When Trump Yelled “BUY”

After Years of Cashing In, Democrats Suddenly Think Insider Trading Is Bad

Yesterday, President Donald Trump did what he does best — shocked everyone.

Just days after unleashing his “Liberation Day” tariffs, Trump suddenly hit pause. He announced a 90-day delay on most tariffs (except for China, which still got slapped with a fresh 125% rate).

But as big as the policy shift was, it wasn’t just the tariffs themselves that made the headlines.

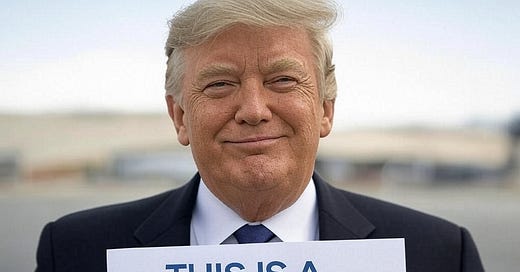

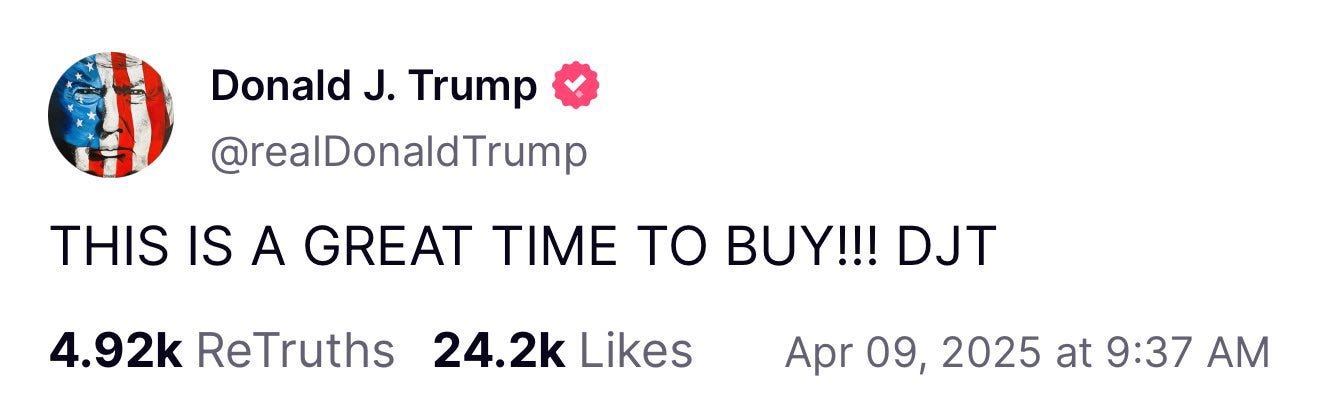

It was also this post on Truth Social.

Trump posted this to his followers — with a not-so-subtle nod to Trump Media (DJT), his own publicly traded company — just hours before the official tariff pause announcement.

Great Time to Buy!

Turns out, it really was.

Not just for DJT — which jumped 22% on the day — but for pretty much everything else too.

The S&P 500 soared 9% in a single session. The Nasdaq surged nearly 12%. In total, almost $4 trillion in market value was added in just a few hours.

Naturally, Democrats — who had spent the last several days complaining about the market getting hammered after Trump’s “Liberation Day” tariff threats — immediately pounced.

California Congressman Adam Schiff — best known for seeing Russian conspiracies behind every bush — called it potential insider trading and demanded an investigation.

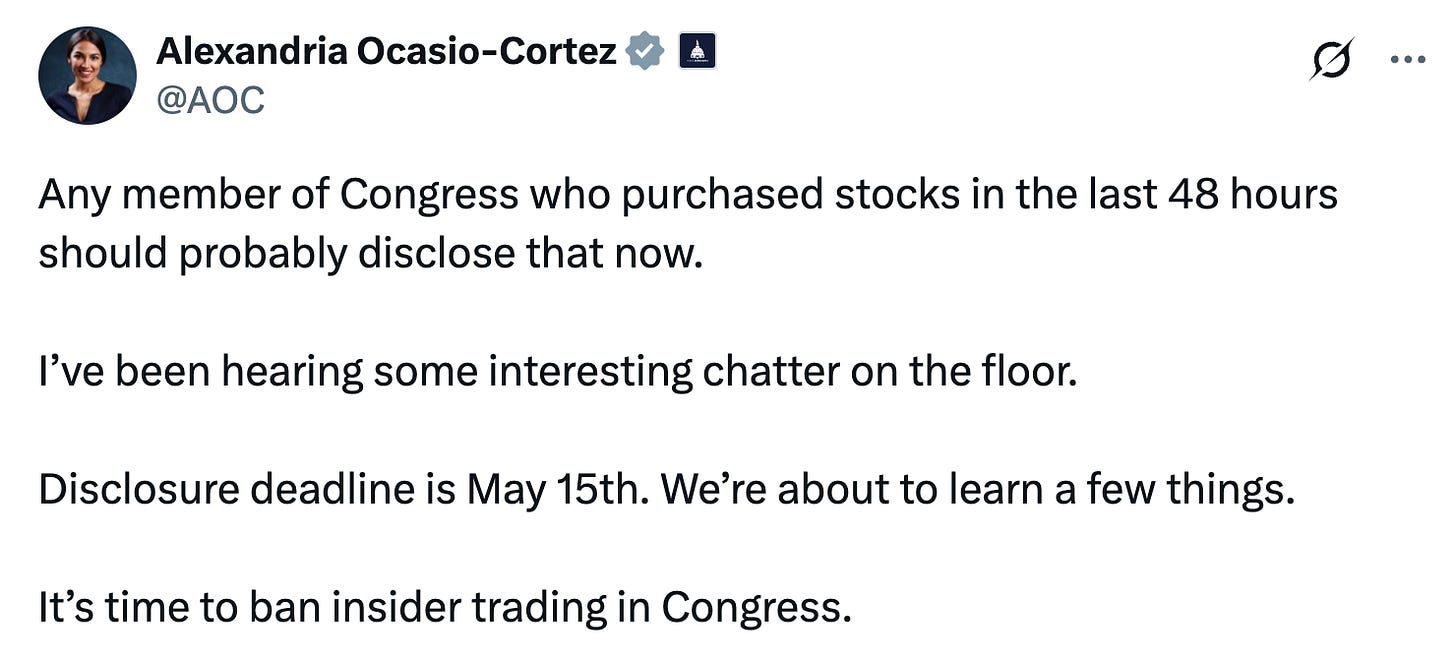

Meanwhile, AOC — bartender-turned-congresswoman and social media influencer extraordinaire — had this to say on X:

Now, I’m all for transparency from those who govern us. But let’s be honest: this wasn’t some quiet tip shared over cigars at a country club.

Trump blasted it out to the entire world. Just look at the chart below — you can literally see Nasdaq call option volumes explode around the time that post went live. Same story on the S&P 500.

Call me naive, but this doesn’t look like some quiet, calculated insider trading scheme from Trump’s inner circle.

It looks like retail.

This is exactly what you’d expect to happen when the world’s loudest showman yells “BUY” to millions of people online. Meme-stock energy kicks in. Robinhood accounts go wild. Options premiums go vertical — and so do stocks.

You Know What? Let’s.

But I’m actually 100% on board with AOC’s call to ban insider trading in Congress.

And this is where the outrage starts to feel a little… selective.

Just look at Nancy Pelosi — the undisputed poster child for congressional trading. Her husband, Paul, has somehow out-traded nearly every hedge fund on the planet for years. Between the two of them, they’re right up there with Warren Buffett — except with better timing.

AOC didn’t seem too bothered when it was Nancy — or other Democratic leaders — getting filthy rich off perfectly timed trades.

But hey — better late than never, I guess.

Because congressional (insider) trading is a huge problem. The numbers speak for themselves.

According to Unusual Whales’ latest report, Democrats crushed the market in 2024 with a 31% return (Republicans came in at 26%). Not bad for a bunch of part-time investors somehow squeezing in trades between running the country and raising campaign money.

Shocking, I know — but most of these gains didn’t come from stock-picking genius. They came from timing. Just look at a few of the highlights:

Republican Representative Michael McCaul of Texas loaded up on Meta (META), the social media giant, before Congress threatened TikTok.

Democratic Representative Jared Moskowitz of Florida bought Lockheed Martin (LMT), the defense contractor, before an $11 billion Pentagon contract.

Democratic Senator Tina Smith of Minnesota bought Tactile Systems Technology (TCMD), a medical devices company, while serving on the health committee.

Republican Senator Markwayne Mullin of Oklahoma loaded up on Badger Meter (BMI), a water technology company, right before Oklahoma’s infrastructure upgrades for water systems.

The situation has gotten so absurd that there are now actual, publicly traded ETFs designed to track the stock trades of members of Congress.

Yes, real ETFs — with ticker symbols and everything.

One of them, appropriately named NANC, follows the trading activity of Democratic lawmakers. The other, KRUZ, tracks Republican trades.

But before you go betting the farm on these things, keep in mind: timing is everything in insider trading — and these ETFs are always late to the party.

In 2024, NANC returned 27%, barely edging out the S&P 500’s 26%. KRUZ didn’t fare nearly as well, managing just 14%.

Why? Because ETFs have to wait for politicians to actually file their trade disclosures — sometimes weeks or even months later. And some don’t bother at all, opting to just pay a laughably small fine instead.

Add in the steep fees, and well… let’s just say the real money gets made by actually being in Congress. Not trying to follow them from the cheap seats.

The Bottom Line

Trump’s post might have been reckless. It might have been dumb. But it was right there, out in the open, for everyone to see.

Meanwhile, Congress has been insider trading for years.

Despite over ten separate bills introduced to ban or limit Congressional trading, none have passed. Leadership from both parties just isn’t interested.

They’d rather spend their time investigating TikTok users for stock tips.

Which is why all this outrage from Democrats over what happened yesterday feels so fake, so ridiculous, and frankly… so manipulative.

Regards,

Lau Vegys

Good read, and you pegged Adam Schiff correctly!........AOC is a train wreck, and how she got in to politics is anybody's guess. Trump is doing just fine!. Oh, by the way, he has only been in office 3 months. The US is a Republic and not a Democracy for those who cannot comprehend.

Great take on this.