This Double Whammy Will Unleash Unprecedented Money Printing... or Break the U.S. Economy

Deficits, Deficits, and More Deficits, Unravelling Social Security, Money Printer Going Brrr

“A government big enough to give you everything you want is a government big enough to take from you everything you have.”

~ Gerald Ford

The Federal Reserve is gearing up to cut rates and fire up the money printer this year. And you can see why…

You have Joe Biden, who's in dire need of a push to turn the tide in the upcoming election. Then you have U.S. banks sitting on a hefty $480 billion in unrealized losses on government securities. The Fed is poised to lend a helping hand to both.

But then there's another reason that tells me that the Fed won't likely stop soon once it starts up the proverbial money printer.

Let me elaborate.

Numbers Straight Out of a Horror Flick

Every six months, the Congressional Budget Office (CBO) releases a rolling 10-year "Budget and Economic Outlook." Most people ignore reading material of this sort, but I'm always eager for it because it showcases just how utterly incompetent governments can be.

If you open the most recent report, and scroll to Page 10, you'll find Table 1-1: CBO’s Baseline Budget Projections. Look for the line labeled "Total Deficit." These are government deficits, and I've marked them in the next image.

The first thing that should catch your eye from the table above is that the deficits will consistently worsen, starting at $1.5 trillion in 2024 and reaching about $2.6 trillion by 2034. That's an increase of 71% in just a decade.

Alarmingly, this also means that the total cumulative deficit between 2024 and 2034 would hit an astounding $21.6 trillion.

If this isn't a damning indication that the U.S. is rapidly heading towards complete fiscal ruin, I don't know what is. But it gets even worse.

The CBO figures show that by 2034, the deficit is expected to hit 6.1% of the Gross Domestic Product (GDP).

That number is quite remarkable. Here’s why…

Since the Great Depression, deficits have only topped that level during and shortly after World War II, the 2007-2009 financial meltdown, and the COVID-19 pandemic.

But the CBO isn't expecting any major crises over the next decade. They're not banking on the possibility of a war, a new financial meltdown, or another pandemic. On the contrary, the CBO report is filled with optimistic assumptions about the future of the U.S. economy: low interest rates, low inflation, and solid GDP growth.

If anything goes wrong, and it most likely will, the $21.6 trillion forecast will be much worse. And here’s just one reason.

Social Security Is Going Broke

It so happens that the U.S. spiraling deficit situation will coincide with another momentous event: the complete depletion of Social Security’s key trust funds by the year 2033. That’s less than 9 years from now.

Don't take my word for it. Here's a link to the official 2023 report of the Social Security Board of Trustees (see page 3).

Doug Casey: You have to pay into Social Security, or you risk landing in jail. Now, a proper social security program would be one where your contributions go into your own retirement account, invested in stocks. This way, your savings would grow along with the economy. But with Social Security, your money isn't invested in that; it's just government debt. People might think it's safe, but it's still debt that needs to be repaid someday. And with the U.S. national debt already at $34.6 trillion, I don't see how they can ever do it. At this point, the government is completely and totally bankrupt. It's like Wile E. Coyote that's walked off a cliff, but doesn't really realize it yet.

Now, Joe Biden made it very clear in last month’s State of the Union that he has absolutely no intention of doing anything to fix that.

“If anyone here tries to cut Social Security or Medicare or raise the retirement age, I will stop them!” he muttered, reading from the teleprompter.

You can bet that's the official line for the whole Democratic party. And it boils down to one thing: a bailout.

They're estimating a shortfall in the Social Security trust funds of around $2.9 trillion by 2033. That's what they'd need to ensure everyone gets their scheduled benefits. And mind you, this is a very optimistic projection.

If you add that to the $21.6 trillion figure mentioned earlier, you can see how deficits could easily reach $25 trillion in total deficit spending.

Now, the CBO predicts that the U.S. economy will grow to $48 trillion by 2034.

So, if the government ends up needing to borrow another $25 trillion, that's more than half the entire economy.

Given that America’s current $34.6 trillion debt is already about 122% of GDP, that much more debt would basically amount to an emergency.

And you know who the government calls on in times of emergency... Yep, you guessed it... the Fed.

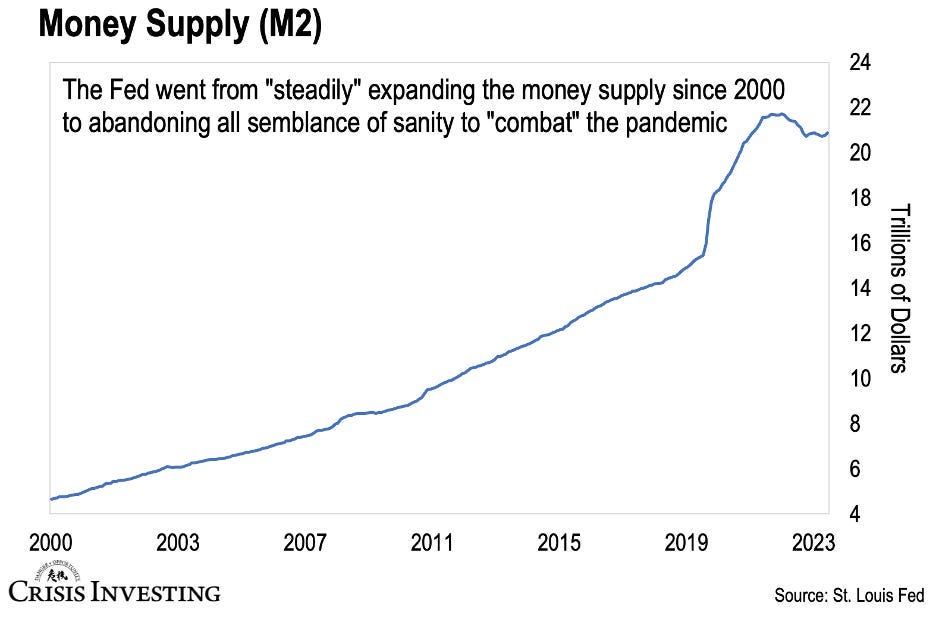

Here’s a visual to remind you of what happened last time when the Fed and the government joined forces to fight an emergency.

Between 2020 and 2021, during all the COVID craziness, the Fed's broad measure of the money supply, M2, shot up by an astonishing $6.1 trillion. That's almost a 40% increase in just two years.

And it was the spread of a flu-like virus – trivial for everyone except the very old or very sick – that made the Fed abandon all sense of reason and ramp up money printing to unprecedented levels.

The outcome? Inflation hit 9% in June 2022, the highest in the nation in 40 years. And that's going by the government's own figures. If we calculate it all, inflation was probably in the double digits.

This should give you an idea of the Fed's response to the deficit crisis.

Until next time,

Lau Vegys

P.S. Now, there’s no better safeguard against the Fed's reckless money printing and various crises, including war, than gold. Its track record speaks for itself. But the Fed's move to turn on the money printer this year will create a bubble in other commodities too. The most vital resources, which central banks and politicians can't just “print”, will do particularly well. One metal recently added to our Crisis Investing portfolio fits this bill, and we're planning to include two more equity picks to capitalize on it soon.

A lot to absorb. Had a look at the data at CBO.gov and it sure does show that the US in in a very deep hole with the digging still happening at a furious rate. An interesting, and related, article on Mises here https://mises.org/mises-wire/federal-mega-debt-here-stay plus an interview with the author on the ‘Radio Rothbard’ podcast (episode 174).

US M2 reminds me of NZ M1 (we don't publish M2).

https://tradingeconomics.com/new-zealand/money-supply-m1