Today, 53 Years Ago, the Dollar Died

Fiat, Funny Money, Banana Republic Bills, and the Great Unraveling

“… your dollar will be worth just as much tomorrow as it is today.”

~ President Richard Nixon

On this day fifty-three years ago, the seeds of our nation’s ruin were sown, and we’re still reaping their bitter harvest today. What happened caused far greater long-term damage than the 1929 stock market crash, JFK's assassination, and the 9/11 attacks. Yet most people know nothing about it.

It was a warm Sunday afternoon in August. Families gathered in backyards, with barbecues sizzling and kids laughing as they enjoyed the last days of summer. As the sun dipped, parents called their kids inside, ice cubes clinked in glasses, and TVs flickered on in living rooms across America.

Little did these people know, as they settled in for their evening routines, that President Richard Nixon was about to make an announcement that would change their lives forever. Here's a snippet of that historical broadcast below.

If you’d rather have the text, here’s the transcript of Nixon’s quote:

The strength of a nation's currency is based on the strength of that nation's economy, and the American economy is by far the strongest in the world. Accordingly, I have directed the Secretary of the Treasury to take the action necessary to defend the dollar against the speculators. I have directed Secretary Connally to suspend temporarily the convertibility of the dollar into gold or other reserve assets, except in amounts and conditions determined to be in the interest of monetary stability and in the best interest of the United States.

Nixon went on to say:

Now, what is this action, which is very technical, and what does it mean for you? Let me lay to rest the bugaboo of what is called devaluation. If you want to buy a foreign car or take a trip abroad, market conditions may cause your dollar to buy slightly less. But if you are among the overwhelming majority of Americans who buy American-made products in America, your dollar will be worth just as much tomorrow as it is today. The effect of this action, in other words, will be to stabilize the dollar.

August 15 went down in history as the day Nixon struck down the last remnants of the gold standard.

I say "remnants" because the U.S. had already left the gold standard for domestic dealings in 1933. But non-U.S. individuals and governments could still exchange dollars for gold at the U.S. Treasury. By the late 1950s, it was limited to foreign central banks. That was the last check against wild borrowing and spending.

Fiat, Funny Money and Banana Republic Bills

Nixon's speech, of course, aged terribly. We don't know if Nixon was naive enough to actually believe any of this or if he was just lying through his teeth... perhaps, like most politicians, he just didn't care about the long-term fallout from his actions. But what we do know is that this "temporary" move was about as temporary as death, and your dollar sure as hell isn't worth just as much today as it was back then.

The truth is, on that fateful day, Nixon read out the U.S. dollar's death sentence. Call it fiat, funny money, or banana republic bills—whatever took its place hasn’t been real money since. Untethered from any substance of true value, the dollar’s supply skyrocketed in the years that followed, thanks to the Fed’s money printer.

With every new dollar printed, its value kept dropping. The inevitable result was runaway inflation—something people didn’t need to wait for the curve (above) to steepen much to feel, by the way.

For example, the basket of goods and services used to calculate consumer price inflation (CPI) cost 41 cents in August 1971. By August 1981, that same basket cost 92 cents. This means the dollar lost 56% of its purchasing power in just 10 years.

And it only got worse from there, bringing us to today, where the dollar buys about 90% less than its equivalent from the early 1970s.

Here’s Doug Casey:

Inflation is one of the most misused words; few even think about its actual meaning. What is inflation? “Well, that’s prices going up.” No, it’s not. To say that is to confuse cause and effect. Inflation is an increase in the money supply. You inflate when the money supply is increased by more than real wealth increases.

Prices go up as a result. People have forgotten about that. They believe inflation comes out of nowhere, like a freak storm. No cause. Or they blame the butcher, the baker, or an evil oil company. Few people think it’s a central bank – the Fed in the U.S. – that actually creates more money and causes inflation.

The Great Unraveling

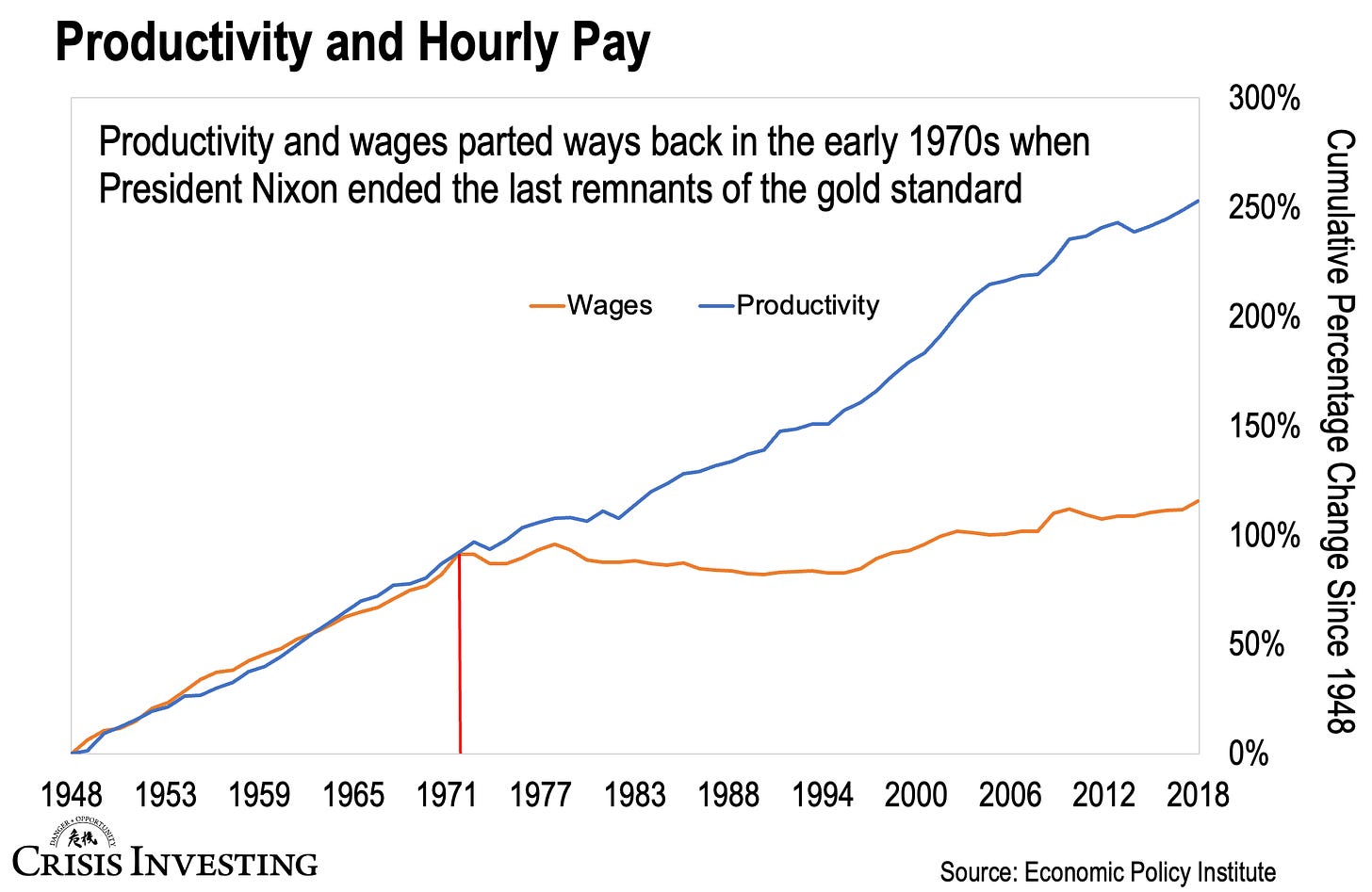

As an “added bonus,” August 15, 1971, also laid the tracks for the slow-motion train wreck of the American middle class. You can see this in the next chart, which shows how the real wages of the average person have essentially remained stagnant since then.

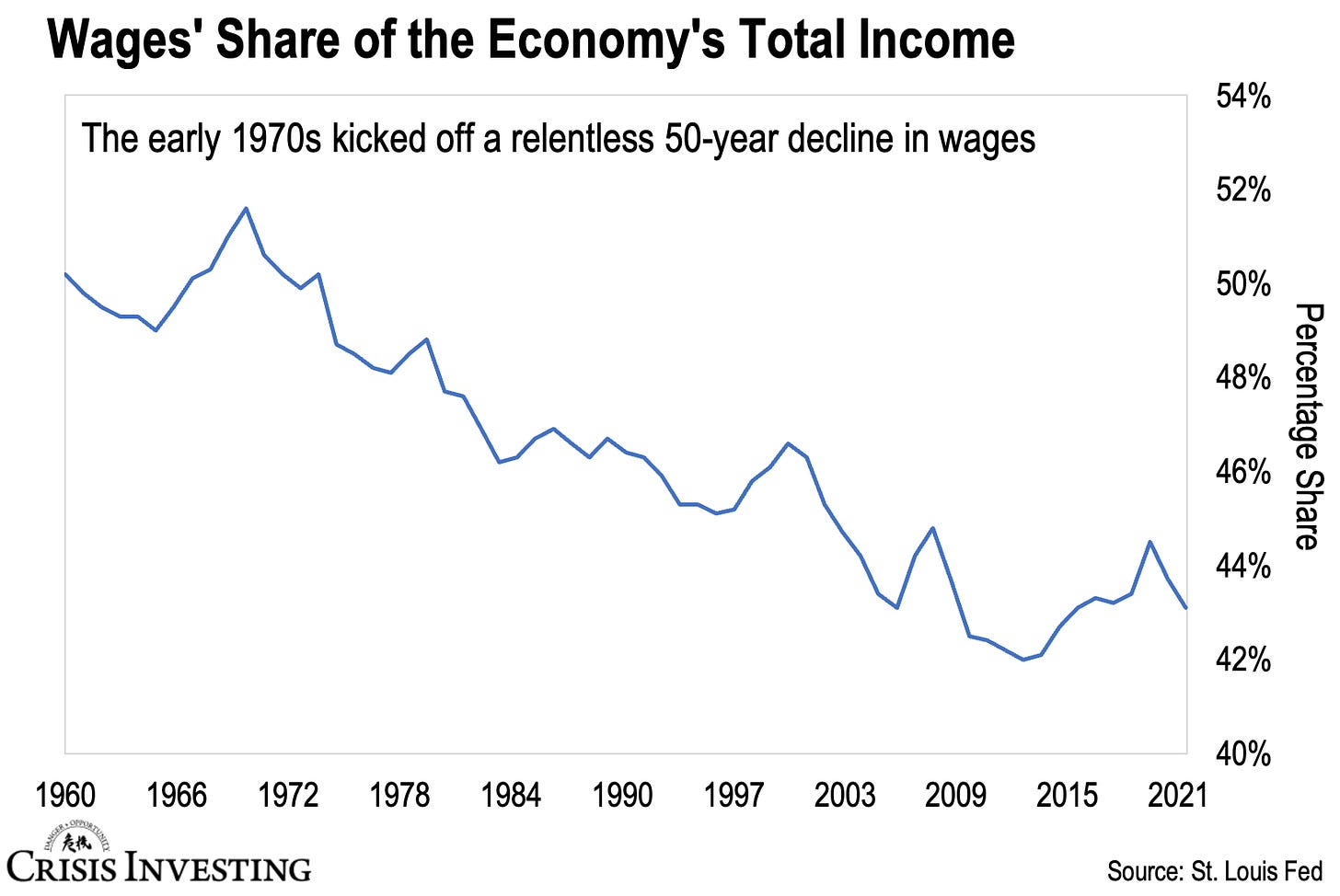

Another way to look at this is to say that wages have been getting a smaller slice of the income pie in the U.S. economy (even as it has steadily grown). And this slice has, without a doubt, been shrinking relentlessly since the 1970s, as you can see in the chart below.

Back in 1970, wages made up about 52% of the total, but by 2022, that had fallen to just 43%. That’s a 17% drop. Meanwhile, the cost of living has gone through the roof, leaving Americans to bridge the gap with debt.

But all of this goes way beyond wages and the economy. The reality is that almost every aspect of life has taken a turn for the worse since that fateful day 53 years ago. From plummeting housing affordability and soaring incarceration rates to more divorces and out-of-wedlock births, all the worst trends have all exploded since 1971.

Beyond that, the existence of funny money has also paved the way for big government, endless wars, spiraling deficits, mounting debt, financial bubbles, Wall Street bailouts, and general cultural decline.

I’ve said it before and I’ll say it again: when you break the underlying measure of value, everything begins to unravel. That’s exactly what happened 53 years ago today.

Regards,

Lau Vegys

"....... the existence of funny money has also paved the way for big government, endless wars, spiraling deficits, mounting debt, financial bubbles, Wall Street bailouts, and general cultural decline." Is there one existing political hack that knows and understands this, let alone cares about it? Maybe even more important, does the oh-so-important constitutionally protected 4th estate see to it that the voters know this so they can mend it through their votes? Is this path to national, cultural, and moral destruction taught in our schools at every level? I know it is not. You got what you voted for; if you didn't like it, you did nothing about it. It feels good, doesn't it?