Everyone’s talking about Trump’s tariffs lately—and with good reason. As of early March 2025, President Trump has rolled out a 25% tariff on most imports from Canada and Mexico, and added an extra 10% on Chinese goods (bringing the total on China to 20%). More tariffs are coming, with global “reciprocal” levies set for April and a 25% hit on the European Union (EU) in the works.

Now, as I’ve written to you before, I’m no fan of tariffs. History shows they tend to raise consumer prices, trigger retaliatory measures, and distort markets. Businesses and consumers ultimately end up paying the price—not the foreign countries they're aimed at.

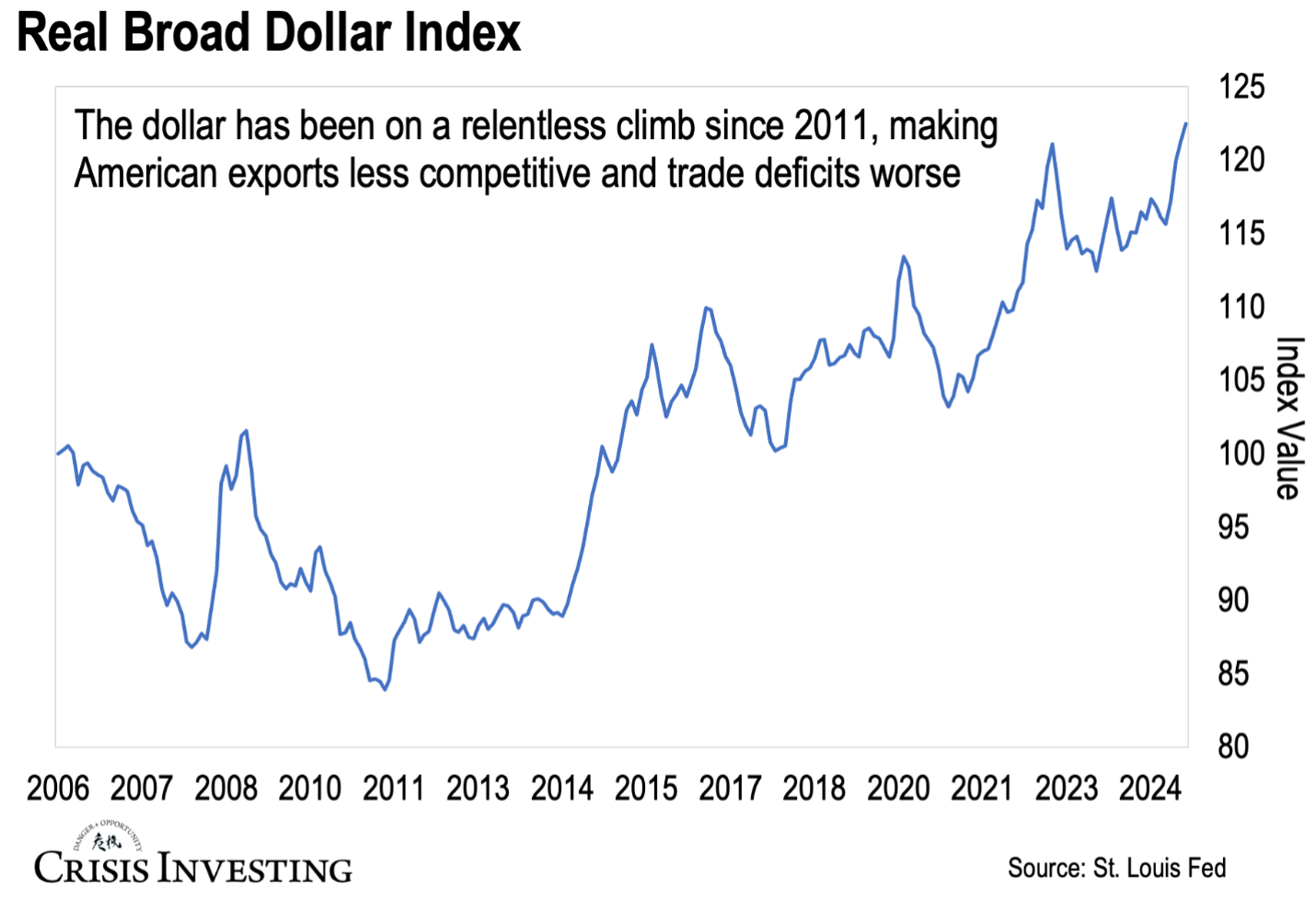

But to understand Trump's perspective, you need to look at this week’s chart below.

As you can see, the dollar has been on a relentless climb for over a decade. Since 2011, it’s surged to peak levels. Now, that’s not to say it’s suddenly worth the paper it’s printed on. But relative to other major currencies like the euro or the yuan, it’s up. Way up.

Doug Casey: “The U.S. dollar is the worst fiat currency in the world. Except for all the others.”

A strong dollar sounds good, but it’s bad for trade. When foreign buyers—like a German company—want American goods, they need dollars to pay. But when the dollar’s too strong, those goods get pricey in their currency, so they look elsewhere for cheaper options. At the same time, a strong dollar makes imports cheaper for Americans, so we end up buying more foreign goods than we sell.

That’s why a strong dollar is a major obstacle to President Trump's vision of an American industrial revival. It makes U.S. exports more expensive globally and encourages manufacturers to move production overseas—the exact opposite of what he's trying to achieve.

Hence Trump’s tariffs.

But here's what most people miss…

As Matt Smith recently uncovered, tariffs are just the opening move in Trump Team's economic grand strategy. His real plan goes far beyond fighting a strong dollar—he's aiming to completely overhaul the American economy and monetary system. To accomplish this, Trump is mirroring strategies used by Nixon in 1971 and Reagan in 1985, updating them with decisive new elements for today's global economy.

And here's where it gets really interesting...

Since December, roughly 2,000 metric tons of gold—64 million ounces—have poured into the U.S. That's nearly a quarter of all the gold America claims in its official reserves, and it's no coincidence. Matt Smith has meticulously documented how this ties directly into Trump's monetary reset plans, creating a financial transformation unlike anything we've ever witnessed. Click here for details.

Regards,

Lau Vegys

sYes, the USG is adding Gold to increase what we have, assuming that we have some in Storage. The US (Trump and military transports) picked up loads of Gold bars, and some other goodies from Vatican stores which were astounding. So the US has some gold for sure in the bag, so to say, regardless of other stores.

Has it been determined whether this gold returning to US shores is what may have been leased out to other nations? Or do these represent new purchases?

My guess is the former.