I don’t know if you heard, but last Friday, something absolutely crazy happened.

President Donald Trump launched his own cryptocurrency—just three days before his inauguration.

I didn’t even see it until the next day because I was traveling. When I did, I thought to myself, “Here we go again—another scam.” After all, we’ve already seen coins like MAGA Coin, TrumpCoin (later renamed FreedomCoin), Donald Tremp, and a bunch of other so-called memecoins whose creators profited off Trump’s hype but had no actual connection to him.

Based on the internet chatter, it seemed like plenty of others felt the same way. Even when people first saw the tweet promoting "Trump Coin", most assumed, “Surely Trump’s account has been hacked, right?”

But no—this time, a Trump coin was 100% legitimate, launched by Trump himself.

Appropriately named “Official Trump” with the symbol $TRUMP, the token went viral almost instantly, soaring more than 1,100% from $6 to $75. At its peak, it hit a market cap of about $14 billion, making it the 15th largest cryptocurrency and overtaking a bunch of established projects in the crypto world.

And it achieved all this in under 48 hours.

Sounds insane? That’s because it is. No U.S. president (or president-elect) has ever launched their own cryptocurrency before—let alone a memecoin.

If you’re wondering what a memecoin is, it’s basically a type of cryptocurrency that usually starts as a joke or internet meme. Unlike Bitcoin (digital gold) or Ethereum (with its smart contracts), memecoins don’t really have a practical use. They’re purely speculative, with prices driven by hype and celebrity buzz instead of actual value.

What’s just as unprecedented as $TRUMP’s launch was the reaction from established crypto exchanges—they were falling over themselves to announce they’d list the token.

Both Coinbase and Binance, the two biggest crypto exchanges in the world, listed $TRUMP within hours of its launch. Other exchanges, like Kraken, KuCoin, HTX, and more, quickly jumped on the bandwagon too.

This is pretty remarkable when you think about it. These exchanges usually have strict listing requirements and long review processes. Solid crypto projects that solve actual problems sometimes wait years to get listed—so for a memecoin like $TRUMP to get fast-tracked? That’s wild.

But the story doesn’t stop there.

Less than a day after Trump’s memecoin launch, Melania Trump decided to throw her hat in the ring with her own cryptocurrency: $MELANIA. (Of course, while it’s branded as hers, this was also a creation from the Trump Organization and its affiliates.)

Unfortunately, $MELANIA ended up draining liquidity from $TRUMP, crashing it from $73 to $38—a nearly 50% drop. Just look at that red candle.

Ouch.

Is $TRUMP a Good Investment?

It feels kind of funny even asking that. Honestly, at first, I didn’t want to get into this. I was planning to move on and talk about the broader implications—which I think are way more interesting—but then I realized some of you might be wondering about it.

I mean, on the surface, it does sound like a great (and pretty straightforward) way to bet on the success of Trump’s presidency, especially since so many exchanges already list it.

But not so fast... While President Donald Trump’s launch of $TRUMP last week made him a crypto billionaire on paper almost overnight, the road to riches for anyone joining in later might not be so smooth.

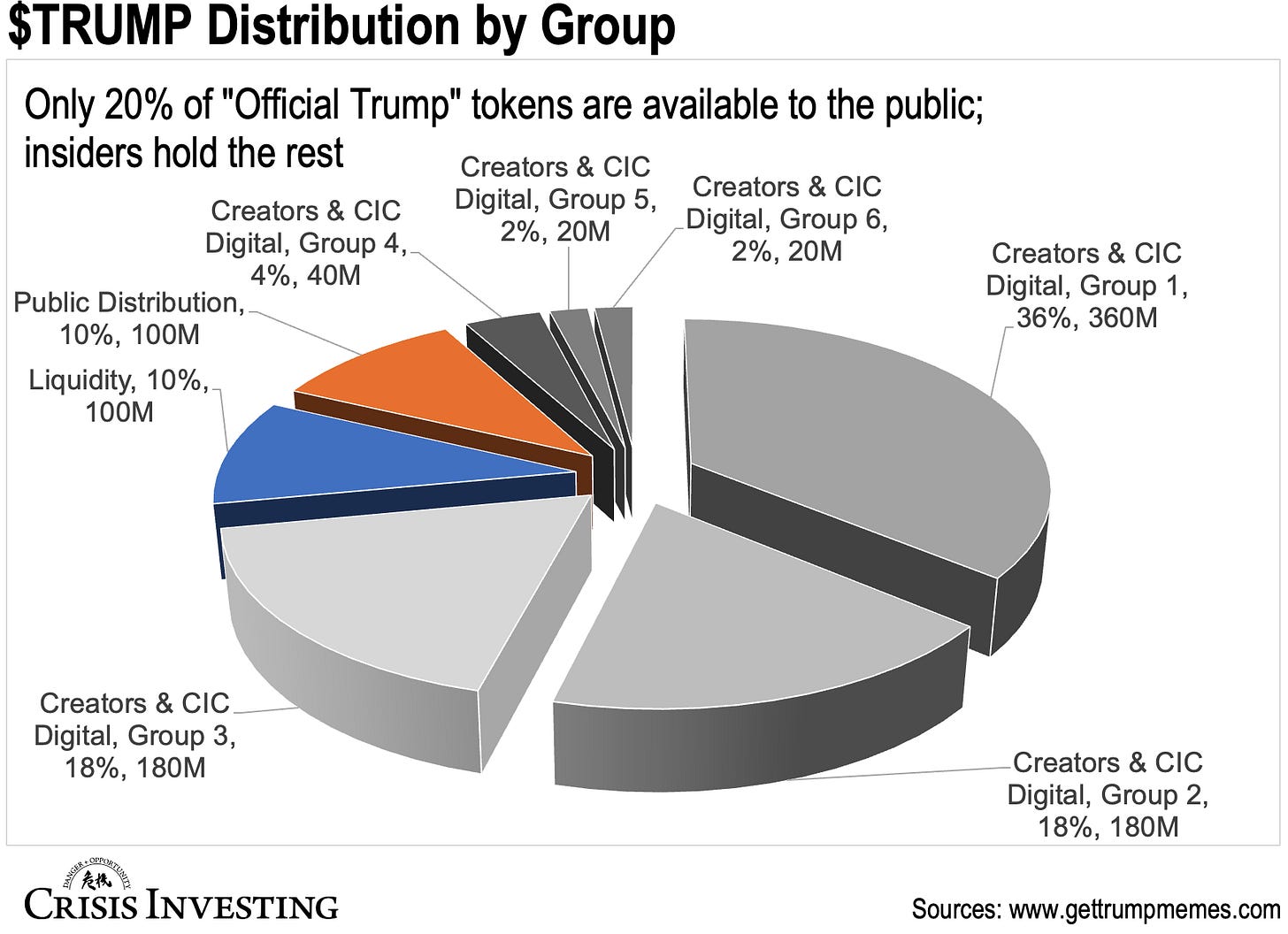

To understand why, we need to take a closer look at something called tokenomics—basically, the economics behind how the coin works. If you take a look at the pie chart below, you’ll notice something interesting: 80% of the 1 billion total coins are owned by CIC Digital LLC, an affiliate of the Trump Organization that actually launched $TRUMP. Only 20% of “Official Trump”—or 200 million coins—is available to the public (the orange and blue sections in the chart).

This kind of distribution comes with some problems…

For starters, with so many tokens controlled by insiders, there’s a massive concentration of power. That means a small group could easily dominate the market and manipulate prices, whether by holding or dumping their tokens over time.

Keep in mind that these are people who knew about the launch in advance and got in at the ground level.

This also raises another risk: the dreaded rug pull.

A rug pull happens when someone creates a new cryptocurrency, convinces users to invest in it, and then abruptly liquidates their holdings, leaving everyone else holding the bag. The name comes from the idea of pulling the rug out from under investors’ feet.

And guess who benefits from rug pulls? Insiders and big stakeholders. Just last month, TikTok star Hailey Welch (the “Hawk Tuah girl”) launched a memecoin that shot up to $500 million in market cap, only to crash 95% in a week. A few insiders walked away with $3 million, while regular investors got burned.

Now, to be fair, the 80% (800 million tokens) controlled by insiders in $TRUMP will unlock gradually over three years. Different groups of “Creators and CIC Digital” (represented by the various shades of gray in the chart above) have lock-up periods ranging from 3 to 12 months. But 80% is still a lot of selling pressure for the market to absorb.

To illustrate: in three months, Group 1, which holds 360 million tokens, will release 10% (36 million tokens) right away. After that, the remaining 324 million tokens will unlock daily over the next 24 months, at around 450,000 tokens per day. That’s a lot of tokens flooding the market.

On top of all that, you really have to trust the lock-up mechanism behind all this. And honestly, from what I’ve seen, I’m not 100% sure it even exists.

Full disclosure: I own some $TRUMP tokens myself. I got in early and only risked a small amount because, well, I like to speculate. But while there’s still potential for big gains—especially if the creators add utility for token holders (like lunch at Mar-a-Lago with Trump or staking opportunities to earn interest on your holdings)—the odds are stacked against new speculators.

So, if you’re thinking about putting money into $TRUMP—which, honestly, you probably shouldn’t, even if you’re excited about what his presidency might bring for America—don’t put in more than you can afford to lose entirely. This is gambling money, plain and simple.

Caveat emptor.

Regards,

Lau Vegys

P.S. Now, it should be obvious that the implications of Trump’s presidency extend far beyond his memecoin project. We’re potentially entering a four-year era of the most business-friendly U.S. government in history. This could have a big impact on the economy and create huge opportunities for savvy investors to profit. In next week’s January issue of Crisis Investing, we’ll dive into these opportunities and explore which sectors and investment ideas are best positioned to thrive during this seismic shift. Keep an eye out—it’s going to be a must-read.

If you like to speculate that’s fine but you shouldn’t be soft pedaling this nonsense. Here’s a more realistic explanation of $TRUMP https://open.substack.com/pub/cryptadamus/p/the-trumpcoin-cometh?utm_campaign=post&utm_medium=web. Btc is not digital gold or any other kind of gold ffs 😂