What's Next for Bitcoin's Price?

ETFs, gold vs. BTC, GLD, institutions, and a $320,000 Bitcoin

"One thing you should learn about the markets: never say never; absolutely anything can happen."

~ Doug Casey

It finally happened.

Bitcoin’s price set a new all-time high above $69,200 earlier today, surpassing the previous record set in November 2021 of $69,150.

That’s a huge milestone for the world’s first cryptocurrency.

It’s also an impressive 307% increase from under $17,000 a coin just a little over a year ago.

SIDE NOTE: I'd be remiss not to mention that following Doug Casey's advice to "buy some" Bitcoin when it was at $10,700, as he mentioned in a his podcast three years ago, would have resulted in a gain of 547%

And you don’t have to be a finance whiz to grasp the main reason behind Bitcoin's recent performance.

On January 11, the SEC okayed 11 spot Bitcoin ETFs (exchange-traded funds), including applications from BlackRock, Fidelity, and VanEck. Together, these firms manage $17 trillion in assets and now have an easy vehicle to invest in Bitcoin.

The long-awaited approval opened the floodgates for billions of dollars just waiting to jump into Bitcoin. Naturally, the crypto king had been buoyed by excitement even before this occurred.

But when you're seeing gains like these in such a short time, it makes you wonder: Is Bitcoin in a bubble?

It’s a sensible question. I mean, buying something at its peak isn't usually the smartest move. But there are some reasons that make me think it could be different this time around with Bitcoin.

Today and in the coming issues, I'll explore these reasons to help you decide if Bitcoin deserves your attention now.

Before we get into it, I know there are some die-hard gold fans out there who cringe at the mention of Bitcoin. I’ll ask you to bear with me (if you have so far) and keep an open mind as we dive into this.

Here’s Doug with words of wisdom:

Some people mistakenly believe Bitcoin is the enemy of gold, but that's simply untrue. Bitcoin has introduced a whole generation to the reality that paper money, issued by governments, is fiat currency. As I've often said, 'fiat money eventually always goes to its intrinsic value – which is zero'. Thanks to Bitcoin, people are embracing these concepts. And, you know, I’ve noticed that, in a way, Bitcoin is sort of like an entry drug to the gold market. And frankly, you want both.

Doug is, of course, spot on. Just because someone favors gold doesn't mean they should be against Bitcoin, and vice versa.

As it happens, today's discussion circles back to gold too. With all eyes on the potential impact of spot Bitcoin ETFs, it only makes sense to look at gold’s history. It can give us clues about where Bitcoin’s price might go next.

So, for all my Bitcoin and gold enthusiasts out there, let's take a trip down memory lane...

The ETF That Made Gold Mainstream

You might recall the "good old days" of gold – before the era of gold ETFs. Prior to 2004, investing in gold meant dealing with bars, coins, certificates, or shares of gold mining companies.

It was a whole different story compared to the simplicity and convenience of ETF investing.

Then, on November 18, 2004, the SPDR Gold Trust ETF (GLD) came into existence.

GLD revolutionized gold trading. The ETF made holding gold in portfolios easier and cheaper than ever before. It basically made gold mainstream, so now almost anyone could get in on it.

So, what did this do for the price of gold?

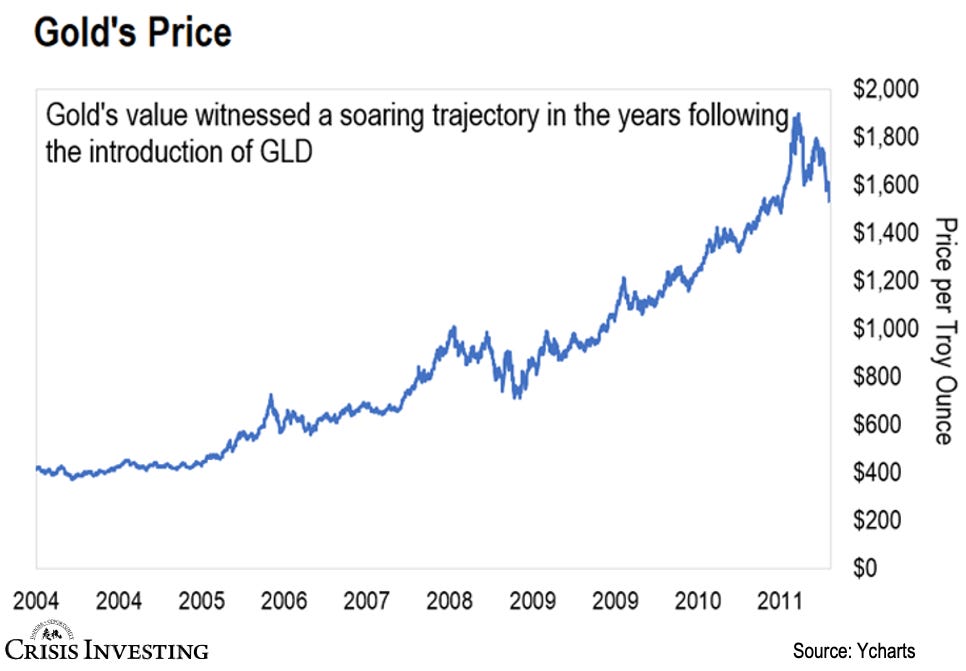

Back in 2004, when GLD was launched, gold was trading below $450 per ounce. By 2011, it had surged to almost $2,000 per ounce. Take a look at the chart below to see how gold's value soared after GLD's launch...

Now, it wasn’t all because of GLD. There were other factors driving up the demand for gold, too.

Events like the Iraq War, the '08 financial crisis, and the USA PATRIOT Act fueled distrust in the government. Alongside, periods of high inflation, driven by rising energy costs and the housing bubble, made gold more attractive.

But, without GLD, these factors wouldn't have pushed gold prices nearly as much.

Consider this…

When the SPDR Gold Trust launched in 2004, it had just over $1.5 billion in assets.

Seven years later, that figure skyrocketed to $73 billion. That’s a 48-fold increase.

The ETF provided easy access to gold without the hassle of owning and storing physical gold. This made investing in precious metals a no-brainer – much like what all those spot Bitcoin ETFs are doing today.

ETFs Are Just Part of the Story

Now, it’s important to understand that these newly approved spot Bitcoin ETFs must buy and hold Bitcoin for every dollar that enters their ETF.

So, if BlackRock’s Bitcoin ETF grows to $50 billion in assets, it must own and custody $50 billion worth of Bitcoin. Keep in mind that it currently only holds about $6.5 billion in assets.

And that's just one of the current ETFs. Picture the scene as money starts pouring into all 11 of them...

But let's take a step back to see the bigger picture.

The top 100 asset management companies manage around $60 trillion.

Let’s assume that only 10% of all that money makes it into Bitcoin. That’s roughly $6 trillion.

Right now, with the latest dip happening as I'm typing this out, Bitcoin's market cap stands at about $1.2 trillion.

If that $6 trillion from those top 100 asset managers finds its way into Bitcoin, it could pump up Bitcoin's market cap by 5 times. That would put the price of one Bitcoin at about $320,000.

And that's just considering 10% of the money from the top 100 asset managers. There's still a lot more cash floating around, waiting to get into Bitcoin.

Smaller pension funds, sovereign funds, and individual investors on the sidelines will probably want in on the action.

After all, when the gold ETF came about, it reportedly brought in millions of new investors to the physical metal. Reportedly, about 70-80% of GLD buyers were first-timers in the gold market.

These spot Bitcoin ETF will similarly bring in scores of new crypto buyers… millions of them probably.

Lastly, I'd like to leave you with this final thought.

There are about 19.5 million Bitcoins currently in circulation right now. Realistically, the figure is closer to 15 million, given that at least four million have been irretrievably lost. Meanwhile, there are over 64 million millionaires worldwide. If every one of those millionaires wanted a piece of Bitcoin, the numbers show they couldn't each secure even a quarter of a Bitcoin.

SIDE NOTE: Bitcoin's price can be a rollercoaster ride. So, you should not dive headfirst. Instead, consider putting in a fixed sum regularly. But never an amount that would keep you awake at night.

For Our Freedom and Yours,

Lau Vegys

P.S. According to a recent survey, 88% of financial advisers interested in buying Bitcoin were waiting until after the SEC approves a spot Bitcoin ETF. This tells me that an ocean of capital is waiting to get into Bitcoin. Whether this will result in $100,000 or $500,000 per Bitcoin, and when it will happen, is anyone’s guess. There is no crystal ball to provide definitive answers. But there are some good reasons suggesting that a perfect storm is forming for Bitcoin in 2024. Stay tuned for Part 2 of my later this week, where I'll dive deeper into that.

I own Bitcoin. I bought back in 2015, when it was still relatively new. Back then, all the talk was about all the cool things you would eventually be able to do with Bitcoin. It would enable smart contracts and a bunch of cool apps could be built atop the Bitcoin blockchain. Eventually, you could pay for a cup of coffee with this new digital currency. There were numerous evangelists, most prominently Andreas Antonopolis, who did a great job of explaining how Bitcoin worked under the hood.

Most of that talk is gone now. Few talk about Bitcoin as a medium of exchange. Now, it's all store of value, or "digital gold." Most of the developers are working on other blockchains. So, I've moved on. I still hold all that I originally bought and am unlikely to sell any time soon (possibly never). But, Bitcoin and most Bitcoiners have moved on from most of the original promise of Bitcoin, even if they still hold all their Bitcoin. There will be some who still tout what I view as the failed Lightning network, but there's not much activity there for reasons that should be obvious.

Also, I'm not one who thinks the introduction of ETFs is a good thing. If all you care about is 'number go up,' then by all means this is a welcome development. But, the malign influence of Blackrock and the other ETF sponsors should not be ignored. These are the groups that control the voting power in your 401ks. That power gave them the ability to foist ESG on all the Fortune 500 companies. How long before they start to alter Bitcoin's original mission?

Finally, I was having a conversation with a colleague just yesterday about this simultaneous rise in Gold and Bitcoin. It's a bit perplexing in some ways. But, I heard a somewhat satisfying explanation today from Jeff Snyder, who puts out a daily podcast at Eurodollar University. His suggestion is that neither gold nor Bitcoin are particularly good inflation hedges. Historically, he appears to be correct. Recently, both Bitcoin and gold plunged in 2022 when inflation really started to tick up. His theory, however, is that both gold and Bitcoin are a response to reckless fiscal policy (which could be inflationary, but also may not be). That seems more accurate to me, as we see $1 trillion of new debt now being created every 100 days and many other problems on the horizon. The gold chart you linked also seems to support this. Gold sold off like everything at the advent of the GFC in 2007 - 08, but it really started to accelerate in 2009 (even though inflation was low).

At any rate, your thoughts on Bitcoin and Gold are appreciated. Thanks for sharing them.

When you buy shares in any of the Bitcoin ETFs you are not buying any bitcoin but rather just price exposer to bitcoin through paper derivative claims! This is VERY different from buying actual bitcoin directly!