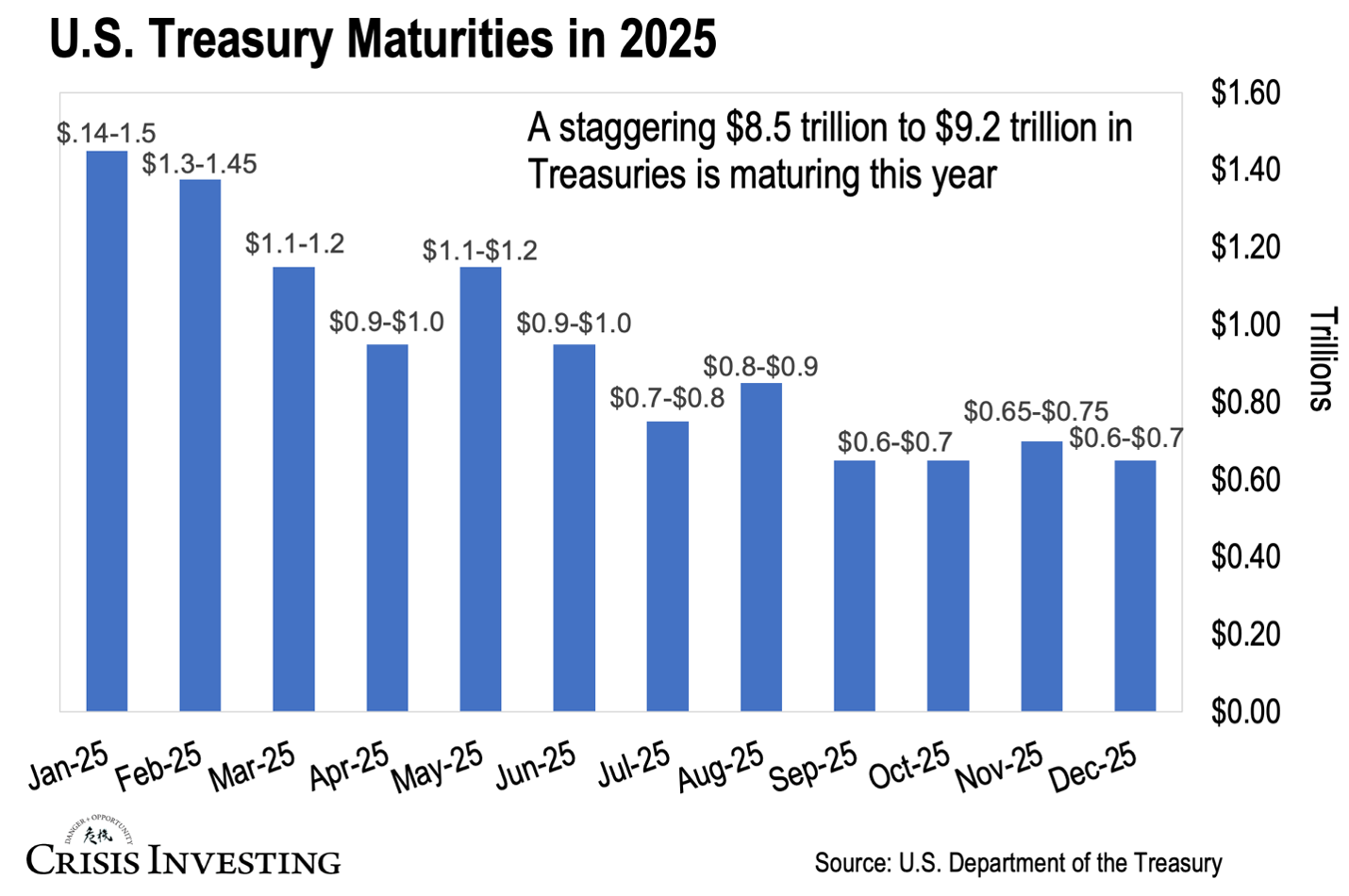

And keep in mind—the U.S. faces $8.5–9.2 trillion in maturing debt in 2025 alone. Under current conditions, that’s not going to be easy to refinance without spiking interest rates or shaking confidence in Treasuries.

The bottom line is that Trump’s Reset could be the most significant shift in the monetary system since August 15, 1971—the day Nixon cut the dollar’s last tie to gold.

And if you look at what’s happening in the markets right now, the signs suggest the U.S. is already laying the groundwork.

For example, since December 2024, COMEX has imported around 674 metric tons of physical gold—a hefty amount on its own. But when you factor in non-COMEX imports, the total goes up to 2,000 tons—64 million ounces—brought into the U.S. between December and February. That’s nearly a quarter of all the gold the U.S. government officially claims in its reserves.

That’s not normal market behavior. Someone with deep pockets—likely the Treasury or the Fed—is aggressively stockpiling physical gold with no concern for price.

Gold at $22,000?

Now, in case you missed it, Doug’s quote above contains a key word: redeemable.

That doesn’t mean we’re banking on a full return to the gold standard right away, but I can easily see the U.S. taking incremental steps to stabilize the system and rebuild confidence in a devalued dollar by gradually moving back toward gold.

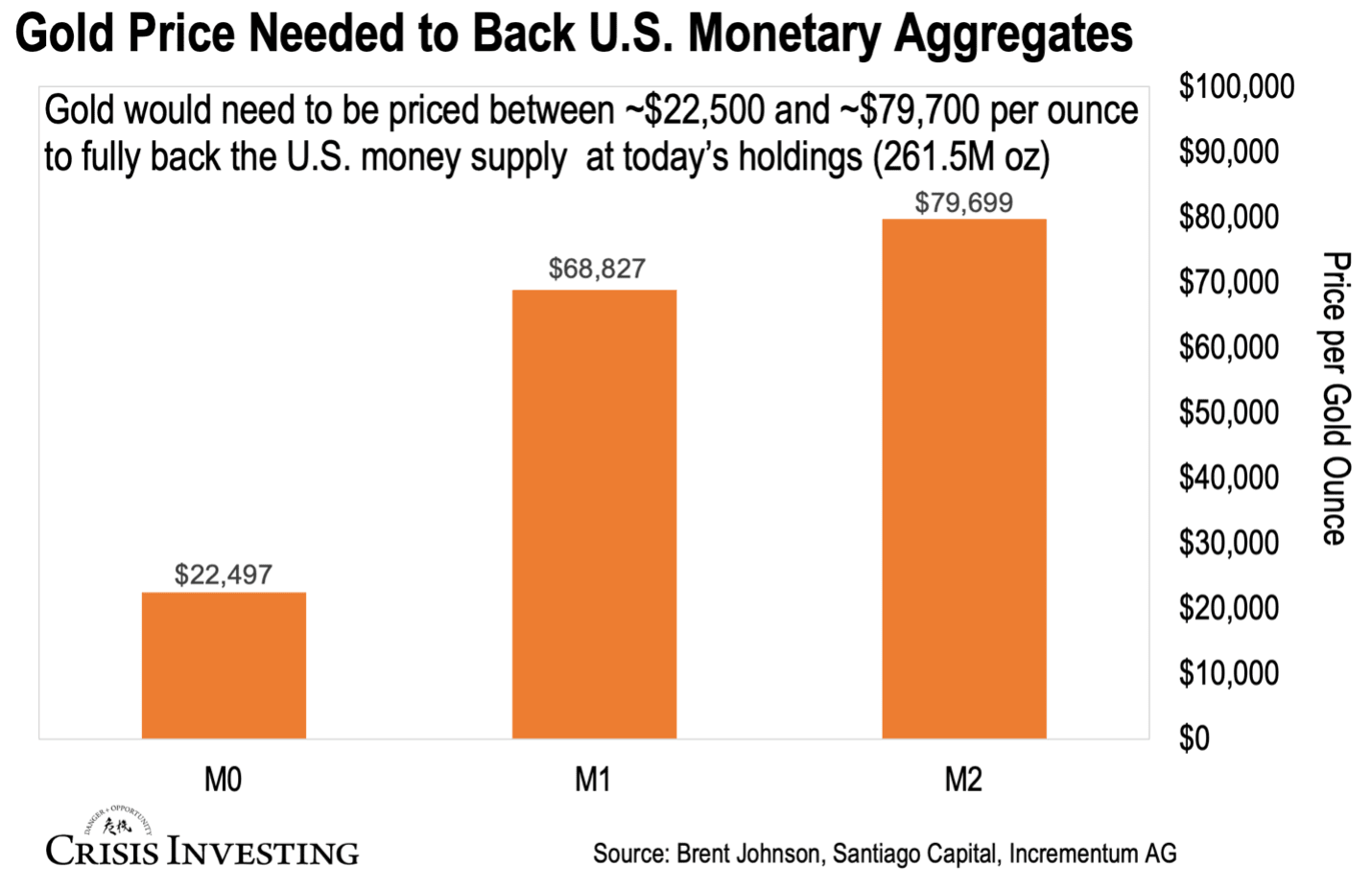

And guess what? Even partial backing would send gold soaring. Take a look at the chart below—it shows the gold price needed to back different U.S. money supplies, from M0 (physical cash) to M1 and M2, which also include savings accounts and time deposits.

As you can see, backing just M0—the narrowest measure of money, which includes physical cash in circulation and reserves held by banks at the Fed—could push gold past $22,000 per ounce. M1 would require $68,827, and M2 a staggering $79,699.

This just goes to show that while the final long-term price would depend on the level of backing (e.g., 20% vs. 100%), even if the U.S. government chooses to only partially restore monetary credibility, gold prices will skyrocket.

Sounds great, right? Well, sure—if you already own gold. But it comes with a massive dollar devaluation.

And, yes, this also means that anyone not holding gold and other “real stuff”—like silver, natural resources, and commodities—is going to see a dramatic drop in their standard of living.

Matt gets into all this—and much more—in his report, so if you haven’t read it yet, I highly recommend you do.

Regards,

Lau Vegys

Most of the USA gold isn’t .9995 pure. Most of it is 90% gold and 10% copper or coin melt so you’d need to discount 10% off of your totals

I believe that Silver would have to have a major role if it’s truly “redeemable “ for physical metal.