The Leak Wasn’t the Problem. The Dollar Is.

Signal, ‘Freeloading Europeans,’ and Trump’s Coming Reset

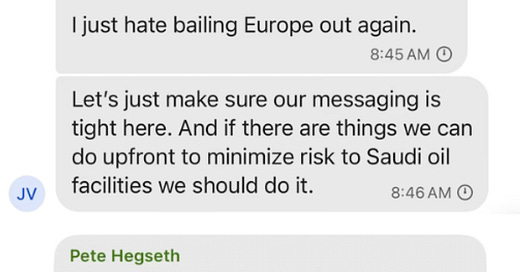

You might’ve seen screenshots making the rounds online—like the one below featuring Vice President JD Vance and Defense Secretary Pete Hegseth:

This came from a leaked Signal group chat between top officials in the Trump administration, who were discussing how to respond to the Houthi attacks on commercial shipping in the Red Sea. Apparently, a reporter from The Atlantic had somehow been included in the chat—accidentally or not—and the entire exchange ended up in the press.

Predictably, headlines zeroed in on the most scandalous part of the story: the security lapse. But as usual, the media missed the real substance—which also came from the Vice President when he noted that only 3% of U.S. trade runs through the canal, as opposed to 40% of European trade. In other words, it’s not really America’s fight… definitely not economically.

This captures the mood in Washington right now. The Trump team believes America has carried Europe on its back for far too long—especially when it comes to global security. And they’re not wrong.

The Dilemma

Now, the European response to that might be something like: “Well, that’s what comes with being the issuer of the world’s reserve currency.” And honestly, they wouldn’t be entirely wrong, either.

The dollar’s reserve status gives the U.S. government enormous advantages—like the ability to run massive deficits, borrow cheaply, and project power globally. And yes, that also means the U.S. has to play global fireman, stepping in when crises hit… with Europe “freeloading” more or less baked into the deal. After all, the world props up the dollar—so America props up the world.

That’s one perspective (and one clearly shared by many Europeans).

But there’s another side to this—and it comes in the form of something called Triffin’s Dilemma.

Named after Belgian economist Robert Triffin, this paradox happens when a country’s currency is also the world’s reserve currency—like the U.S. dollar. The problem? To meet global demand for dollars, the U.S. must run trade deficits by exporting more dollars than goods and services. This keeps the world economy running, but it hollows out U.S. industry and fuels debt.

So if you’ve ever wondered why the U.S. economy has become so financialized, addicted to debt, and propped up by “services”—now you know.

And here’s the conundrum…

If the U.S. stops running deficits, the world faces a dollar shortage, leading to a potential global economic slowdown. That would inevitably push countries even further toward alternative reserves, reducing long-term demand for U.S. Treasuries and undermining the dollar’s global supremacy.

But if the U.S. keeps running deficits, it’s the same old story—skyrocketing debt, billions burned on interest alone, and a manufacturing base that keeps withering away.

This puts President Trump in a bind. Trump wants the dollar to remain the world’s reserve currency—but he also wants a weaker dollar to boost exports and bring jobs back home. And keep in mind: that second scenario doesn’t guarantee a weaker dollar. Global demand often absorbs the excess, keeping the dollar surprisingly strong.

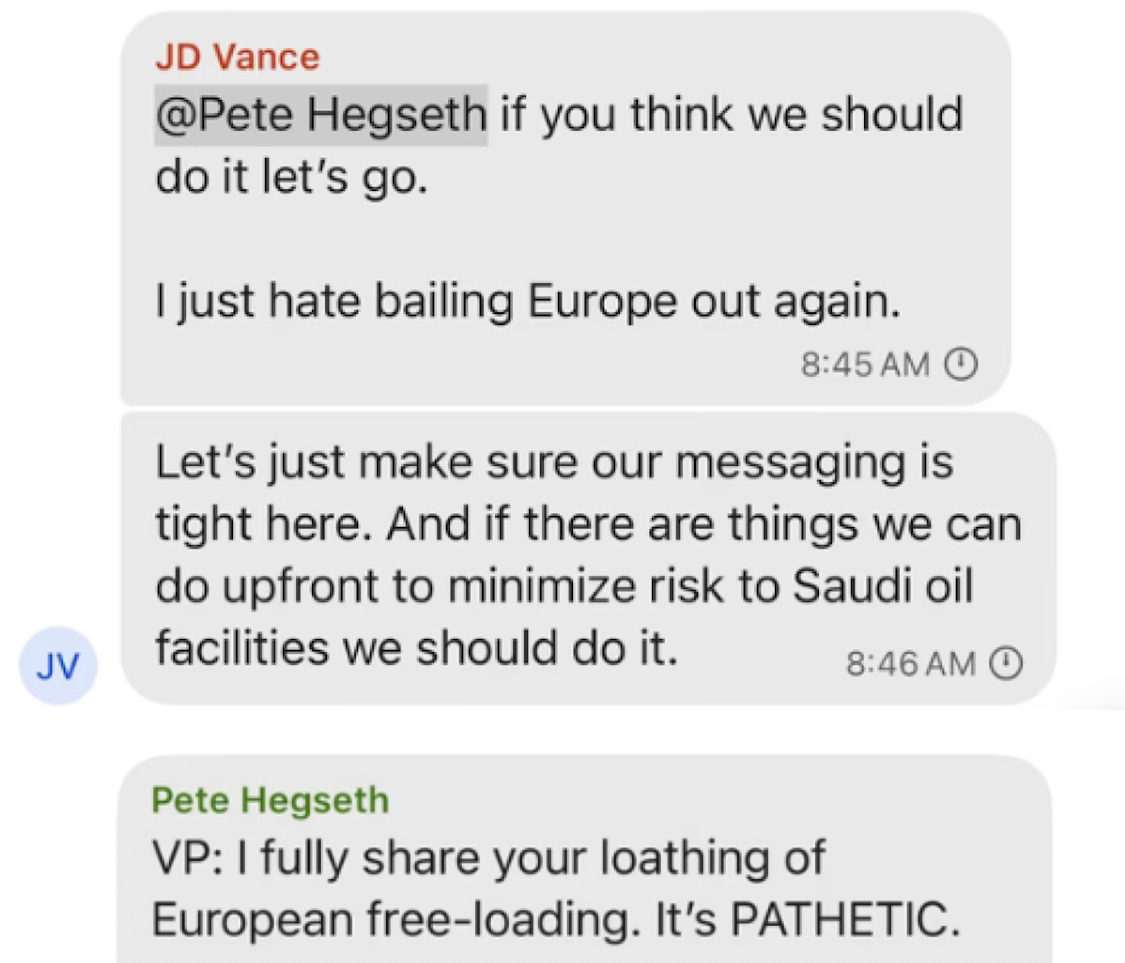

Just look at the next chart—the greenback has been on a relentless climb for over a decade. That’s despite trillions of dollars being printed since the 2008 financial crisis and throughout the COVID era.

That’s not to say the U.S. dollar is suddenly worth the paper it’s printed on. But relative to other major currencies like the euro or the yuan, it’s been going up. Way up.

Again, that’s a problem for Trump. A strong dollar makes U.S. exports more expensive, encourages offshoring, and hollows out domestic manufacturing—the exact opposite of what he wants.

Mar-a-Lago Accord

So, how do you solve that?

Enter Stephen Miran, Trump’s chair of the Council of Economic Advisers. In November 2024, Miran published a paper outlining a framework for America’s next monetary reset, dubbed the “Mar-a-Lago Accord”—a throwback to the 1985 Plaza Accord, when the U.S. pushed its allies—using tariffs and backroom diplomacy—to go along with a plan to weaken the dollar.

Much like the Plaza Accord, the Mar-a-Lago Accord calls for a controlled devaluation of the dollar to boost U.S. exports, revive American manufacturing, and rebalance global trade. And just as in the Plaza Accord, Miran suggests using tariffs as the primary tool to pressure other countries into accepting a weaker dollar.

But unlike the Plaza Accord, this plan is far more complex. The global financial system today is bigger, more interconnected, and more fragile than it was 40 years ago— which means Miran’s "secret sauce" comes with a lot more ingredients.

And if you read through his 40-page report, you’ll quickly realize some of those ingredients aren’t spelled out. Not necessarily because they haven’t been worked out, but because outright stating them might spark panic. You have to read between the lines and connect the dots yourself.

My takeaway after doing that?

If successful, the Mar-a-Lago Accord will remake the global trade and monetary order on a scale that makes the Plaza Accord look like child’s play.

Mind you, this won’t be a pleasant process—especially for anyone who doesn’t own “real stuff” like gold and other “unprintable” assets. The alternative, though, could be much worse.

Regards,

Lau Vegys

P.S. Speaking of gold—since December, roughly 2,000 metric tons, or 64 million ounces, have poured into the U.S. That’s nearly a quarter of the gold America claims in its official reserves, and it’s no coincidence. Matt Smith has meticulously documented how this ties directly into Trump's monetary reset plans. If you haven’t read his latest report yet, make sure you do—especially if you don’t have time to wade through Miran’s 40-page plan.

Great explanation!

I'm no macro economist but Triffins Dilemma demonstrates that Trump putting lipstick on a pig doesn't make it pretty. Trump wants a weak dollar that remains a global reserve currency, like having your cake and eating it. To me that's Jewish Wall Street thinking advice he's being offered. They are trying to make weakened America strong so that they have a better tool to defend the global onslaught forming against them. I predict it won't work, nations playing endless games with rigging fiat currency ratios to each other in order to seek trading cost advantage. Fiat currency is the problem, compounded by the tribe that controls it. It's simply a dishonest global economic system arising out of a dishonest international monetary system. The only thing that can right the world economic system is specie money, and right now that's gold and Bitcoin. Trump is going to try to bully other nations into strengthening their fiats in relation to the dollars, artificially disadvantaging them and advataging him. It's all a bullshit game. Perdonally I use fiat money to settle accounts in mainstream business but I calculate account values using a stable everyday product that I choose. The trick to protecting your wealth on main street is to never price or value your assets in fiat and to strike your financial accounts in a stable commodity or product (Big Mac or whatever). That way you know if you are really getting richer or poorer. How can you measure relative values with wonky fiat yardsticks?