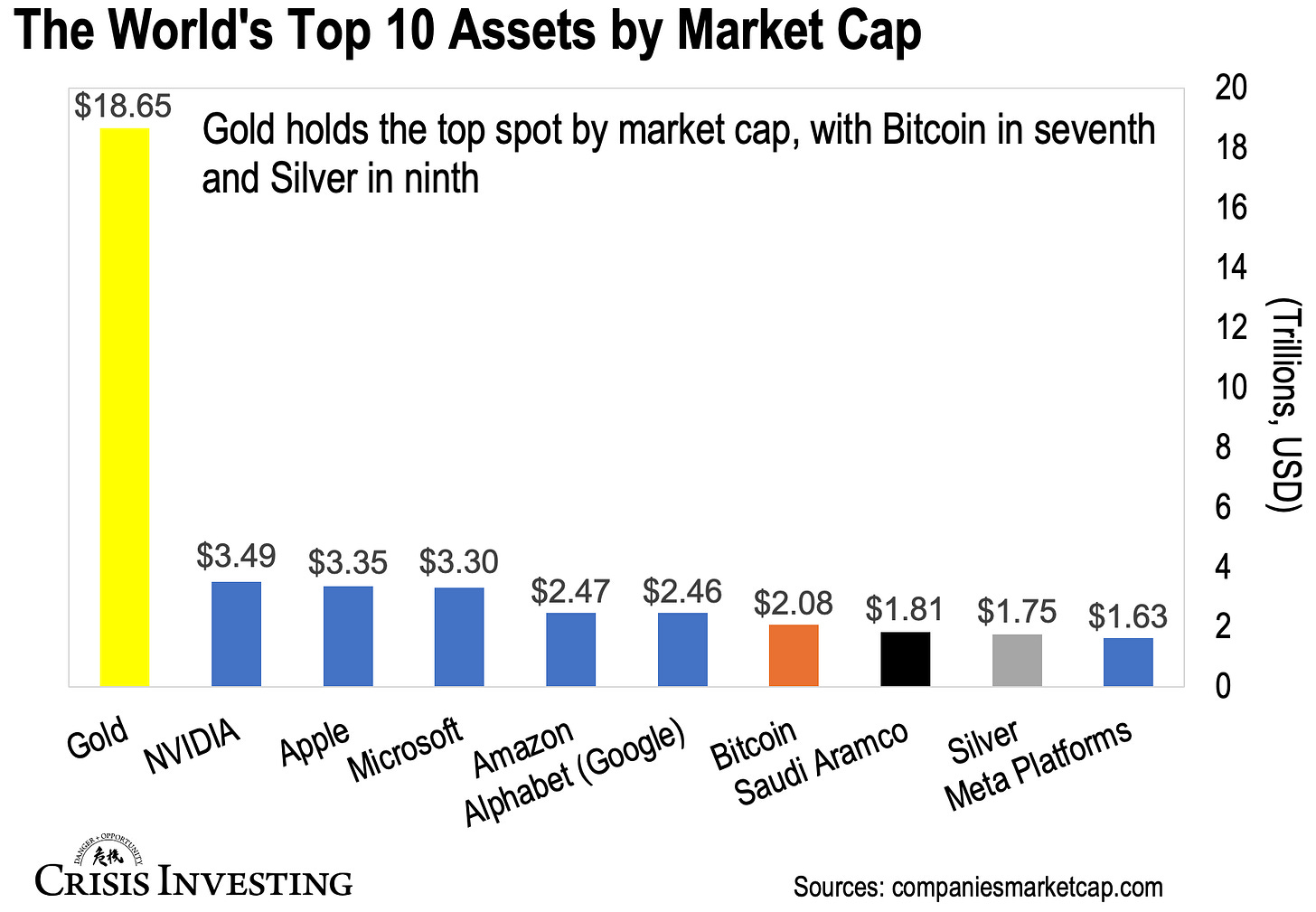

In a world where value takes many forms, the rankings of the top assets offer a fascinating snapshot of global wealth and priorities. That’s exactly what this week’s chart shows: the world’s Top 10 assets by market capitalization. Take a look.

As you can see from the graph above, Gold ranks first, with a value of roughly $18.7 trillion.

Keep in mind this value comes from multiplying the current gold price ($2,777 per ounce) by the world’s above-ground gold reserves, so it might not be 100% accurate. But it’s probably in the ballpark.

Another thing that stands out is that only four of these top 10 assets—Gold, Bitcoin, Saudi Aramco (the Saudi oil giant), and Silver—aren’t U.S.-based tech companies. They’re highlighted in colors other than blue to set them apart.

This shouldn’t be surprising, given how the stock market has soared since the COVID-19 pandemic, fueled by unprecedented money printing by the Federal Reserve and other central banks. Trillions of dollars of liquidity flooded into the financial system, driving valuations for tech stocks to astronomical levels.

NVIDIA (NVDA), Apple (AAPL), and Microsoft (MSFT), of course, lead that tech parade.

Just to give you an idea of how valuable (or overvalued, depending on your point of view) these three tech giants are, NVIDIA, Apple, and Microsoft together are worth an incredible $10.14 trillion. That’s still far off from Gold’s value, but for perspective, it already exceeds the combined GDPs of Japan (~$4.2 trillion) and Germany (~$4.5 trillion).

If I had to predict how the rankings might shift by the end of the year, I’d say Silver could move up the list simply because of how undervalued it remains. Bitcoin might climb as well—especially if President Trump follows through on his campaign promise to create a Bitcoin stockpile. But I’m not entirely convinced he will, given the wording of the recent crypto executive order, which only mentions the exploration of a “potential” stockpile. As I’ve said before, of all Trump’s campaign promises, the Bitcoin reserve seems like the easiest one to break—and I still feel that way.

Regards,

Lau Vegys

Lau,

I really like your work. I am sure many more appreciate the insight, but rarely thank the author, including me. So....

Thanks!

Iv been in bitcoin About 11 years , 200 dollar cost now about 100.000 US dollars it gives me financial orgasms .